![]() Fixed-income investors may consider smart beta bond ETFs as a suitable alternative that could make up the shortcomings of traditional bond index funds.

Fixed-income investors may consider smart beta bond ETFs as a suitable alternative that could make up the shortcomings of traditional bond index funds.

On the recent webcast, The Fed, Factor Investing and Fixed Income, Martin Kremenstein, Senior Managing Director and Head of ETFs at Nuveen, warned that fixed-income investors should expect some changes in the months ahead.

For instance, the Federal Reserve will likely begin unwinding its portfolio of Treasury and mortgage-backed securities to shrink its enlarged balance sheets, which would put moderate upward pressure on long-term rates. Nuveen also expects the Fed to hike rates in December, followed by two more rate hikes in 2018, and anticipate yields on benchmark 10-year Treasury notes to climb back to 2.45% by year-end.

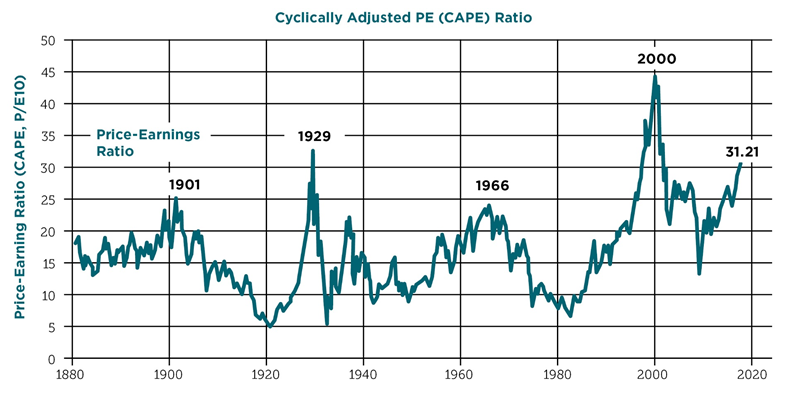

Joshua Jenkins, Portfolio Manager for CLS Investments, also pointed out that equity valuations appear stretched, which may open up short-term opportunities in fixed-income assets as bond returns have historically exhibited an inverse correlation to equities during periods of heightened volatility or periods of drawdowns in the stock markets.

Meanwhile, the prolonged low-rate environment, despite expectations for Fed rate hikes, has caused investors to look for riskier assets to generate more income. Kremenstein, though, warned that many cannot assume the risks inherent in high-yield bonds in their search for yield, especially those nearing or in retirement whom face significant challenges.

Despite the risks associated with a changing market environment and a potential end to a thirty year bull run in the debt markets, there is a growing need for fixed-income assets, especially among a growing population of retirees. Kremenstein pointed out that about 10,000 baby boomers will turn 65 every day for the next 19 years. Furthermore, adult men and women are increasingly experiencing longer life spans and are enjoying healthier lives.

Furthermore, a greater share of adults age 65 and older with debt have increased from 30% in 1998 to 44% in 2012, with many older adults continuing to make mortgage payments even in retirement.

“Ongoing income from investments plays a greater role today, especially as retirees exit the workforce,” Kremenstein said.

Consequently, given the risks and expectations in the current market environment, Kremenstein argued that investors may benefit from a strategic approach to fixed income investing as a way to meet the changing composition of the investment-grade bond market.