Capital gain taxes have also trended lower over the past few years, leaving more of the gain with investors. For the sake of discussion, let’s assume that the overall effective investment tax declined from 25% to 20%, though each individual investor will likely have a different experience on this front.

Combo = Triple Net Return

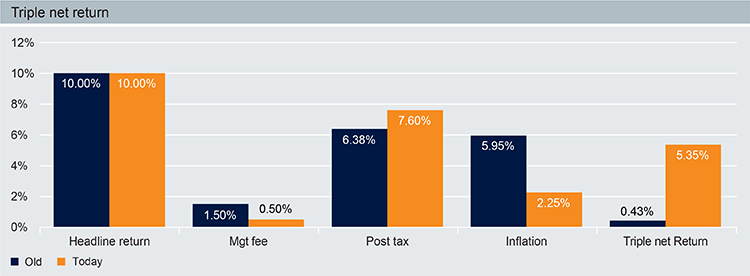

Combining the factors discussed above results in the triple net return. This is arguably a more important metric for investors to consider, since it takes all of the relevant costs and aspects that are unavoidable, but obviously important, into account.

Given that actual returns may be higher today than they were in the past—thanks to the factors outlined above—investors shouldn’t feel too bad about paying a higher PE premium for stocks today. Because of the changing market environment, the real returns after these pertinent factors are taken into account, can be higher than we saw a few decades ago.

Take the hypothetical example below, which assumes a 10% gain, to see just how big of a difference triple returns make to the final picture. Clearly, relatively high inflation in the past was a major roadblock to solid real returns for investors, though the other aspects of the triumvirate didn’t help matters either:

![]()

(Hypothetical example. Past performance is no guarantee of future returns)

Bottom Line

Since taxes, fees and inflation are all lower today than they were a few decades ago, investors need less from equities to produce the same level of real return. For that reason, we can justify a higher multiple today than we could in the past, even if expected returns are the same.

While elevated PEs might be a worry, investors need to take the different market environment into account. A lot has changed in the economy, and one of the only ways you are going to notice that from a valuation perspective is if you focus on triple net returns in the future.

1. Source: ICI, Deutsche AM as of 2015 (latest data available). Past performance may not be indicative of future results.

2. Source: BLS, NBER, Federal Reserve Bank of Minneapolis, Index of Prices Paid by Vermont Farmers for Family Living, Consumer Price Index by Ethel D. Hoover, Cost of Living Index by Albert Rees, Deutsche AM as of December 2017. Past performance may not be indicative of future results.