By Natalia Gurushina

Chief Economist, Emerging Markets Fixed Income

The market clamors for a 75bps rate hike in the U.S. today, followed by 72bps more in July. Does this mean that the rest of the world would have to step up policy tightening?

Fed, ECB Policy Expectations

We actually thought that this was the case yesterday evening (plus, a chance to express our admiration for Metallica – songs only, not the looks). However, the morning started with a big surprise in Europe – the European Central Bank’s (ECB’s) unscheduled meeting to discuss “current market conditions” (=Eurozone’s bond market fragmentation). The end-result was a massive rally in peripheral yields (Italy’s 10-year yield=41bps tighter), as the ECB said it would use the existing pandemic emergency program (PEPP) to keep these countries’ borrowing costs under control. The euro actually weakened after the announcement, even though the market now prices in a solid 36bps ECB rate hike in July and another 52bps in September. Going back to the main event of the day – the U.S. Federal Reserve’s (Fed’s) meeting – the market clamors for +75bps today and close to +75bps in July.

China Growth Headwinds

Emerging markets (EM) Fixed Income and FX were mixed going into the Fed’s meeting – with several EM-specific drivers closely watched, including China’s near-term growth headwinds. China’s latest monthly activity indicators showed some improvements, but nothing earth-shattering. Consumption still looks weak – sequential retail sales were practically flat and annual retail sales growth very negative (-6.7%) in May, with the industrial rebound firmly in the driving seat (+5.61% month-on-month in May). The latest policy moves – no cut in the medium-term lending facility rate yesterday, predominantly supply-side oriented measures – signal that growth rebalancing is not China’s greatest concern right now. What’s important is closing the (widening) gap between the 2022 growth forecast (4.3%) and the official growth target (about 5.5%).

Rate Differentials Between U.S. and the Rest of the World

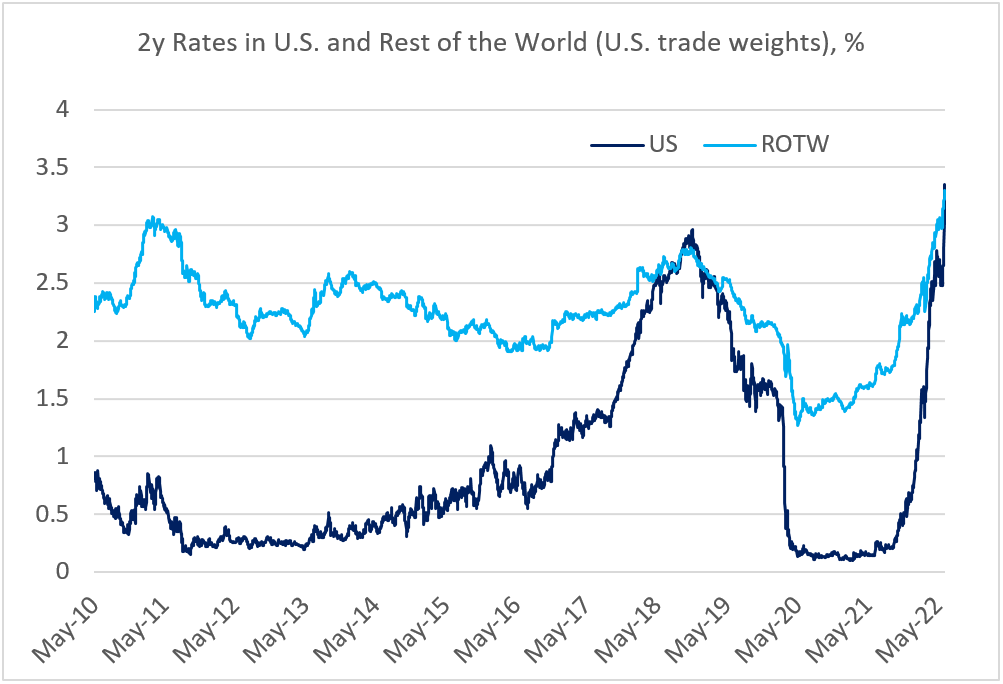

One final question to ask before today’s Fed meeting – especially if the hawkish expectations are realized – is whether the rest of the world will have to step up policy tightening. The chart below shows the rapidly shrinking differential between short rates in the U.S. and the rest of the world (including some major EMs, which started to hike much earlier than the Fed), which undermines many carry trades, and potentially spells trouble for vulnerable (or overbought) EM currencies. The rate-setting meeting in Brazil this afternoon – where the market expects a slower pace of hikes from now on – would be an important litmus test. Stay tuned!

Chart at a Glance: King Dollar?

Source: VanEck Research; Bloomberg LP

Originally published by VanEck on June 15th, 2022.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.