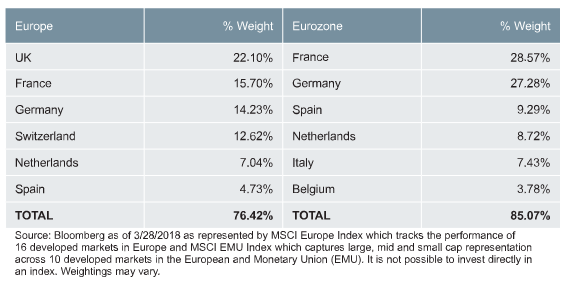

Figure One makes the point more vividly, listing the six largest country allocations in each region (using MSCI Indexes). Notice two things – the disappearance of the UK and Switzerland as you move from Europe to the Eurozone, and the significantly higher weightings that France and Germany get, almost double their holdings in Europe.

Figure One: The Top Six Country Weights in MSCI Europe and MSCI Eurozone (as at 3/28/18)

![]()

Germany and the UK – A Divergent View

For many of the reasons outlined above we are currently overweight Europe and the Eurozone. However, we are slightly more positive about the prospects for the narrower Eurozone than broad Europe, and the main reason for this is our calls on two of the key markets highlighted above – Germany and the UK.

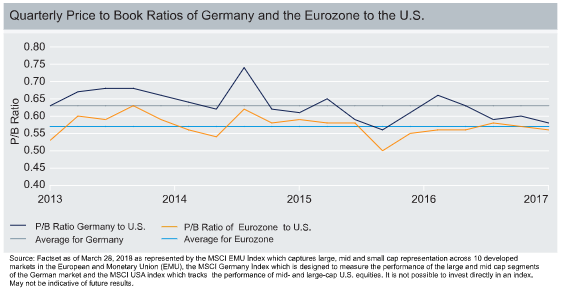

We moved to an overweight position on Germany given the record levels of exports that the German economy is currently producing, coupled with a still relatively attractive valuation to the U.S. Figure Two shows this graphically, charting the average ratio of the Price-to-Book in Germany, and the Eurozone, versus the U.S. It’s clear that both are still below the longer term average.

Figure Two: The Price-to-Book Ratios of Germany and the Eurozone to the U.S. (6/13 – 12/17)

For the UK on the other hand, our relatively more conservative forecast for equity markets, while still positive, remains below that of Germany and Europe because of the continued drag that we believe Brexit, and its ancillary effects, are having on the UK economy. Our growth forecast is 1.5% this year and 1.6% next, and, with inflation running above target – mainly due to the weaker pound boosting import prices – it seems as though the Bank of England will have a tricky challenge ahead. Balancing the need for higher rates that that inflation demands, while mitigating the downside of tightening into an economy with subdued growth, flat business investment, lower exports, and a slightly worsening unemployment rate will require some very careful policymaking. And you thought central bankers had it easy!

Related: China – Bullish on a China Shop

So, the bottom line is that there are some significant differences between accessing Europe, and accessing the Eurozone. Investors should at least be aware of the key weighting differentials that each region has in terms of the big four European equity markets – the UK, Germany, France, and Switzerland. In this blog, we’ve given a few thoughts on how different views for the first two impact our broader regional; calls. To anyone who regularly follows the soccer World Cup, the message is an old one – they should both do well, but prefer Germany!