October 2018 has been one to forget for U.S. equities, but in a survey by the American Association of Individual Investors, it wasn’t much better for bonds as exposure to fixed-income dropped to a 10-year low, reflecting the lockstep move both asset classes made during that month of extreme volatility.

The Nasdaq Composite fell by 9.2% in October, making it its second largest decline since it fell 10.8% back in November 2008. Things weren’t much better for the S&P 500, which followed the Nasdaq into correction territory and fell by 7% in October–its worst month since September 2011.

The Dow Jones Industrial Average fell 1,300 points or 5%, which hasn’t happened since January 2016. Investors have been spooked by copious amounts of volatility after a decade-long bull run that has seen the growth fueled by FANG (Facebook, Amazon Netflix, Google) stocks dwindle as the technology sector fell into correction territory.

“October volatility is legendary, and we’re not just talking about the crash in 2008,” said S&P Dow Jones Indices analyst Howard Silverblatt. “October is a much more volatile month than any of the others as far as quick declines go.”

“While this is a significant pullback, some of it does appear to be reallocation and money is sitting on the sidelines,” Silverblatt added. “That should gives us a stronger base. Earnings were good but perception is everything: We expected a lot more.”

No Immunity for Fixed-Income

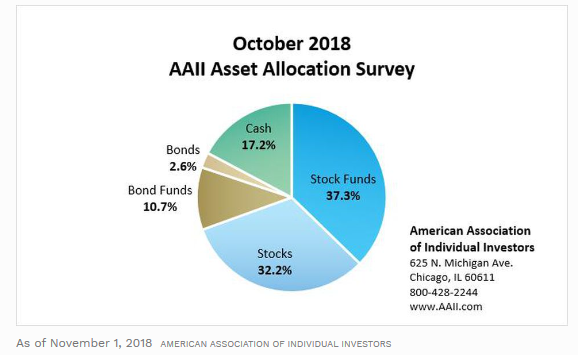

In the pie chart below, fixed-income assets, represented by bonds and their associated funds, were not immune to the October volatility:

According to the AAII, bond allocations have a historical average of 16% and with a combined 13.3% allocation for bonds and bond funds in October, it marked the 11th consecutive time allocations in these asset classes were under the average.

According to the AAII, bond allocations have a historical average of 16% and with a combined 13.3% allocation for bonds and bond funds in October, it marked the 11th consecutive time allocations in these asset classes were under the average.