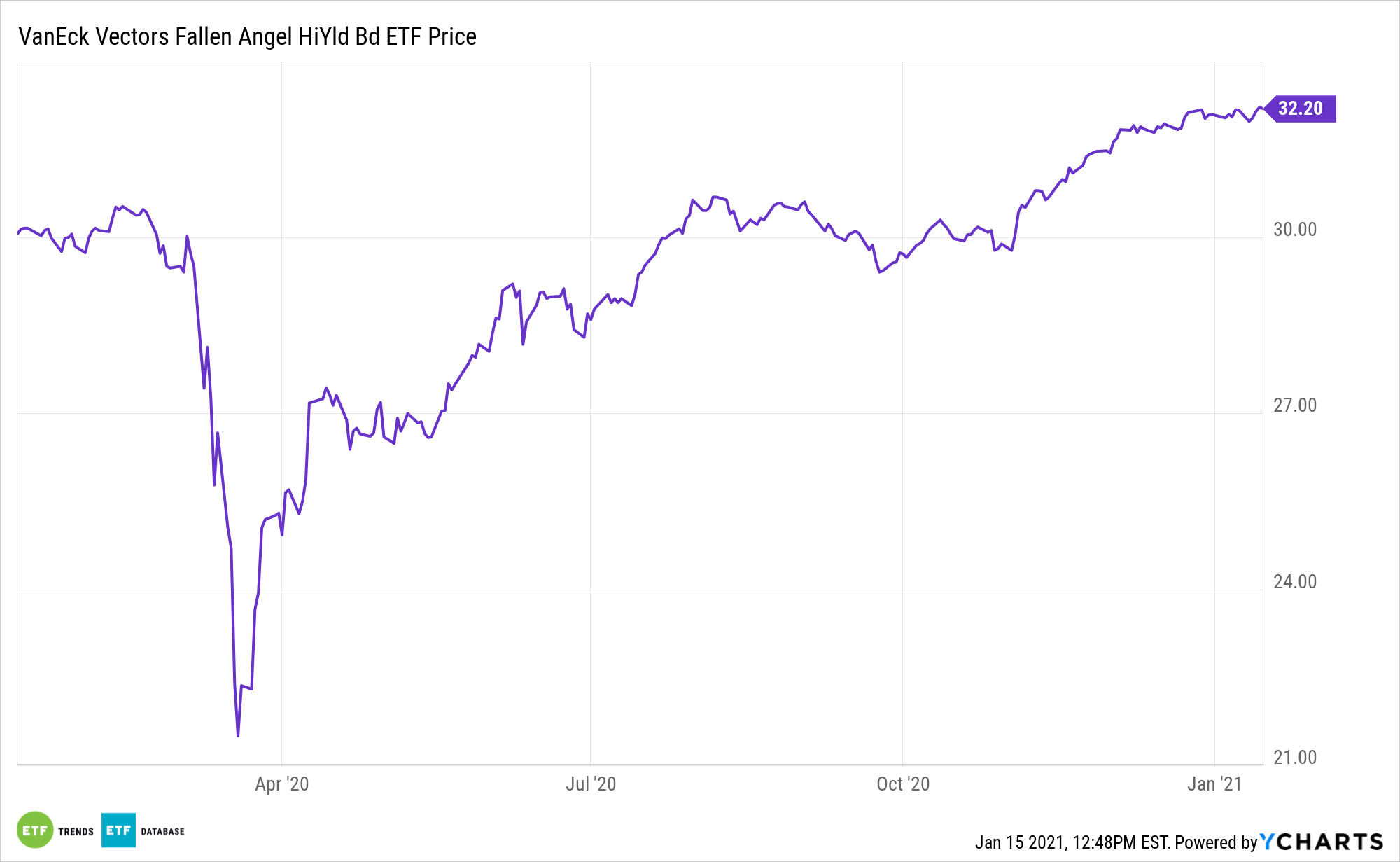

Both ESG investing and energy have been prevailing trends getting a lot of investor interest to start the new year. ETF issuer VanEck is seeing interest in some more places forward-thinking investors may want to consider.

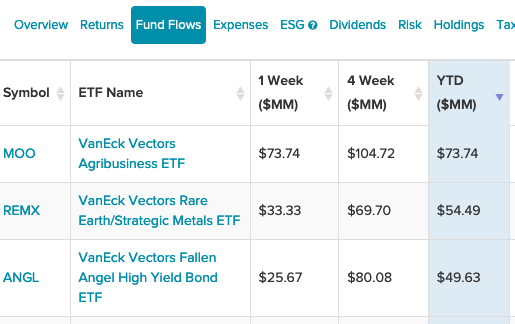

VanEck Vectors® Agribusiness ETF (MOO): seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Agribusiness Index (MVMOOTR), which is intended to track the overall performance of companies involved in: agri-chemicals, animal health and fertilizers, seeds and traits, from farm/irrigation equipment and farm machinery, aquaculture and fishing, livestock, cultivation and plantations (including grain, oil palms, sugar cane, tobacco leafs, grapevines, etc.), and trading of agricultural products. MOO gives investors:

- A Position to Meet Growing Demand: Global population growth is driving increasing food demand and the need for efficient agricultural solutions

- A Pure Play with Global Scope: Companies must derive at least 50% of total revenues from agribusiness to be added to the Index

- Comprehensive Exposure: Index targets companies across the agribusiness industry from seeds and fertilizers to farming equipment and food processors

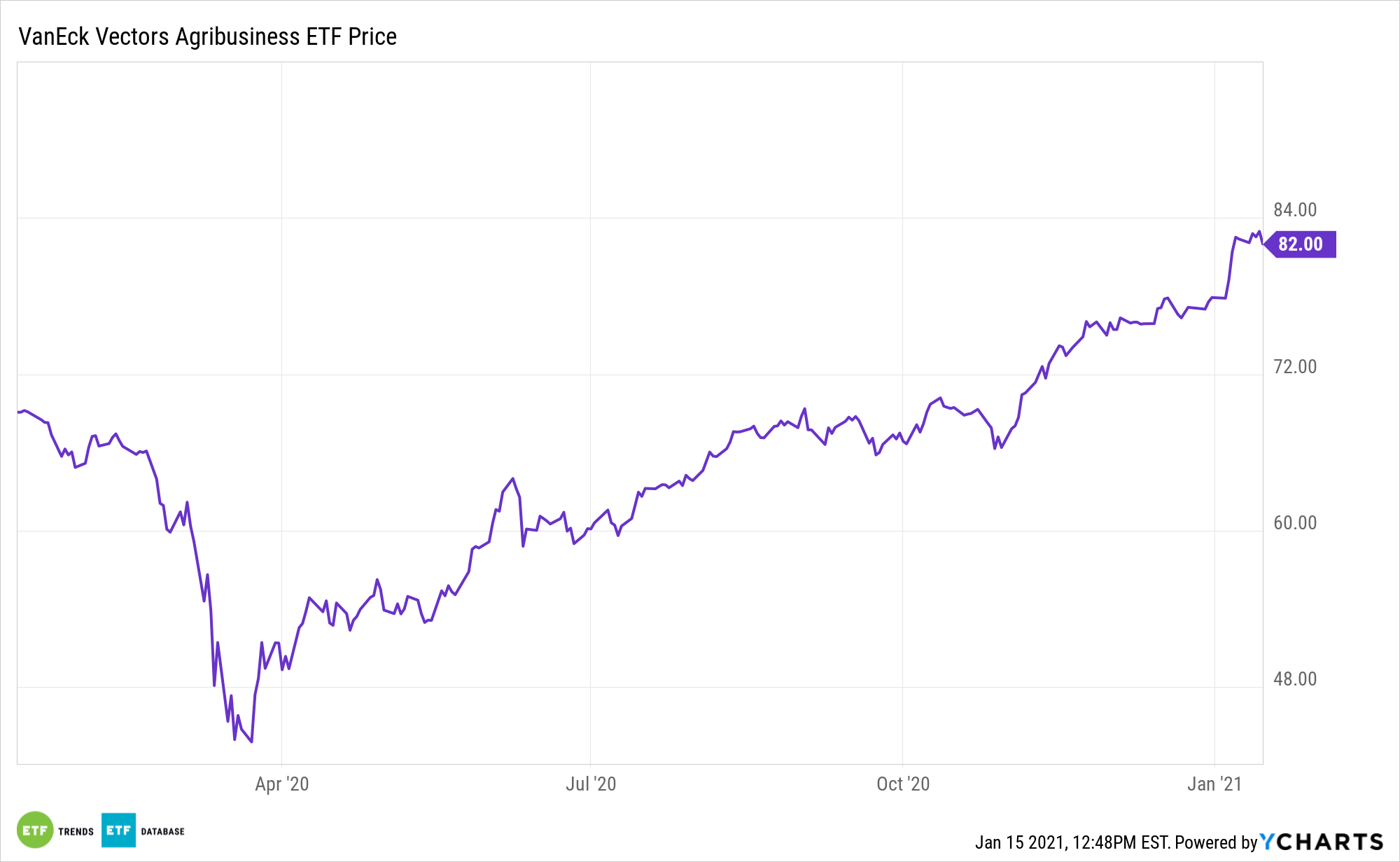

VanEck Vectors Fallen Angel High Yield Bond ETF (BATS: ANGL): ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

The fund focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status. ANGL gives investors:

- Higher-Quality High Yield: Fallen angels, high yield bonds originally issued as investment grade corporate bonds, have had historically higher average credit quality than the broad high yield bond universe

- Outperformance in the Broad High Yield Bond Market: Fallen angels have outperformed the broad high yield bond market in 12 of the last 16 calendar years

- Higher Risk-Adjusted Returns: Fallen angels have historically offered a better risk/reward trade off than found with the broad high yield bond market

VanEck Vectors Rare Earth/Strategic Metals ETF (REMX): seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Rare Earth/Strategic Metals Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes companies primarily engaged in a variety of activities that are related to the producing, refining, and recycling of rare earth and strategic metals and minerals. REMX gives investors:

- One-Trade Access to the Rare Earth/Strategic Metals Industry: A highly volatile industry that supplies key inputs to many of the world’s most advanced technologies

- Comprehensive Global Exposure: Companies must derive at least 50% of total revenues from the rare earth/strategic metals industry to be added to the Index and may include A-shares issued by Shanghai-listed companies trading via Shanghai-Hong Kong Stock Connect

- An Industry Known for Volatility: Rapidly changing supply and demand dynamics, government defense implications, and heavy China involvement have driven significant volatility in the industry historically

For more news and information, visit the Tactical Allocation Channel.