By Abby Woodham, Deutsche Asset Management

Investors hear a lot about smart beta nowadays. But how is smart beta actually evaluated and used in portfolios? Helpfully, FTSE Russell just released their 2017 Smart Beta Survey. FTSE surveyed almost 200 global institutional asset managers—government organizations, universities, pension funds, among others—on how they evaluate and use smart beta investments. The survey offers valuable insight into shifting investment priorities and what role smart beta plays in the respondents’ portfolios. The full survey is a great read, but we’ve summarized the key findings here.

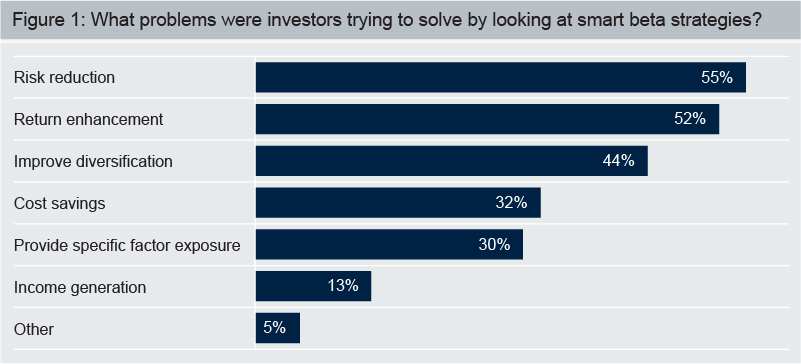

First, let’s look at what problems investors are trying to solve by using smart beta. When the participants were asked why they started evaluating smart beta, they answered with a host of investment objectives. Over half of the investors said they wanted risk reduction and/or return enhancement, and almost half were looking for improved diversification. One third sought cost savings, up from just 15% in 2014. We expect this number in particular to continue to rise as investors adjust their portfolios to lower fees in response to regulatory changes and client preferences.

Every week, clients ask our team “does smart beta replace active management or passive management in my portfolio?” – and, for better or worse, there is no one-size-fits-all solution. This is reflected in the survey results, in which about a third of respondents said they financed the shift to smart beta by reducing their active equity allocation, a third said they reduced both active and passive sleeves, and a third took from passive or used new money. We believe the correct use of smart beta depends on the individual portfolio and the problems the investor is trying to solve. Is the goal to try to outperform a passive benchmark with lower costs than an active manager might charge? Is it to diversify from the heavy allocation to megacap stocks found in the S&P 500 or Russell 1000? Are they trying to mitigate loss with a level of downside protection?