![]()

Related: Geopolitical Concerns Could Bolster Gold’s Rally

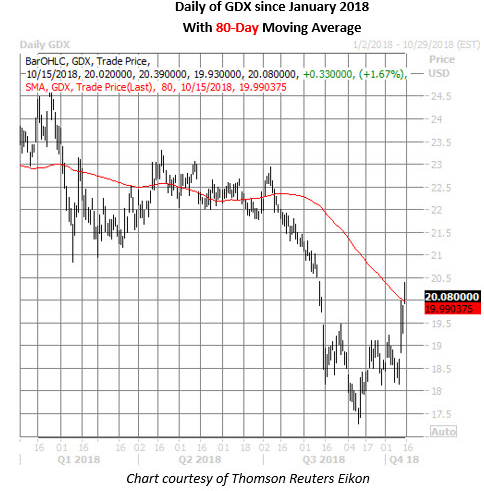

GDX is comprised of global gold miners, with a notable tilt toward Canadian and U.S. mining companies. Stock fundamentals like cost deflation across the mining industry, share valuations below long-term average and rising M&A are all supportive of the miners space as well, but those fundamentals could be glossed over if the dollar strengthens.

“One options trader today doesn’t seem to worried about this potential layer of resistance. Amid accelerated call volume — the 115,000 contracts traded is twice the expected intraday amount — a bullish bettor appears to be selling to close October 20 calls and rolling them up and out to the weekly 10/26 21-strike, expecting GDX to break out above $21 by the close next Friday, Oct. 26,” reports Schaeffer’s.

For more information on the gold market, visit our gold category.

Tom Lydon’s clients own shares of GLD.