With the evolution of 5G, cloud computing and e-commerce growing rapidly, trillions of dollars will be spent in the next few years to facilitate the massive build out of infrastructure and technology to support these disruptive industries.

On the recent webcast, 5G, Cloud Computing and E-commerce: How to Capture the Growth in ETF Strategies, Sean O’Hara, President, Pacer ETFs Distributors, Pacer ETFs and Kevin Kelly, CEO, Benchmark Investments, explored how advisors can capitalize on thematic growth trends and yield opportunities associated with 5G, autonomous vehicles, servers, artificial intelligence, e-commerce and streaming.

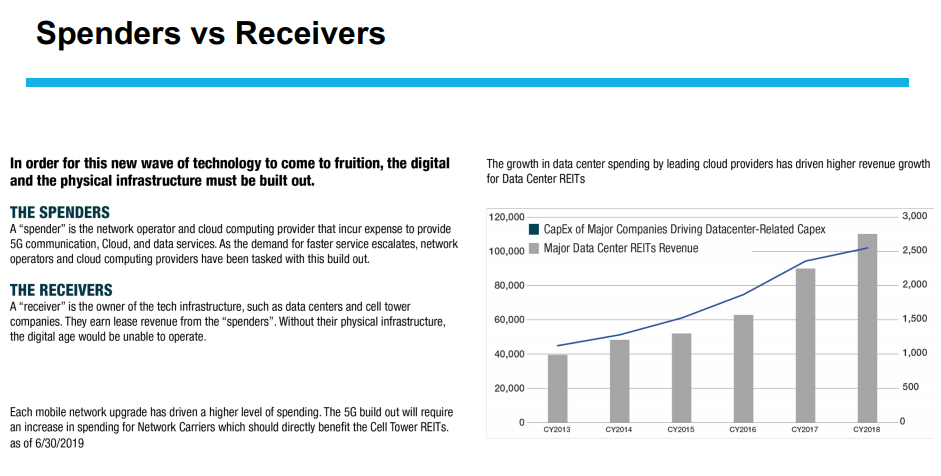

“There’s a massive build-out going on right now,” O’Hara said. “It’s going to take a massive amount of investment to get there – $2.5 trillion in the next five years.”

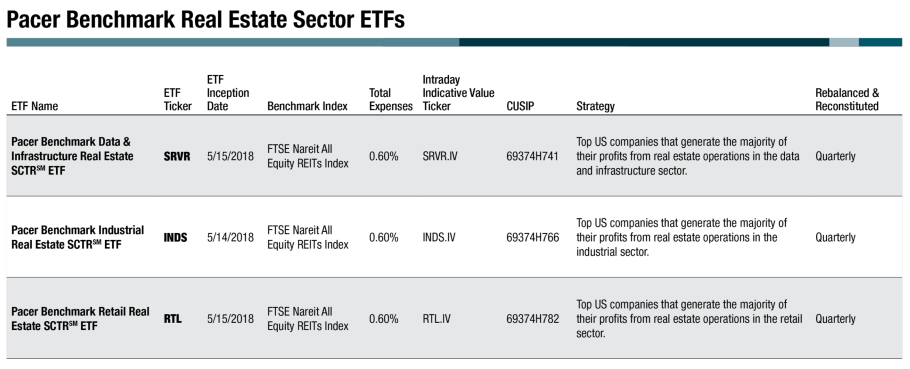

To capitalize on this big spending, Pacer ETFs has a line-up of defined solutions to help investors access these targeted areas of growth, including the Pacer Benchmark Industrial Real Estate SCTR ETF (NYSEArca: INDS), Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSEArca: SRVR) and Pacer Benchmark Retail Real Estate SCTR ETF (NYSEArca: RTL).

For example, O’Hara said its SRVR ETF focuses primarily on publicly traded real estate that is going to make all of these industry developments possible.

“It’s data centers, cell phone tower networks and the fiber optic networks that are going to connect all of this,” he said. “They are going to be the major receivers of these dollars that are going to be spent.”

Pacer ETFs access all areas of the future growth of these industries.

“We believe there’s going to be spenders – in other words, people are going to increase capital expenditure spending in order to get there – and there’s going to be receivers – the people who are actually going to build the real infrastructure networks out,” O’Hara said.

With competition heating up in the disruptive ETF space, advisors need to lift the hood of ETFs in this area to find which are best positioned.

Pacer ETFs’ new real estate focused ETFs help investors gain exposure to the growing e-commerce space by investing in data center and distribution center REITs, along with higher quality retail real estate.

Specifically, SRVR tries to reflect the performance of the Data & Infrastructure Real Estate SCTR Index, which is comprised of cell tower REITs, data center REITs, and similar facilities – these cell towers and data processing centers store the information and handle the orders that start the e-commerce process.

INDS tries to reflect the performance of the Benchmark Industrial Real Estate SCTR Index, which is comprised of real estate investment trusts that specialize in the logistics required to make e-commerce work. The portfolio includes warehouses, distribution centers and similar facilities that allow for e-commerce companies to ship goods to their final destinations, sometimes within hours.

Additionally, RTL tries to reflect the performance of the Benchmark Retail Real Estate SCTR Index, which is made up of shopping centers, shopping malls and similar structures that are thriving enterprises filled with retail establishments and are located in prime locations with quality tenants throughout the country.

“When you are looking and thinking about data centers, cell phone towers and fiber optic networks, you’re really trying to capture the essence of how digital communications are evolving at an unprecedented rate,” Kelly said.

Financial advisors who are interested in a strategy to capitalize on the growth of digital networks can watch the webcast on demand here.