The Urban Land Institute released a report outlining the climate risks associated with real estate investing–something that investors in the tangible asset class might not be aware of when assessing risk versus opportunity.

The reported cited Hurricanes Harvey and Maria in the United States and storms affecting northern and central Europe as prime case studies where the damage resulted in $135 billion paid out by insurers globally. However, $307 billion in actual damage from natural disasters affected the United States, according to the National Oceanic and Atmospheric Administration.

“Failure to address and mitigate climate risks may result in increased exposure to loss as a result of assets suffering from reduced liquidity and lower income, which will negatively affect investment returns,” the report noted. “At the same time, investors who arm themselves with more accurate data on the impact of climate risks could help differentiate themselves and benefit from investing in locations at the forefront of climate mitigation.”

As far as its effects on value, the report noted that a 2018 study determined that homes that were left vulnerable to flooding in Florida, Georgia, North Carolina, South Carolina, and Virginia lost $7.4 billion in valuation between the years 2005 and 2017. In addition, the New York metropolitan area lost $6.7 billion in value of value in the same period because of increased flooding from sea-level rise.

Related: Solar Boom is Heating Up; ‘TAN’ ETF Up 34% YTD

The reports cited two primary types of risk that could affect real estate: physical risks and transition risks:

- Physical risks: those capable of directly affecting buildings; they include extreme weather events, gradual sea-level rise, and changing weather patterns.

- Transition risks: those that result from a shift to a lower-carbon economy and using new, non-fossil-fuel sources of energy. These include regulatory changes, economic shifts, and the changing availability and price of resources.

Because the majority of real estate investors hold their assets long-term, climate risks become a concern. Additionally, the report notes that insurance alone won’t be able to protect against loss in value.

However, the industry is starting to take notice.

“Many investment managers indicated they are exploring how climate mitigation strategies—such as seawalls, dikes, building hardening, increased elevation, and additional cooling systems—can be incorporated into properties to improve their resilience and reduce the risk of losses or business interruption during a major weather event,” the report said.

To that end, investors can take part in the real estate market through the Vanguard Real Estate ETF (NYSEArca: VNQ). VNQ seeks to provide a high level of income and moderate long-term capital appreciation by tracking the performance of the MSCI US Investable Market Real Estate 25/50 Index that measures the performance of publicly traded equity REITs and other real estate-related investments.

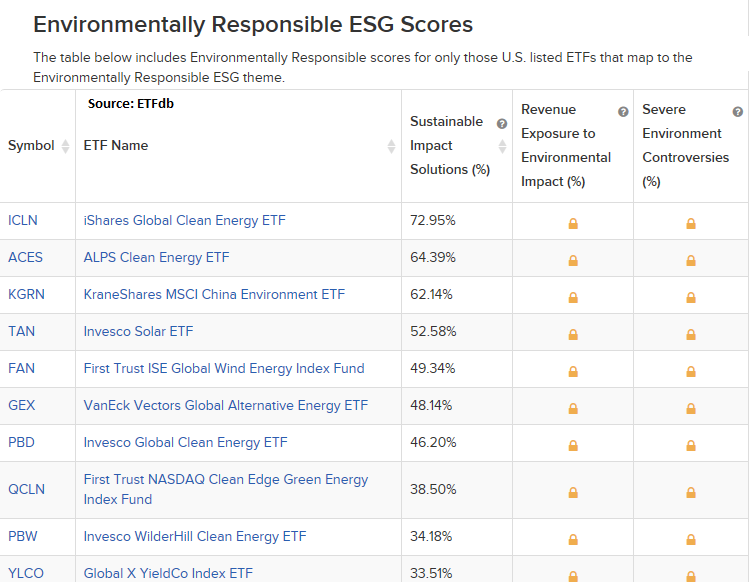

For ETF investors who want to take on the challenges presented by climate change can look to environmentally-responsible funds. Below are examples:

To read the full ULI report, click here.

For more market trends, visit ETF Trends.