When it comes to investing in space, space tourism tends to get the most attention. The real superstar, however, is satellites.

There’s no doubt that space tourism gets a lot of buzz. Yesterday, Time magazine named SpaceX founder Elon Musk as the Person of the Year. However, it’s important to remember that SpaceX and Blue Origin are kept alive primarily by investments from their wealthy founders and government subsidies. These companies may be exciting — they certainly tap into the human imagination — but in reality, the real returns in space investing come from the humble satellite, which does everything from tracking weather, assisting our ability to navigate the world, enhancing our ability to communicate, and beaming TV or radio into our homes.

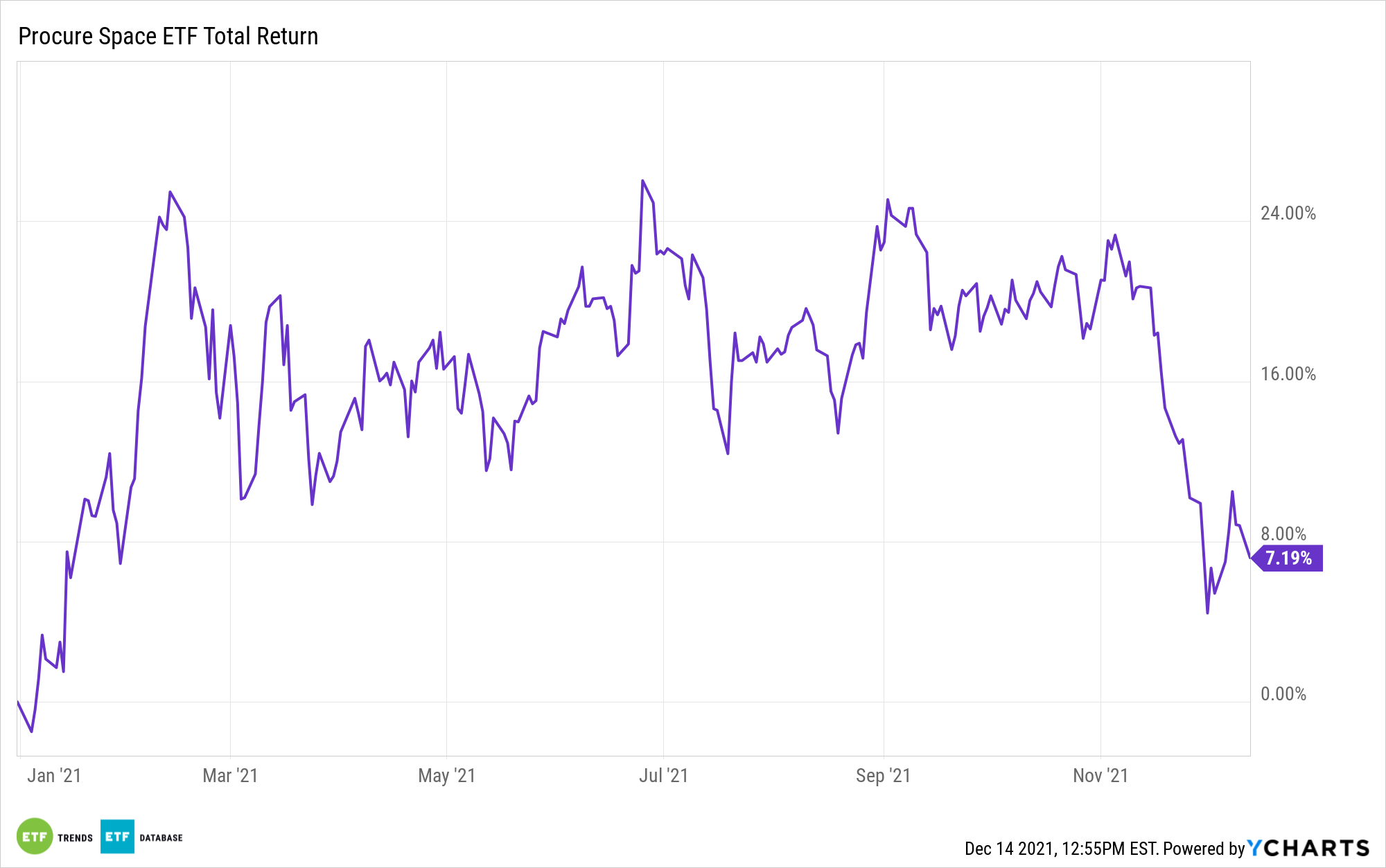

When people think of space, Comcast, Dish, and AT&T aren’t typically the first things that jump to mind, but those are the kinds of firms that truly drive space-related investing through their work with satellites. The largest holding of the Procure Space ETF (UFO) isn’t a space tourism company, but Sirius XM Holdings Inc (SIRI) at 5.7%. Though it’s true that UFO also holds Virgin Galactic, the lion’s share of its $110.7 million in AUM isn’t going to space tourism — its going to companies that generate revenue from space and interact with our daily lives in ways that we don’t always fully consider.

Space Is Everywhere on Earth

Chances are, you probably don’t even realize how frequently your life is impacted by satellites.

Credit cards and electronic payments were already on the rise prior to the pandemic, but concerns about how COVID is spread led to a large pivot away from cash transactions. Satellites are what make that possible. When you tap your bank card on a merchant’s POS machine, a satellite link is established between your bank and the business.

The food that you eat is likely grown with the assistance of satellites, as satellite imagery is used by farmers to determine the best irrigation times and techniques for their crops. Robbie Schingler, cofounder and chief strategy officer of satellite data company Planet Labs said in an interview with McKinsey, “There are a lot of examples from agriculture, which is our largest market. By adding our data to agriculture platforms, farmers can understand when they should cultivate certain crops, how much fertilizer to apply, and what types of crops are growing. The data also helps them understand supply-chain issues. One agricultural customer increased crop productivity by 10 percent by monitoring its entire growing area. That’s huge in a commodity market.”

Every time you check the weather before heading outside, it is a satellite that has made the forecast possible. When you’ve entered your destination on your phone, it is a satellite that has made that navigational tool possible.

Satellites are also key players in the internet of things.

The Procure Space ETF (UFO) is an excellent way for investors to get exposure to space-based companies and satellite-focused companies that will no doubt continue to grow as technology advances and possibilities expand.

For more news, information, and strategy, visit ETF Trends.