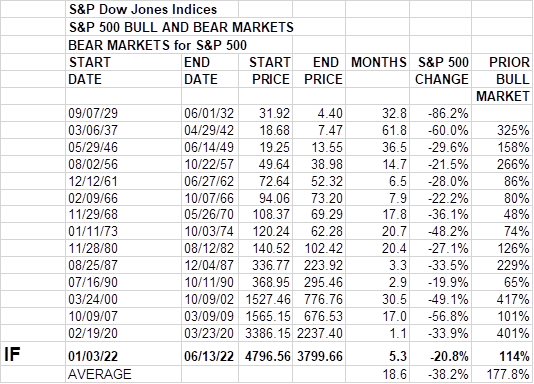

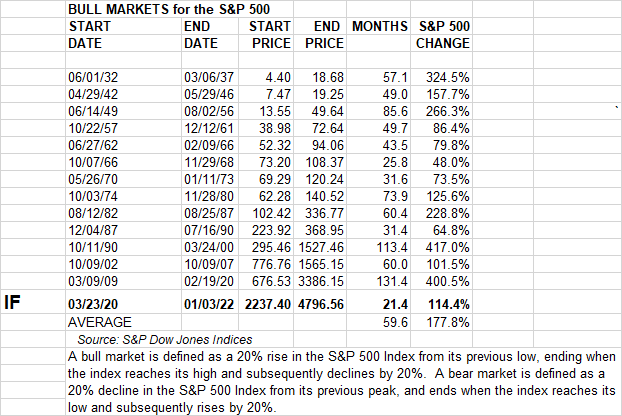

Avoid burning excess food and garbage in a fire and don’t cook near your tent, because we’re entering bear country. The market got off to a rough start this week as the S&P 500 fell 3.8% in morning trading Monday and is now trading 20% below its last closing high on January 3, 2022.

Currently, the S&P 500 is down 3.03% and experiencing heavier than normal trading volume. If the index closes at -1.63% or lower for the day, January 3 will be classified as the ending date of the bull market and the starting date of the bear. A bear market is defined as a 20% loss from a recent high.

“The selling started over the weekend. People want to get out,” Howard Silverblatt, senior index analyst, product management, for S&P Dow Jones Indices, told VettaFi. “Everyone knew we were heading into this.”

Silverblatt primarily attributed Monday’s abnormally high trading volumes to the record-high inflation. Although soaring gas prices, anemic company earnings, and the Federal Reserve aggressively raising rates are other drivers of the selloff.

While it’s certainly possible that the market won’t close in bear territory, it will depend on the level that buyers return to bottom fish later today. “We should expect to see significant trading shortly before the market closes,” Silverblatt said. “The question is, do buyers come in? If so, a lot would have to come from institutional investors to offset [the selloffs].”

Silverblatt also noted that not only is the FOMC starting its two-day meeting tomorrow, but the Producer Price Index data is also scheduled to be released Tuesday morning before the markets open. That could impact trading.

“We’re down over 3%. It’s not unheard of, and still over 10% higher than we were from the February 2020 mark, pre-Covid,” the S&P senior index analyst said. “But the bottom line is the Fed is meeting tomorrow and the PPI [data are]coming out tomorrow, and the numbers aren’t expected to be great.”

For more news, information, and strategy, visit VettaFi.