The COVID-19 pandemic has given way to new technological innovations in the biotechnology sector with respect to creating a vaccine. ETF investors looking for a play that can take them well into 2021 might find the VanEck Vectors® Biotech ETF (BBH) appealing.

The fund seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Biotech 25 Index (MVBBHTR), which is intended to track the overall performance of companies involved in the development and production, marketing, and sales of drugs based on genetic analysis and diagnostic equipment.

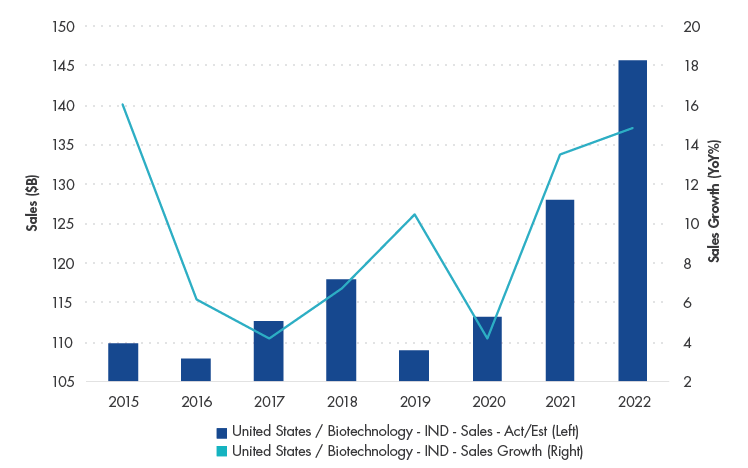

The fund is up 16% year-to-date and 21% within the past year. Overall, BBH offers investors exposure to:

- Highly Liquid Companies: The index seeks to track the most liquid companies in the industry based on market cap and trading volume.

- Industry Leaders: Index methodology favors the largest companies in the industry.

- A Global Scope: BBH may include both domestic and U.S. listed foreign companies allowing for enhanced industry representation.

“Looking ahead into 2021, the biotech sector is attractive from many perspectives,” a Stock News article said. “Valuations are quite reasonable and earnings have steadily increased. The leading stocks in the sector have high-margins and above-average revenue growth. Finally, the total addressable market for effective treatments continues to expand.”

“Another catalyst for the sector is that due to the coronavirus, many countries are increasing spending on public health and upgrading their health infrastructure,” the article said further. “Private-public partnerships like “Operation Warp Speed” seem to be working and have created a framework to incentivize and support companies who are developing therapies that could yield public health benefits.”

BBH’s Growth Potential

“The sector’s growth potential seems encouraging, as forecasters expect demand for diagnostics and antibody tests to outstrip supply for the foreseeable future,” a VanEck blog post stated. “At the time of writing, the coronavirus has already infected more than 4M globally, and the death toll has surpassed 290,000. Even governments that appeared to have tamed the disease have warned of resurgence.”

“COVID-19 and the urgency in finding a cure have opened up opportunities, making the biotech sector a prospective space for investments,” the post said. “Instead of trying to pick which are the most likely beneficiaries, one of the easiest ways to invest in biotech is via an ETF like BBH.”

For more news and information, visit the Tactical Allocation Channel.