As China continues to reopen its economic doors following the Covid-19 pandemic, it’s been electrical vehicles leading the way for the automotive market. This, in turn, could fuel gains for exchange-traded funds (ETFs) focused on electric vehicles.

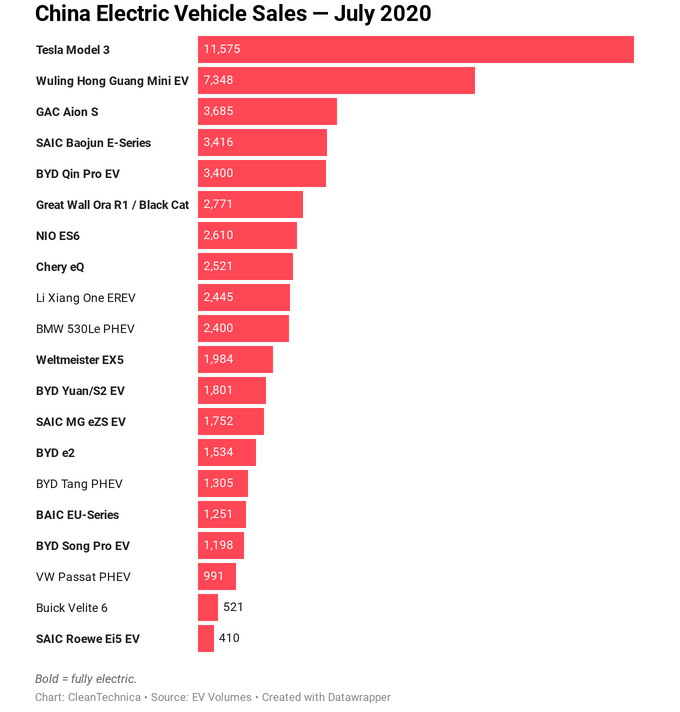

“A star is born in China. And it is not the flashy Xpeng P7 (1,725 units) or BYD Han EV (1,205), but something far more humble. More on that below,” a Clean Technica article said. “The overall Chinese market went back to positive numbers in July (+9% year over year), with plugin vehicles faring much better, growing 48% last month, to 95,000 units, a new year best. Full-electric vehicles (BEVs) jumped 65%, to 75,000, while plugin hybrids grew a shy 5%, to 20,000.”

The article also noted that best sellers include “3 compact-to-midsize sedans (#1 Tesla Model 3, #3 GAC Aion S, and #5 BYD Qin Pro EV) and 2 city EVs, both from the same stable, the SAIC-GM-Wuling conglomerate — the Baojun E-Series in 4th and the new Wuling Mini EV, a tiny, cheap EV that is sure to make seismic waves on the market, immediately reaching the runner-up spot in its first full sales month….”

![]()

ETFs to watch include the Global X Autonomous & Electric Vehicles ETF (NYSEArca: DRIV). DRIV seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Autonomous & Electric Vehicles Index.

DRIV provides:

- High Growth Potential: DRIV enables investors to access high growth potential through companies critical to the development of autonomous and electric vehicles – a potentially transformative economic innovation.

- Unconstrained Approach: DRIV’s composition transcends the classic sector, industry, and geographic classifications by tracking an emerging technological theme.

- ETF Efficiency: In a single trade, DRIV delivers access to dozens of companies with high exposure to the autonomous and electric vehicles theme.

Another way to play electric vehicles is via lithium that is used for batteries that power the cars themselves. As such, ETF investors may want to check out the Global X Lithium & Battery Tech ETF (NYSEArca: LIT), which seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index.

The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) based on the securities in the underlying index. The underlying index is designed to measure broad-based equity market performance of global companies involved in the lithium industry.

For more market trends, visit ETF Trends.