![]() By Rusty Vanneman, CFA, CMT, CLS Investments Chief Investment Officer

By Rusty Vanneman, CFA, CMT, CLS Investments Chief Investment Officer

Investors often ask, and for good reason, which asset allocation approach is best: strategic or tactical. The answer, like much in the markets, is it depends. Investors should consider which matches up better with his or her philosophy, temperament, and objectives. These qualitative considerations are the keys to determining which approach is best suited to keeping investors participating in the market’s long-term growth.

Before I dive deeper, let’s define the terms. Different definitions are used by different market players, so it’s important to make sure everybody is on the same page before a proper discussion can begin.

At CLS Investments, we believe a strategic allocation approach is one that manages to a target allocation, whether one is targeting risk or an asset allocation. We target risk based on our Risk Budgeting Methodology. With a strategic approach, an investor should have confidence the portfolio will behave as expected and adhere fairly closely to the target. Strategic does not mean buy-and-hold or passive. It most often means active — in the sense that the portfolio is being actively managed to account for changes in expected risks and returns within the markets.

At CLS, we define a tactical approach as one where large and sudden changes in portfolio risk and asset allocation are made. While it may also have a benchmark to target over time, the portfolio could be vastly different from one period to the next. The great promise of tactical strategies, of course, is that they will lose less when the market is down.

Now that we have defined the terms, which approach is best, and when should each be used? The answer, of course, is it depends. It depends on who is using it and why.

It is my strong belief that strategic approaches are better in most cases, at least based on the numbers. They historically perform better, and are more efficient at generating risk-adjusted performance. At CLS, approximately 90% of the assets we manage are strategically managed and about 10% are tactically managed, so we might have a bias, but I believe the data that follows bears it out.

To compare performance, we reviewed mutual funds in the Morningstar database. While most tactical asset allocation (TAA) funds compete against the entire stock market, the comparisons below are against balanced mutual funds with similar risk and equity allocations. It’s a fairer representation, in my opinion.

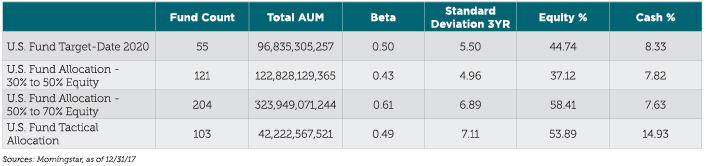

Using Morningstar data through the end of 2017, and adjusting for portfolio risk, we compared (with the help of CLS analyst Mark Matthews) peer groups with similar risk to TAA funds. These include balanced funds, such as asset allocation funds (30-50% equity and 50-70% equity) and target-date funds (in this case, the 2020 vintage). We reviewed these balanced portfolios as they have fairly similar risk and asset allocations over time.

As the table below shows, the tactical asset allocation group’s average beta was 0.49 and its 3-year standard deviation was 7.11%. These numbers are similar, if not a bit higher than other balanced peer groups. Given the strong market returns over the last three years, this should give the TAA funds a performance advantage. Also, the average equity allocation of 54% favorably compares to two of the other three categories.

Despite the risk and allocation advantages mentioned above, TAA funds underperformed in terms of pre-tax performance. While TAA funds performed relatively well over the last year, they finished dead last in the 3-, 5- and 10-year time frames.

A significant reason for the underperformance, however, was cost. An expense ratio 50-300% higher and a turnover ratio 7x the average of the other peer groups provided a headwind for relative performance.