The ‘reopening’ trade isn’t just relegated to strength in equities as the economy recovers. Copper prices are also rising, and ETF investors can capture the forthcoming upside with the Global X Copper Miners ETF (COPX).

”The narrative we’ve been hearing is that it’s really a play on the broader reopening of the economy,” says Spencer Barnes, associate vice-president of mutual fund and ETF strategy at Raymond James Ltd., in a The Globe and Mail article. “Copper is cyclical and driven by market expansion, so it’s not surprising how it’s been bid up thanks to the massive push to reopen the economy, and the stimulus we’re seeing.”

COPX seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Copper Miners Total Return Index, which is designed to measure broad-based equity market performance of global companies involved in the copper mining industry.

COPX gives investors:

- Targeted Exposure: COPX is a targeted play on copper mining.

- ETF Efficiency: In a single trade, COPX delivers efficient access to a basket of companies involved in the mining of copper.

The fund also offers impressive country-by-country diversification.

“COPX offers exposure to a basket of about 30 mining companies including top holdings such as India’s Vedanta Ltd., Toronto-based First Quantum Minerals Ltd. and Arizona-based Freeport-McMoRan Inc,” the article added.

History Favors Higher Copper Prices

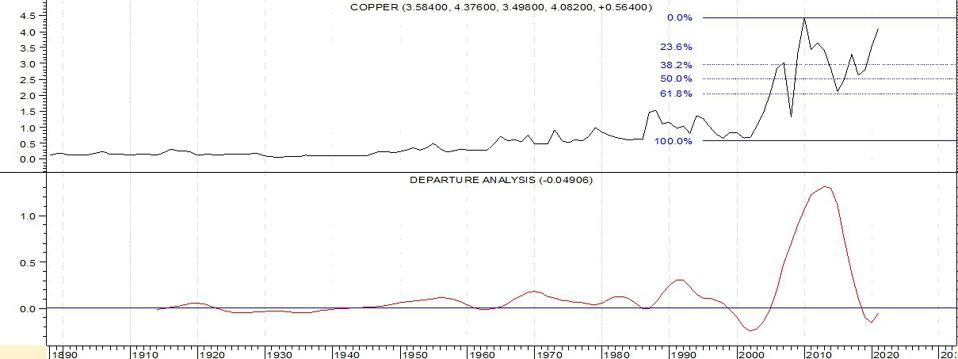

While current, near-term technical indicators can speak to the strength of copper prices, history also favors higher copper prices. Copper’s prices generally follow a monthly cycle that dates back to 1890.

“Below, we see annual copper from 1890. Note that the momentum oscillator is oversold and is turning up at a higher low than the last low, a constructive development,” a Forbes article said. “Monthly price is overbought, but this is not a great concern due to the annual momentum situation. Note in the monthly histogram that the current month has been seasonally strong. In March, price has risen in 60% of all cases for an average 2% gain. The April, May, June months have individually closed on the upside less than 50% of the time. The monthly dynamic cycle dips from April through mid-May so a correction back to $3.80-$3.90 is possible. But the longer bull market remains intact.”

“All retracement levels have been surpassed, so new highs past $4.50 are likely likely in the summer,” the article added.

For more news and information, visit the Thematic Investing Channel.