Data and analytics no doubt play a vital role in giving firms the information they need to make sound investment decisions. As more data becomes available in the debt markets, funds like the VanEck Vectors Moody’s Analytic (MBBB) can incorporate a quantitative strategy tilt for numbers-focused ETF investors.

MBBB seeks to track, as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Moody’s Analytics® US BBB Corporate Bond Index, which includes BBB rated corporate bonds that have attractive valuations and a lower probability of being downgraded to high yield compared to other BBB rated bonds.

Overall, the fund gives investors a:

- Portfolio of BBB rated bonds with attractive valuations relative to their “Expected Default Frequency”

- Quantitative approach supported by Moody’s Analytics’ extensive dataset and a team of 30 researchers

- Process driven by the same platform that powers credit risk management at over 650 of the world’s largest institutional investors

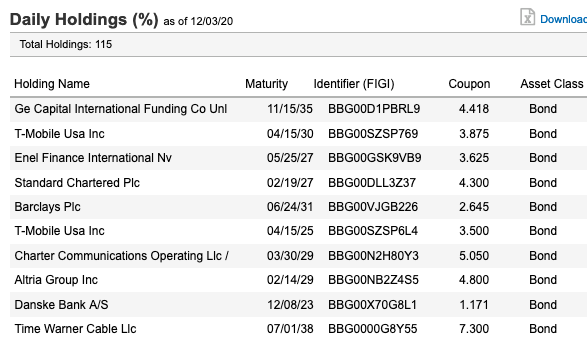

Looking at its top 10 holdings, you can see a nice mix of corporate debt issues. As the debt market is still on shaky ground amid the pandemic (like the rest of the capital markets), MBBB has an assortment of short-term debt and long-term debt where necessary to account for duration risk.

How Does the MBBB ETF Work?

How exactly does MBBB select its holdings? A Seeking Alpha post featuring Bill Sokol, Director of ETF Product Management at VanEck, highlighted the need for using a quantitative approach in investment grade corporate debt when it came to funds like MBBB:

“We think that a quantitative approach makes a lot of sense in the investment grade bond market when you’re trying to identify the most attractively valued bonds, because it allows you to be more forward-looking and take into account what the market is telling you,” Sokol said. “That’s in contrast to a more fundamental approach through financial statement analysis, or by relying on credit ratings alone, which tend to lag the market and probably won’t provide you with the right signals that are frequent enough in order to identify these value opportunities when they arise. Moody’s Analytics is the industry leader in terms of credit risk modeling. Their model is backed by an extensive data set of global bond default and recovery data over several decades.”

“It’s also supported by a team of over 30 researchers. And that’s why hundreds of the world’s largest institutions rely on Moody’s Analytics for their credit risk management decisions,” Sokol added.

For more news and information, visit the Tactical Allocation Channel.