Iron ore keep on climbing, feeding into more strength for the VanEck Vectors Steel ETF (SLX), which is up 30% on the year.

Furthermore, it’s a trend that should persist throughout the rest of the year, according to a Mining.com article.

“According to IndexBox, global steel consumption is forecast to increase in 2021 by 4.1% year-on-year,” the article said. “Prices have also been fueled by falling supplies from major miners.”

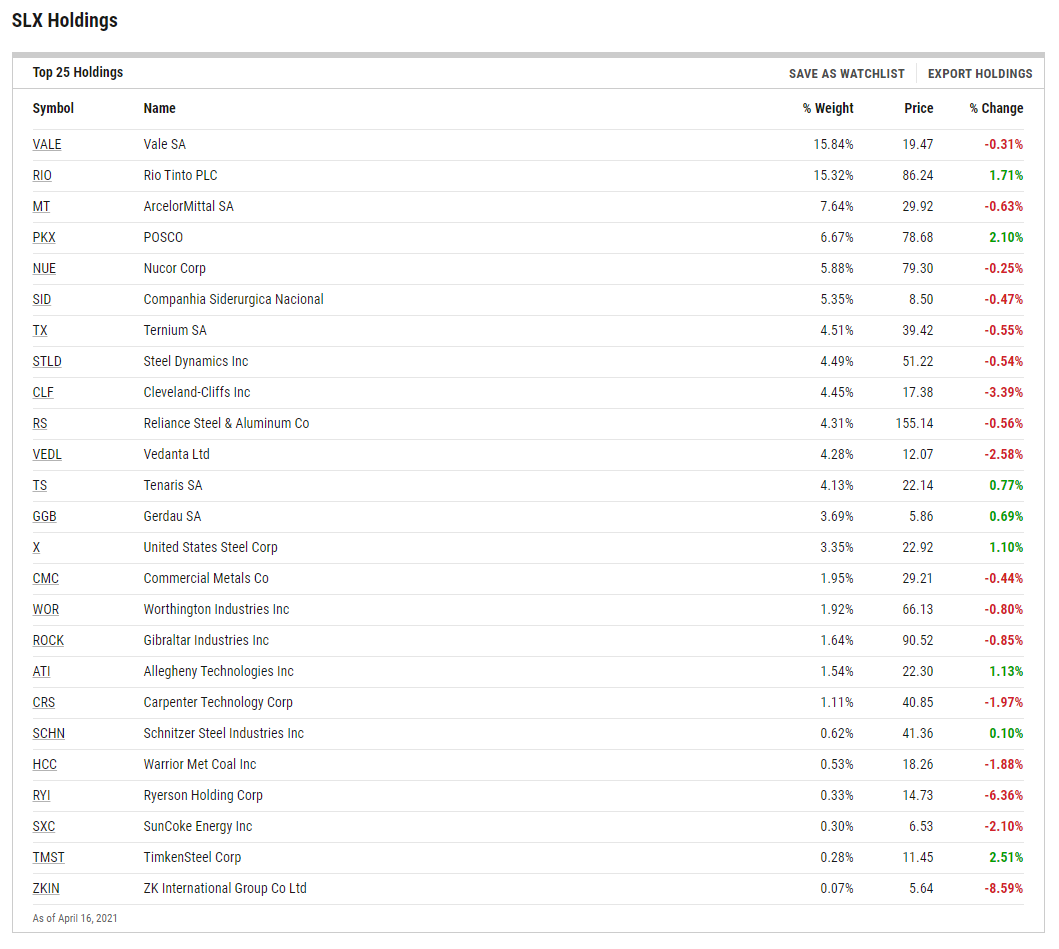

SLX tries to reflect the performance of the NYSE Arca Steel Index, which follows global companies involved in the steel industry. While more than a third of SLX’s lineup is allocated to U.S. steel producers, the ETF has a heavy global tilt, including exposure to ex-U.S. developed markets and emerging markets steel companies.

SLX investors get:

- One-Trade Access to the Steel Industry: An industry supporting global industrialization.

- A Pure Play with Global Scope: Includes companies involved in a variety of activities related to steel production.

- Convenient Customization: Customize overall commodity exposure with targeted allocation to steel companies.

- Strong Performance: The fund is up 150% within the past 12 months.

“SLX is poised to benefit nicely from increased steel demand as the global economic recovery picks up speed and from continued investments in infrastructure,” noted an ETF Database analysis. “SLX often trades as a leveraged play on the underlying natural resources, meaning that this fund can experience significant volatility but can be a powerful tool for profiting from a surge in steel prices.”

Steel Demand Still Strong, Despite Restrictions in China

China has been stepping up its efforts to curb pollution, including the placement of restrictions on certain steelmaking cities. Per the Mining.com article, “Tangshan, China’s top steelmaking city, said last month it will punish firms that either have not taken the steps spelled out under its emergency anti-pollution plan or have illegally discharged pollutants, following weeks of heavy smog in northern China.”

Nonetheless, steel margins remain high given the strong demand.

“Steel margins in China are very attractive at the moment, so even with the restrictions in Tangshan, other producers have every incentive to try to increase operating rates,” ING head of commodities strategy Warren Patterson told the Financial Review.

“Stronger margins, along with more focus on reducing emissions, has also proved supportive for higher-grade iron ore demand. This is reflected in the quality premium, which has widened recently,” Patterson added.

“Despite talk of nationwide inspections, we believe other regions will ramp up, particularly given the spike in steel margins,” JPMorgan analyst Lyndon Fagan said.

For more news and information, visit the Beyond Basic Beta Channel.