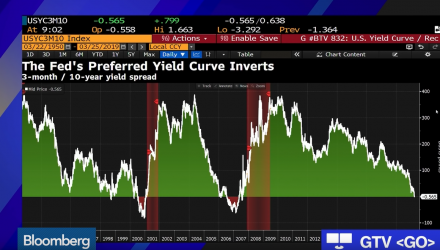

An inverted yield curve has been the cause of much angst the past week in the capital markets.

The pair consisting of the short-term 3-month Treasury yield and the long-term 10-year yield have been the prime focus the past week. On Tuesday, the 3-month note eased off its upward ascent while the 10-year yield climbed, decreasing the steepness of the inversion.

Fears of an inverted yield curve racked the markets during 2018’s fourth quarter sell-off, but they returned last week as the short-term 3-month and longer-term 10-year yield curve did as such–unveil an inversion that hasn’t been seen since 2007–just ahead of the financial crisis.

The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. This strong recession indicator contrasted a more upbeat central bank, but investors were quick to sense the cautiousness.

In the video below, Lale Topcuoglu, senor fund manager at JOHCM, Bob Michele, global chief investment officer at JPMorgan Asset Management, and Andres Garcia Amaya, founder and chief executive officer at Zoe Financial, discuss the global bond market rally and U.S. yield curve. They speak with Bloomberg’s Jonathan Ferro on “Bloomberg Markets: The Open.”

For more market trends, visit ETF Trends