The fall of 1988 saw “Don’t Worry, Be Happy” by Bobby McFerrin climb the music charts, which was a year removed from a time when happiness was nonexistent in a U.S. stock market that experienced “Black Monday” on October 19, 1987–the largest single-day decline when the Dow Jones Industrial Average shed a whopping 22.6 percent. Fast forward to the 2019 ETF Virtual Summit where investors are singing that same tune with confidence.

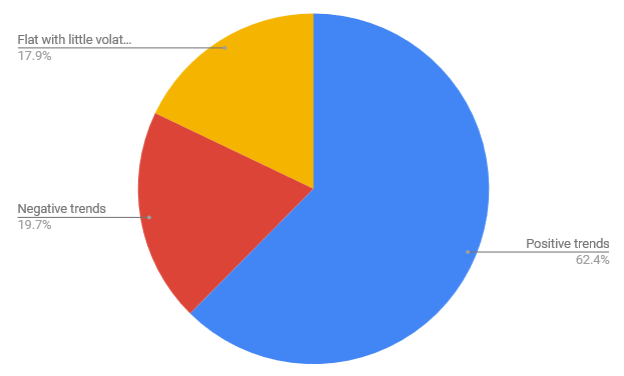

During the Out of the Box; Alternative and Thematic Tools to Better Diversify Client Portfolios segment, attendees were asked what their market expectations were for the rest of 2019: positive trends, negative trends or flat with little volatility. The results were eponymously positive–62.40 percent cited positive trends expected through year’s end.

The positive expectations mirror the current market sentiment as evidenced by the CNN Business Fear & Greed Index, which is pegged to the right to indicate extreme greed–a positive sign of confidence in the markets. The index derives its results from looking at stock price momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand.

The Out of the Box; Alternative and Thematic Tools to Better Diversify Client Portfolios panel:

- Sylvia Jablonski, Capital Markets-Institutional Strategist, Managing Director, Direxion

- Meb Faber, Chief Executive officer and Chief Investment Officer, Cambria Investment Management

- Bill DeRoche, Chief Investment Officer and Portfolio Manager, AGFiQ

Even with positive vibes reverberating through the market after the S&P 500 and Nasdaq Composite closed to new highs on Tuesday, it would be foolhardy to ignore market volatility. The first quarter has been a good one for U.S. equities, but with the wall of worry growing–inverted yield curves, trade wars, global growth, and a more dovish Federal Reserve–it has investors wondering about the rest of 2019.

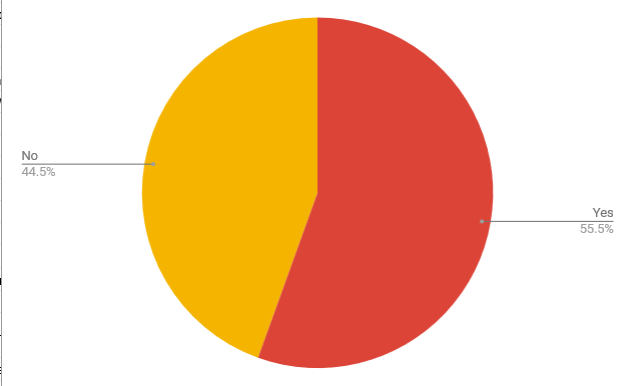

More volatility on the horizon perhaps? Maybe that’s what ETF Virtual Summit attendees were thinking when they were asked if the plan to add hedging strategies in their portfolio allocation between now and the end of the year: yes or no?

Survey said: yes–a sign that investors are looking towards positive trends through the end of the year, but are not taking anything for granted and ETF products can provide investors with the ability to capture upside while protecting them from the downside.

With the transparency and liquidity of an ETF wrapper that incorporates multiple hedge fund strategies, it opens up the arena to all types of investors irrespective of net worth–the case for using alternative and thematic tools in the current market landscape. This can benefit investors, particularly during a market drawdown where hedging and inverse opportunities can be had.

During the summit, investors were provided with ETFs that can provide the aforementioned features. Feeling sad because you missed the 2019 Virtual Summit?

Don’t worry, be happy because the on-demand version is available now: https://www.etftrends.com/virtual-summit.