State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT), today announced that four existing single-country SPDR ETFs that provide exposure to Canada, Germany, Japan and the United Kingdom will change indices, names and tickers, and carry lower expense ratios. In addition, the firm will launch the SPDR Solactive Hong Kong ETF (ZHOK), at start of trading on Wednesday Sept. 19, 2018.

The SPDR Solactive Hong Kong ETF will track the Solactive GBS Hong Kong Large & Mid Cap Index, a market capitalization index designed to measure the equity market performance of large and mid-cap companies in Hong Kong. As of Aug. 30, 2018, the index comprised 58 securities. ZHOK has a net expense ratio of 0.14%1 and begins trading on the NYSE Arca exchange on Wednesday.

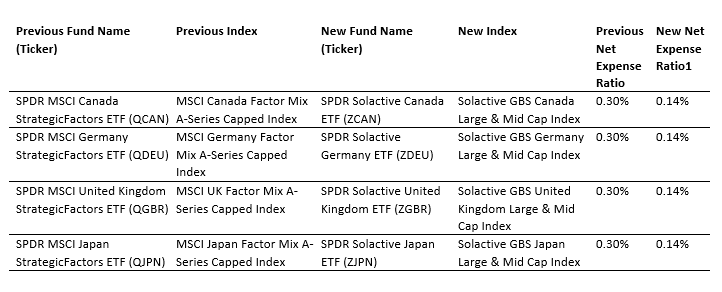

In addition to the launch of ZHOK, State Street Global Advisors is making changes to four single-country ETFs. Effective today, September 18, 2018, the funds will no longer track StrategicFactorsTM smart beta indices and will instead track market capitalization weighted indices designed by Solactive. As a result, the funds’ names, tickers and expense ratios will change as detailed below:

![]()

“Investors are seeking traditional market-cap weighted beta indices when adding country-specific international exposures to their portfolios,” said Noel Archard, global head of SPDR Product at State Street Global Advisors. “Launching the SPDR Solactive Hong Kong ETF, while also changing the underlying indices and lowering the fees of four single-country SPDRs, provides our clients with an offering that is better aligned with their approach to single-country strategies.”

“Investors are seeking traditional market-cap weighted beta indices when adding country-specific international exposures to their portfolios,” said Noel Archard, global head of SPDR Product at State Street Global Advisors. “Launching the SPDR Solactive Hong Kong ETF, while also changing the underlying indices and lowering the fees of four single-country SPDRs, provides our clients with an offering that is better aligned with their approach to single-country strategies.”

For more market trends, visit ETFTrends.com.