The adage of “no risk, no reward” is often circulated through the capital markets when it comes to achieving alpha, but historical data tells a different story, particularly when it comes to equities. More risk doesn’t necessarily translate into more gains as studies show that over the past 20 years investing in lower risk equities has yielded superior returns.

“For investing purposes, we make the assumption that the more risk we take, the more return we receive is true across everything that we do in investing,” said Alex Piré, Head of Client Portfolio Management, Natixis Seeyond. “Our studies and academic research have shown that’s not the case. If you’re allocating across risky assets, it’s not the same thing as if you’re allocating across stocks that potentially have very high correlations to each other.”

Humanizing the Modern Investor

Harry Markowitz’s pioneering work in modern portfolio theory provides a firm basis for an asset allocation framework, but doesn’t fully take into account investor behavior. According to Markowitz’s theory, investors act as rational creatures devoid of emotion when it comes to making daily market decisions.

However, extensive research by Kahneman, Tversky, Statman and Shefrin as well as independent organizations like DALBAR have challenged that notion. Through these studies, data extrapolated shows that investors act neither rationally nor irrationally.

This research provided the basis for behavioral finance, which helps bridge the gap with Markowitz’s modern portfolio theory.

“Everyone believes that investors are normal–we have flaws, we make mistakes, we’re not computers all the time,” said Pire. “What does this really mean in practice? It means that we’re potentially going to make errors or make decisions that are not in our best interest in the long-term.”

Fast forward to today where the capital markets are flush with investors who fall victim to their own emotional biases, making them prone to cognitive errors and making rash decisions in order to realize the short-term gain. All in all, it can prevent investors from making decisions that serve their portfolios best.

For example, a dichotomy exists between the holding periods for mutual funds and their investment horizons. According to the 2018 QAIB Report Advisor Edition 5724 from DALBAR, investors exhibit a tendency to hold equity mutual funds for an average of under 3.5 years over the past 20 years despite having investment horizons of 20 to 40 years.

The holding period is even less when markets go awry, providing more evidence that investors can react according to their emotions–once again, to the detriment of their portfolios. This emotion can also surface with respect to the fear of missing out on gains realized, which could lead to excessive buying and selling of securities.

“One of the most important things that you can do as an investor is invest for the long-term and invest in your time horizon,” said Pire.

The Current Market Landscape

Last year’s bull market peak provided a serendipitous run for U.S. equities, but in 2019, investors have to be more strategic with their capital allocation. This is especially so with the possibility of slower global growth on the horizon.

Recently, the IMF cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets. According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January.

According to Natixis Investment Managers, this means:

- There is certainly a scenario for equities to continue their upward trajectory though at current level we would expect returns to be more muted.

- There is also unfortunately a strong case to be made for deceleration to slip into recession which would yield significant pain for investors. Thus the asymmetric risk reward relationship.

According to the 2018 Natixis Individual Investor Survey, close to eight out of ten financial professionals agreed that the current bull market run is making risk an afterthought in the minds of investors. The current market environment actually portends to something different: investors need to be focused on risk more than ever given the potential market headwinds.

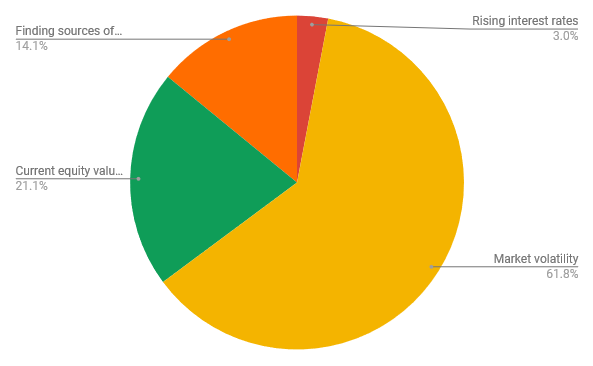

Furthermore, the image of the fourth-quarter volatility in 2018 must be firmly etched in investors’ minds as it was the primary concern for the rest of the year and beyond as revealed in survey results from the 2019 Virtual Summit. Survey respondents were asked what’s weighing heavily on the minds of investors as 2019 wears on and over 60 percent chose market volatility as the main concern.

As such, what exchange-traded products (ETPs) are there available in the marketplace that can address this concern for volatility risk while at the same time, realize any upward gains realized when markets rise? At the same time, what product can provide investors with the international exposure necessary for diversification?

An ETF for the Current Market

One such product is the Natixis Seeyond International Minimum Volatility ETF (MVIN). MVIN focuses on developed markets and seeks to generate long-term capital appreciation with less volatility than typically experienced by international equity markets–the minimum volatility approach helps diminish portfolio risk.

MVIN gives investors:

- Less volatile approach to diversify internationally

- Long-term capital appreciation seeking less volatile international stocks

- Actively managed ETF with the ability to adapt over time

Even with U.S. equities rebounding from last year’s fourth-quarter tumult, it still makes sense to buy into a product like MVIN, which can provide investors with the duality of realizing gains during a market upswing and protect investors in a downturn.

“What it enables you to do is invest in an asset class like international equities that can have significant up and down movements and extreme movements on both sides, but in a way that minimizes our own emotional reaction,” said Pire.

“We look to participate on the upside and cut that drawdown,” added Pire.

Having this protection built-in via an ETF wrapper prevents investors from having to hedge their positions with the addition of uncorrelated assets like bonds or precious metals. Speaking to the former, however, the stock sell-off in the fourth quarter of 2018 also affected the fixed-income space.

The lockstep between stocks and bonds as of late is not something typically seen within the capital markets as both are prone to marching to the beat of their own drum. As such, investors can’t always look to bonds as the default go-to safe haven when the equities market goes awry.

Dynamic, Low Volatility Strategy

As opposed to relying on investment fundamentals, MVIN selects stocks based on risk (standard deviation) and correlations, which provide a better pulse of the markets. The fund seeks to outperform the broad international equity markets over a full market cycle, while at the same time, mute volatility by building a diversified portfolio composed of 80 to 160 low-volatility stocks.

Via quantitative and qualitative filtering, MVIN omits stocks that lack insufficient history, liquidity and high correlation with other stocks in the portfolio. Furthermore, the strategy eliminates stocks that demonstrate specific risks.

“MVIN has a very low sensitivity to the market, it has one of the lowest beta of any funds in the foreign market blended category,” said Pire.

Given certain market conditions, investors need more than just a passive index that goes beyond a one-size-fits-all template that uses market cap weighting. While these indexes provided simple, low-cost solutions, the need for even greater scrutiny is necessary in the quest for more alpha–a case for products like MVIN.

As such, MVIN is actively-managed, which provides:

- Continuous monitoring of portfolio for volatility, liquidity and individual risk factors

- Discretionary rebalancing based on proprietary risk framework

- Adaptability to changes in market conditions when necessary

According to Morningstar performance numbers, MVIN has been providing investors with an 8.56 percent gain year-to-date.

“Through this active management, we’ve been able to demonstrate alpha generation through time that seeks to more effectively keep up on the upside” said Pire.

For more relative market trends, visit ETFtrends.com.