The price of gold is lingering under $1,300, but the latest decision to keep rates unchanged could help exchange-traded funds (ETFs) that allocate to real assets like the VanEck Vectors® Real Asset Allocation ETF (NYSEArca: RAAX).

RAAX uses a data-driven, rules-based process that leverages over 50 indicators, including technical, macroeconomic and fundamental, commodity price, and sentiment. Using this data, it allocates across 12 individual real asset segments in five broad real asset sectors.

The aforementioned indicators identify the segments with positive expected returns. Using correlation and volatility, an optimization process determines the weight to these segments with the goal of creating a portfolio with maximum diversification while at the same time, reducing risk.

One of the allocations the fund added as of late was opportunities in gold. With the latest announcement by the Federal Reserve that it would continue to keep interest rates in check, this could mean for strength for gold if a dollar weakens.

“It increased its gold equity allocation from 13% to 16%,” wrote David Schassler, Portfolio Manager at VanEck. “This was funded by reducing its REIT position from 12% to 9%. RAAX now holds its largest gold allocation ever, with its gold bullion and gold equity allocation accounting for a combined 36% of its assets.

Gold has long been used as a safe haven asset, particularly when the value of the dollar declines. Furthermore, it provides a hedge for inflation since its price typically rises in conjunction with consumer prices.

During the Great Depression of the 1930s, gold was also a hedge against deflation. While the prices of assets were dropping during this time, the purchasing power of gold rose to prominence.

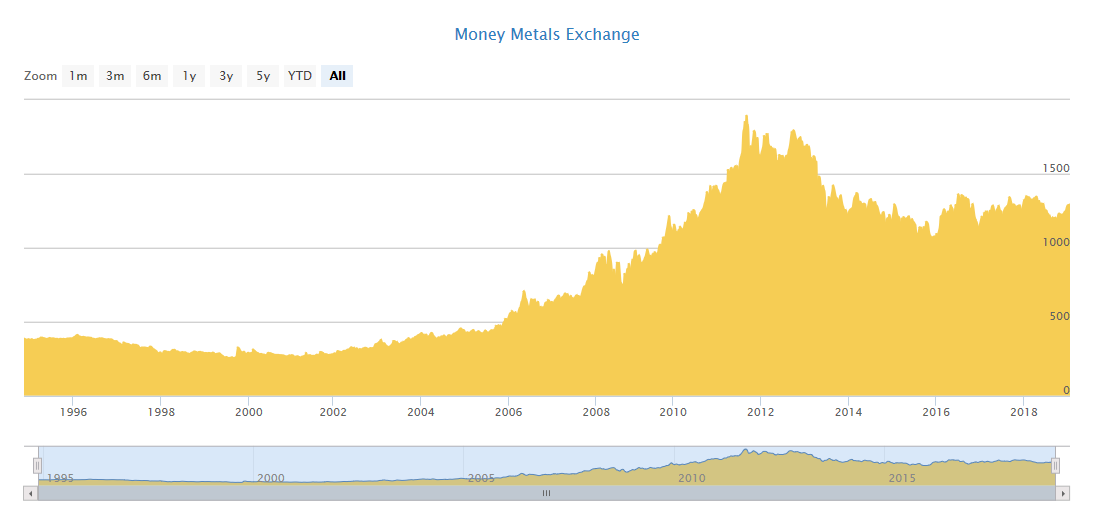

Fast forward to the financial crisis in 2008, the price of gold increased sharply while faith in U.S. equities was languishing. In essence, gold has proven to withstand times of geopolitical and economic uncertainty.

Furthermore, the value of gold has risen steadily over the years.

With the latest Fedspeak sounding more dovish, this could be the trigger for gold to return to come back into the forefront, particularly as a safe-haven option in the wake of more volatility. While bonds are typically the default play when U.S. equities go awry, gold is also a prime option for diversification as a safe alternative.

With the latest Fedspeak sounding more dovish, this could be the trigger for gold to return to come back into the forefront, particularly as a safe-haven option in the wake of more volatility. While bonds are typically the default play when U.S. equities go awry, gold is also a prime option for diversification as a safe alternative.

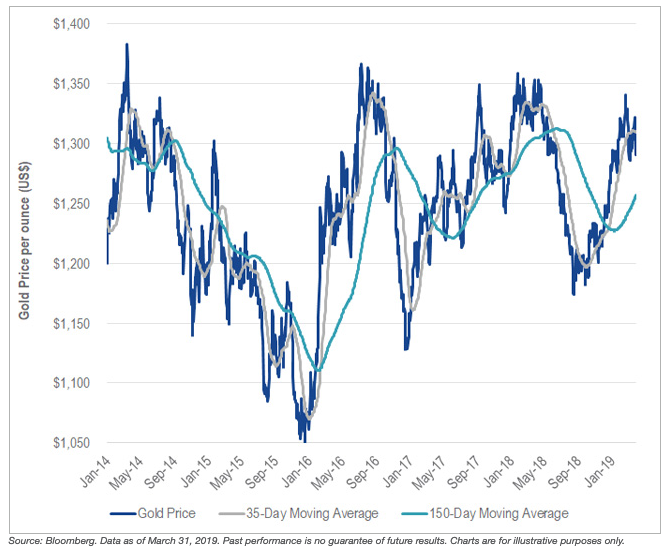

“RAAX likes gold, a lot,” Schassler noted. “We use several indicators to determine if we will invest in gold. A simple, yet potent, indicator that we use is a moving average crossover. It measures trends in prices. Simply put, it buys based on strength and sells based on weakness. When the short-term average of the price (grey line) crosses above the long-term average of the price (teal line) you buy and when it crosses below you sell.”

For more market trends, visit ETF Trends.