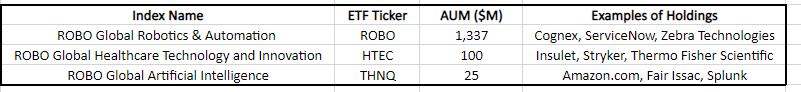

A decade ago, when the ROBO Global Robotics & Automation Index ETF (ROBO) launched, the U.S. thematic ETF market was nascent, with only a handful of products and minimal assets. However, at the end of 2021, there was approximately $130 billion in assets invested, per Global X. While the base shrunk to $75 billion at the end of 2022, due largely to poor performance amid rising interest rates, product development continued. There were 270 thematic ETFs listed in the U.S. to start 2023, including two more from ROBO Global Indexes: the ROBO Global Healthcare Technology and Innovation ETF (HTEC) and the ROBO Global Artificial Intelligence ETF (THNQ).

Last week, ROBO Global Indexes became part of the VettaFi family, and we could not be happier about the opportunities to further educate advisors about thematic indexing.

“We are thrilled to add the ROBO Global suite to VettaFi’s existing family of thematic indexes, as indexing is one of the most vibrant corners of the investment management industry,” said Leland Clemons, CEO of VettaFi. “Our clients and our prospective clients will be very excited about the range of indexing ideas and approaches we can now bring to bear on their behalf, in tandem with all of the data, analytics, and digital distribution offerings that make up the full range of VettaFi solutions.”

With the acquisition of this suite, VettaFi’s full range of index solutions now underpins more than $17 billion in ETFs and other investment vehicles. Other ETFs partnering with indexes run by VettaFi include the Alerian MLP ETF (AMLP), the ALPS Sector Dividend Dogs ETF (SDOG), the First Trust S-Network Future Vehicles & Technology ETF (CARZ), and the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

At $1.3 billion in assets, U.S.-listed ROBO is the largest of the three ETFs tracking a ROBO Global Index. The thematic ETF provides global exposure to the value chain of robotics, automation, and AI companies, across developed and emerging markets. The research-driven approach focuses on 11 subsectors tied to robotics and automation, including autonomous systems, food and agriculture, healthcare, logistics, and manufacturing. Its top 10 holdings include Cognex, Intuitive Surgical, ServiceNow, and Zebra Technologies. Just over half of the ETF assets are invested outside of the U.S. and are largely split between Asia Pacific and European markets.

While ROBO was the first of its kind, there are other robotics-focused ETFs on the market, including the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT).

HTEC has $100 million in assets invested in companies leading the healthcare technology revolution across nine impacted subsectors, including diagnostics, genomics, lab process automation, medical instruments, precision and regenerative medicine, and telehealth. Top holdings include Insulet, Intuitive Surgical, Stryker, and Thermo Fisher Scientific. More than 80% of HTEC assets were recently invested in the U.S. and Canada, with most of the remainder coming from Europe.

Other thematic healthcare technology ETFs include the ARK Genomic Revolution ETF (ARKG) and the iShares Genomics Immunology and Healthcare ETF (IDNA).

Meanwhile, THNQ is the newest of the ROBO Global index-based ETFs, having launched in May 2020, and has $25 million in assets. The fund invests in companies actively developing and leveraging tools and artificial intelligence powered engines to capitalize on new market opportunities to accelerate their revenue growth. The companies are in one of 10 related subsectors, including business process, e-commerce, network and security, and semiconductors.

THNQ’s top holdings include mega-caps Amazon.com and Microsoft, but the fund’s median market cap was recently $33 billion due to the more moderately sized Fair Issac and Splunk. The fund has 75% of assets invested in the U.S. and Canada, with the remainder largely split between Asia Pacific and Europe.

Engagement with artificial intelligence-related ETFs on VettaFi’s platforms was strong in the first quarter of 2023, with the ARK Next Generation Internet ETF (ARKW) and the Global X Artificial Intelligence & Technology ETF (AIQ) among the rising stars.

We’re still in the early stages of innovation for companies in the robotics and automation, healthcare technology, and artificial intelligence industries. VettaFi believes that as more advisors and end clients understand the drivers of these trends and the benefits of including exposure to such index-based strategies in a diversified portfolio, adoption will increase further.

For more news, information, and analysis, visit VettaFi | ETF Trends.

VettaFi LLC (“VettaFi”) is the index provider for AMLP, CARZ, HTEC, ROBO, SATO, SDOG, and THNQ, for which it receives an index licensing fee. However, AMLP, CARZ, HTEC, ROBO, SATO, SDOG, and THNQ are not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of AMLP, CARZ, HTEC, ROBO, SATO, SDOG, and THNQ.