As China continues its regulatory wrangling of big tech firms like Alibaba and Tencent Holdings, the country developed a set of artificial intelligence (AI) guidelines.

“China has revealed its first set of ethical guidelines governing artificial intelligence, placing emphasis on protecting user rights and preventing risks in ways that align with Beijing’s goals of reining in Big Tech’s influence and becoming the global AI leader by 2030,” the South China Morning Post reported.

“Humans should have full decision-making power, the guidelines state, and have the right to choose whether to accept AI services, exit an interaction with an AI system or discontinue its operation at any time,” the report said. “The document was published by China’s Ministry of Science and Technology (MOST) last Sunday.”

It certainly highlights the power of AI, and big tech firms have been quick to use the technology in order to obtain more consumer engagement. China, however, is ensuring that mind control rests in the power of humans themselves.

“This is the first specification we see from the [Chinese] government on AI ethics,” said Rebecca Arcesati, an analyst at the German think tank Mercator Institute for China Studies (Merics). “We had only seen high-level principles before.”

Keep This ETF in Mind

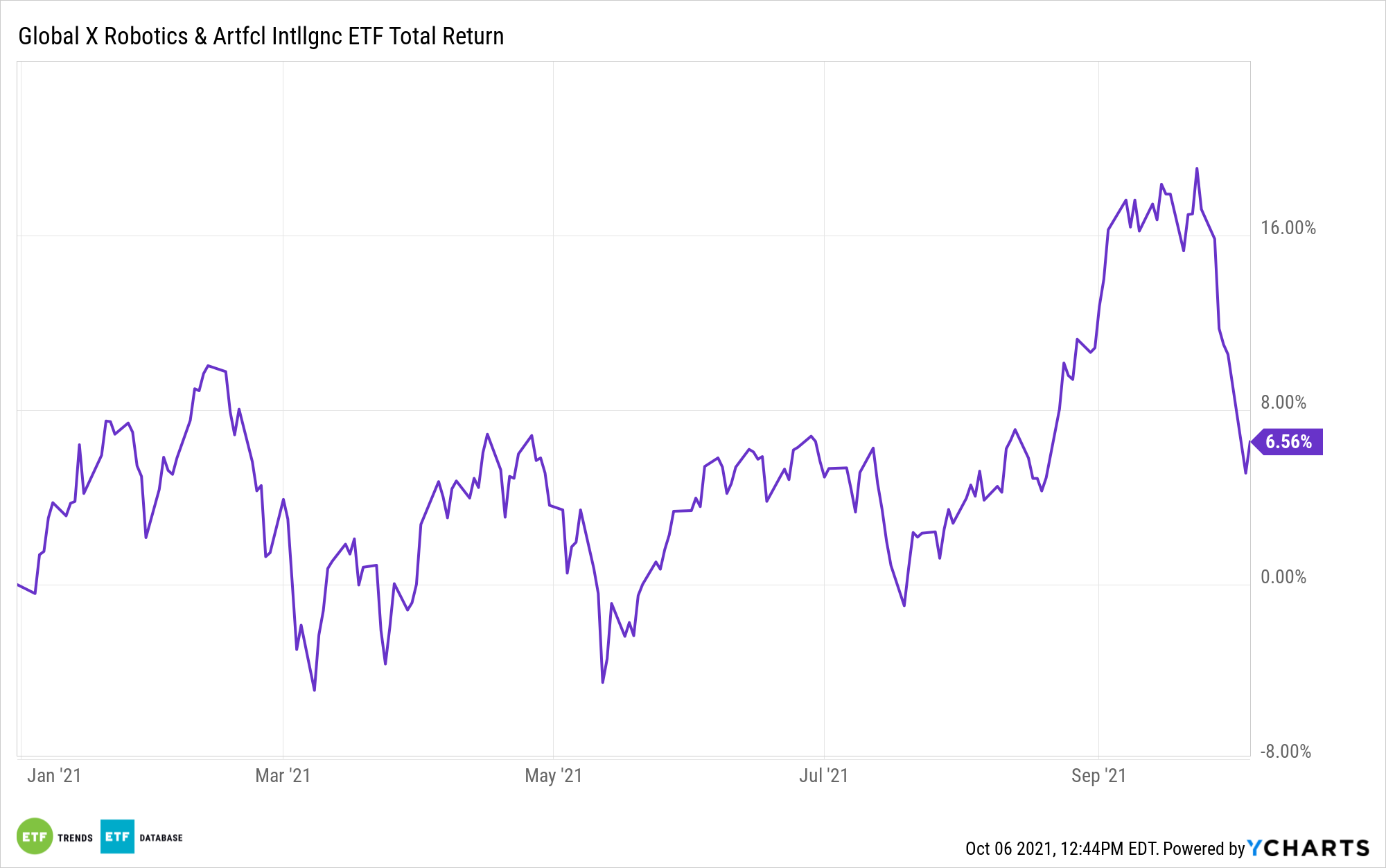

Mind control aside, ETF opportunities in the AI space exist with funds like the Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ). BOTZ seeks to invest in companies that stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

Additionally, BOTZ seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Robotics & Artificial Intelligence Thematic Index. The index itself captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries.

Fund benefits include:

- High growth potential: BOTZ enables investors to access high growth potential through companies involved in the ideation, design, creation, and application of programmable automated devices.

- An unconstrained approach: BOTZ’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF efficiency: In a single trade, BOTZ delivers access to dozens of companies with high exposure to the robotics and AI theme.

For more news, information, and strategy, visit the Thematic Investing Channel.