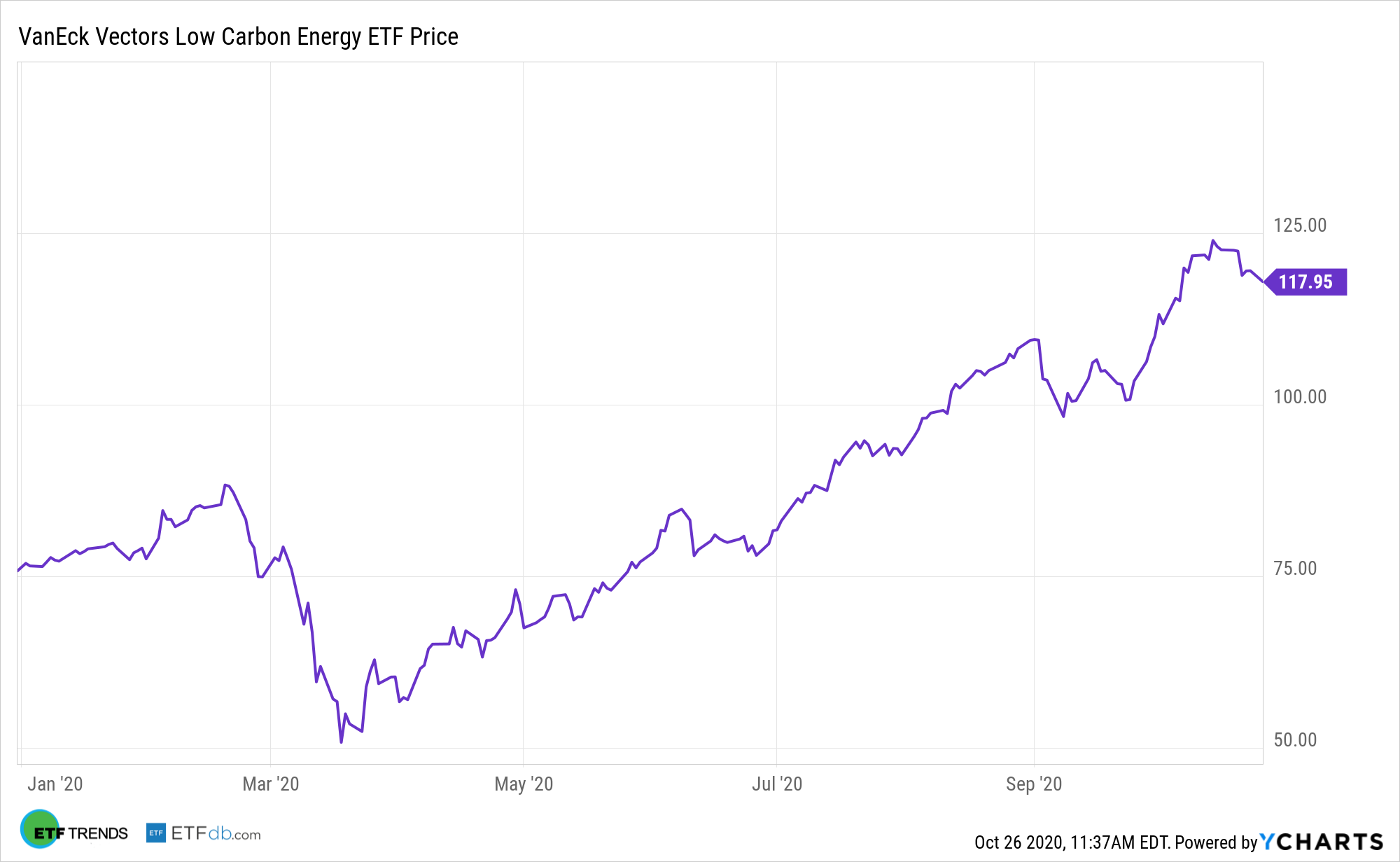

As speculation swirls in the capital markets on the proverbial ‘blue wave’, a Democratic majority in the White House can certainly help boost clean energy. This could bode well for the VanEck Vectors® Low Carbon Energy ETF (SMOG).

“An aggressive push towards 100% renewable energy would save Americans as much as $321bn in energy costs, while also slashing planet-heating emissions, according to a new report,” an article in The Guardian noted. “Joe Biden, the Democratic presidential nominee, has vowed to eliminate greenhouse gases from the US power grid within 15 years and essentially zero out emissions by 2050, a plan assailed by Donald Trump as costly and detrimental to the American economy.”

As for SMOG, the fund seeks to replicate as closely as possible the price and yield performance of the Ardour Global IndexSM Extra Liquid (AGIXLT). The index is intended to track the overall performance of low carbon energy companies which are those companies primarily engaged in alternative energy which includes power derived principally from bio-fuels (such as ethanol), wind, solar, hydro and geothermal sources and also includes the various technologies that support the production, use and storage of these sources.

- One-Trade Access to Low Carbon Energy: Dynamic industry driven by growing demand for clean and alternative energy sources

- Pure Play with Global Scope: Global companies must derive at least 50% of total revenues from low carbon energy (i.e., alternative energy) to be added to the Index

- Convenient Customization: Customize overall commodity exposure with targeted allocation to low carbon energy companies

Here are a few more funds to consider in the clean energy space:

- ALPS Clean Energy ETF (ACES): seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, the CIBC Atlas Clean Energy Index. The underlying index utilizes a rules-based methodology developed by CIBC National Trust Company, which is designed to provide exposure to a diverse set of U.S. and Canadian companies involved in the clean energy sector including renewables and clean technology. The fund is non-diversified.

- KraneShares MSCI China Environment Index ETF (KGRN): seeks to provide investment results that correspond to the price and yield performance of MSCI China IMI Environment 10/40 Index. The underlying index is a modified, free float-adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies that derive at least a majority of their revenues from environmentally beneficial products and services, as determined by MSCI Inc.

- Invesco Solar ETF (TAN): seeks to track the investment results (before fees and expenses) of the MAC Global Solar Energy Index (the “underlying index”). The underlying index is designed to provide exposure to companies listed on exchanges in developed markets that derive a significant amount of their revenues from the following business segments of the solar industry: solar power equipment producers including ancillary or enabling products; etc.

For more market trends, visit ETF Trends.