Most might consider 13 to be an unlucky number, but for hedge funds, it marks the best first quarter its had in as many years. According to the Hedge Fund Research index, which tracks the performance of hedge funds, it rose 5.7 percent in Q1 of 2019–its highest since 2006.

The rebound in U.S. equities thus far in 2019 has re-injected risk back into the markets, which appears to be fueling hedge fund gains.

“Hedge fund capital posted sharp gains to begin 2019 as investor risk tolerance increased,” said Kenneth Heinz, president of Hedge Fund Research, a Chicago-based provider of hedge fund data and analysis.

In addition, hedge funds took in $3.18 trillion despite $18 billion in assets, but that was offset by $97 billion in performance gains.

“It is likely that the hedge fund capital and flow cycle lags realized performance by several quarters as investors evaluate new allocations in light of recent performance,” Heinz added. “We expect this process to contribute to continued asset growth and new investor allocations throughout 2019.”

That said, investors might want to look at exchange-traded funds (ETFs) that mimic hedge fund strategies. By virtue of an ETF wrapper, investors can access these strategies that were once only available to only high-net worth individuals.

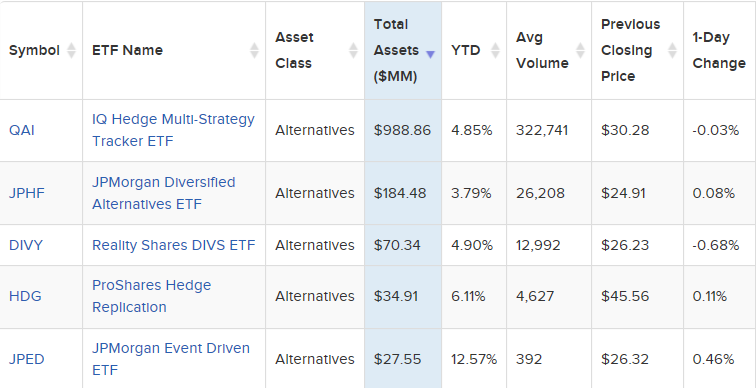

Below are five to consider:

- IQ Hedge Multi-Strategy Tracker ETF (NYSEArca: QAI): seeks investment results that correspond generally to the price and yield performance of its underlying index, the IQ Hedge Multi-Strategy Index. The fund is a “fund of funds” which means it invests, under normal circumstances, at least 80 percent of its net assets, plus the amount of any borrowings for investment purposes, in the investments included in its underlying index, which includes underlying funds. The underlying index consists of a number of components selected in accordance with IndexIQ’s rules-based methodology of such underlying index.

- JPMorgan Diversified Alternative ETF (NYSEArca: JPHF): seeks to achieve its investment objective by allocating assets across several different investment strategies, including traditional and alternative investment strategies, such as those utilized by certain hedge funds. The strategies identified by the adviser for the fund fall into the following broad categories: Equity Long/Short, Event Driven and Macro/Managed Futures strategies. The fund will invest its assets based on a systematic investment process for securities selection and asset allocation.

- Reality Shares DIVS ETF (NYSEArca: DIVY): seeks to produce long-term capital appreciation. The fund’s principal investment strategy is designed to provide exposure to the aggregate value of ordinary dividends expected to be paid on a portfolio of large capitalization equity securities listed for trading in the U.S. The fund may use a variety of investment strategies to achieve this objective. Under normal circumstances, it generally invests in a combination of dividend swaps, dividend futures and forwards on indexes of Large Cap Securities.

- ProShares Hedge Replication ETF (NYSEArca: HDG): seeks investment results that track the performance of the Merrill Lynch Factor Model-Exchange Series. The fund invests in financial instruments that ProShare Advisors believes, in combination, should track the performance of the benchmark. The benchmark seeks to provide the risk and return characteristics of the hedge fund asset class by targeting a high correlation to the HFRI Fund Weighted Composite Index. The HFRI is designed to reflect hedge fund industry performance through an equally weighted composite of over 2000 constituent funds.

- JPMorgan Event Driven ETF (NYSEArca: JPED): seeks to provide long-term total return. The fund seeks to achieve its investment objective by employing an event-driven investment strategy, primarily investing in companies that the fund’s adviser believes will be impacted by pending or anticipated corporate or special situation events. It will do so based on its systematic investment process. The fund will generally invest its assets globally to gain exposure, either directly or through the use of derivatives, to equity securities (across market capitalizations) in developed markets.

For more investment trends, visit ETFTrends.com