Encouragingly, only 3% of participants consider smart beta for short-term (tactical) implementation. We think trying to market-time factors or other smart beta investments is a difficult proposition. Unless factor timing is a proud core competency for an investor, we think they are likely better off with a strategic allocation to a diversified factor portfolio. 70% of respondents said they used or evaluated smart beta strategies with long-term allocation in mind, up from last year.

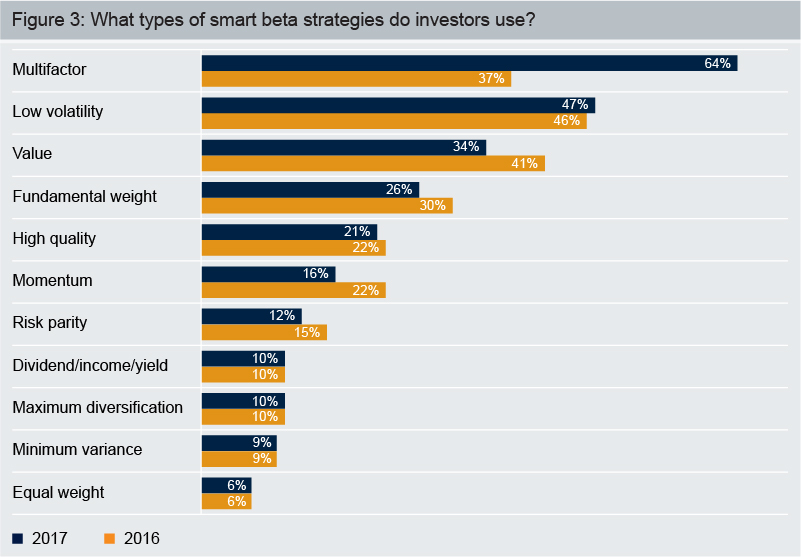

We think the most important shift apparent in the survey is the type of smart beta strategies investors are using. In 2015 and 2016, low volatility was the most popular with almost half of smart beta users holding such a strategy. But in 2017, multifactor strategies were the most popular with utilization by 64% of smart beta users—up from 37% last year. That’s a huge shift, and comes from the large number of investors who evaluated multifactor funds last year. With almost 75% of investors saying they are looking at multifactor this year (an even higher number), we think the adoption of multifactor strategies should continue.