By Natalia Gurushina

Chief Economist, Emerging Markets Fixed Income

EM FX Devaluations

An FT article caught our attention this morning – but it’s not the one about the sustainability of Japan’s central bank government bond purchases and potential changes in the yield curve control mechanism (YCC) under the new governor (albeit this might have very serious implications for global Fixed Income, especially Investment Grade instruments with their super-tight spreads). “Our” article talks about “a spate” and “a further slew” of emerging markets (EM) FX devaluations caused by the strong U.S. Dollar. We are not sure how well this characterizes EM, especially in light of strong performance of many EM currencies last year or a dramatic repricing lower of Asian interest rates. Further, letting currencies go while accelerating structural reforms and engaging multilateral financial support is probably the best thing that can happen to developing economies from the longer-term perspective. This is the lesson learned by their predecessors – many of whom are now “EM Graduates” – in the wake of the 1997/98 global financial crisis. Egypt is not doing this – yet – and therefore still strikes us as vulnerable to such episodes – it’s really a “classic” setup including the part about learning the hard way.

EM Structural Adjustment

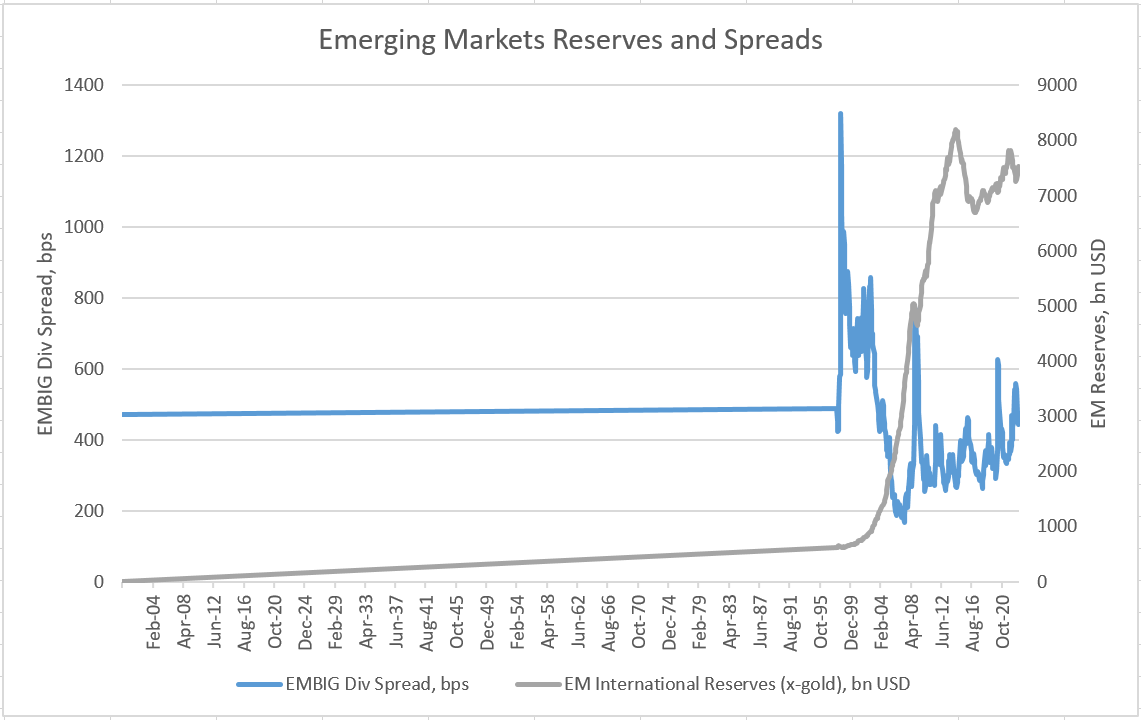

Using FX as a shock-absorber – while relying on interest rates as the primary policy instrument to target inflation – helps to initiate a “textbook” adjustment of the current account balance (less imports and more competitive exports). With fewer FX interventions, this is the fastest way to start rebuilding the international reserves. Over time, the accumulation of reserves and a stronger structural/institutional backdrop should lead to a major decline in sovereign spreads, limiting the extent of potential “flare-ups” in the future. The chart below demonstrates all these points very well (higher reserves/tighter spreads/lower peaks). Many EMs are now net sovereign creditors in U.S. dollars!

EM FX And U.S. Dollar

EMs that used their past devaluation experiences wisely – reforms, accumulation of reserves, inflation-targeting – are now less tied up to the U.S. Dollar cycle. The Brazilian real, the Mexican peso, the Peruvian sol, and the Chilean peso ended up stronger vs. the U.S. Dollar last year. The final point here is that there are different ways to get exposure to emerging markets these days. For example, we don’t like Brazil’s local market currently (due to policy noise), so we just don’t own it…but the current environment can still be positive for Brazilian credits that pay in real and earn in U.S. Dollar (for example). Stay tuned!

Chart at a Glance: EM Reserves vs. Sovereign Spreads in Different Regimes

Source: Bloomberg LP.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.