ETF Trends CEO Tom Lydon discussed the Global X MSCI Greece ETF (GREK) on this week’s “ETF of the Week” podcast with Chuck Jaffe on the MoneyLife Show.

GREK invests in among the largest and most liquid companies in Greece. It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Greece Select 25/50 Index.

The MSCI All Greece Select 25/50 Index is designed to represent the performance of the broad Greece equity universe while including a minimum number of constituents. The Broad Greece Equity Universe includes securities that are classified in Greece according to the MSCI Global Investable Market Index Methodology together with companies that are headquartered or listed in Greece and carry out the majority of their operations in Greece.]

When most investors think about Greece, they recall the past few years, when the country struggled economically, owing a massive liability to the EU, and nearly defaulted on its debt.

But according to Lydon, many things have changed.

“It’s almost like we are pinching ourselves,” Lydon said. “Are we’re really talking about Greece as a potential buying opportunity… It just seemed that Greece couldn’t get out of its own way. But just recently, because of some political changes that have happened, and maybe the people in Greece just needed change, so they voted out the popular party, and voted in a more progressive party. And here seems to be some momentum that’s very very popular right now in Greece. There are businesses that are being started in Greece. But most importantly, Greek stocks are coming back.”

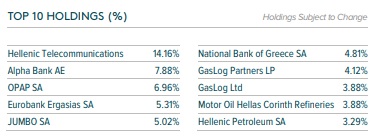

GREK has a diversified spectrum of holdings across multiple industries. Listed below are some of the ETFs top holdings.

Chart courtesy of GlobalX

With the tumultuous nature of the market recently, enhanced global uncertainty, and a more than 10 year bull market in stocks, Lydon advocates that investors consider emerging markets like Greece as an opportunity to seek growth elsewhere and avoid potential domestic pitfalls.

“Especially if we look at the markets that we’ve seen here in the U.S. start to falter, emerging market stocks and specifically the stocks in Greece are actually doing really really well,” Lydon added. “So the whole idea about following trends really comes into play…If you feel like the S&P and U.S. stocks might be a little bit long in the tooth, you’ve got some time on your side, and also there’s some other trends, especially other areas of the world that have been really beaten up that show an incredible amount of value. It may be an opportunity for you to be tactical in nature and swoop in and see some new trends develop.”

Listen to the ETF of the Week podcast on the GREK ETF here:

For more podcast episodes featuring Tom Lydon, visit our podcasts category.