Fidelity Value Factor ETF (FVAL)

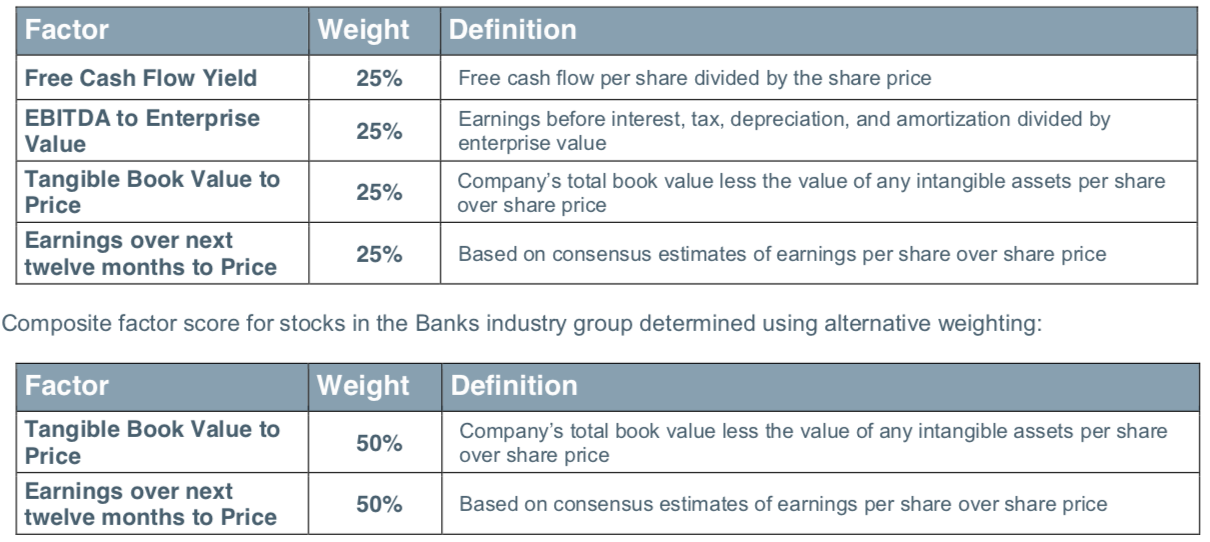

If you break it down, FVAL has a strong quality tilt to it as well. Enterprise value and book value are pretty common in determining attractiveness, but the other factors used are a nice complement.

I explained my affinity for free cash flow yield above, and while it isn’t directly related to whether or not a company is attractively valued, it suggests that it has a healthy balance sheet, something that is always welcome in a portfolio. The use of estimated earnings growth I also find interesting. It’s essentially saying that even if a company has a high P/E, something that may be a disqualifier in other ETFs, it could still be a relative value if it’s got the earnings to back it up. I like this fund.

Highly correlated ETF: Vanguard Value ETF (VTV)

Fidelity International High Dividend ETF (FIDI)

FIDI is essentially the international equivalent of FDVV.

The only real difference here is that FIDI starts with a universe of the largest 1000 companies within international developed markets instead of the United States, no emerging markets here. Pretty much everything I mentioned above with FDVV applies here as well.

Highly correlated ETF: iShares International Select Dividend ETF (IDV)

Fidelity International Value Factor ETF (FIVA)

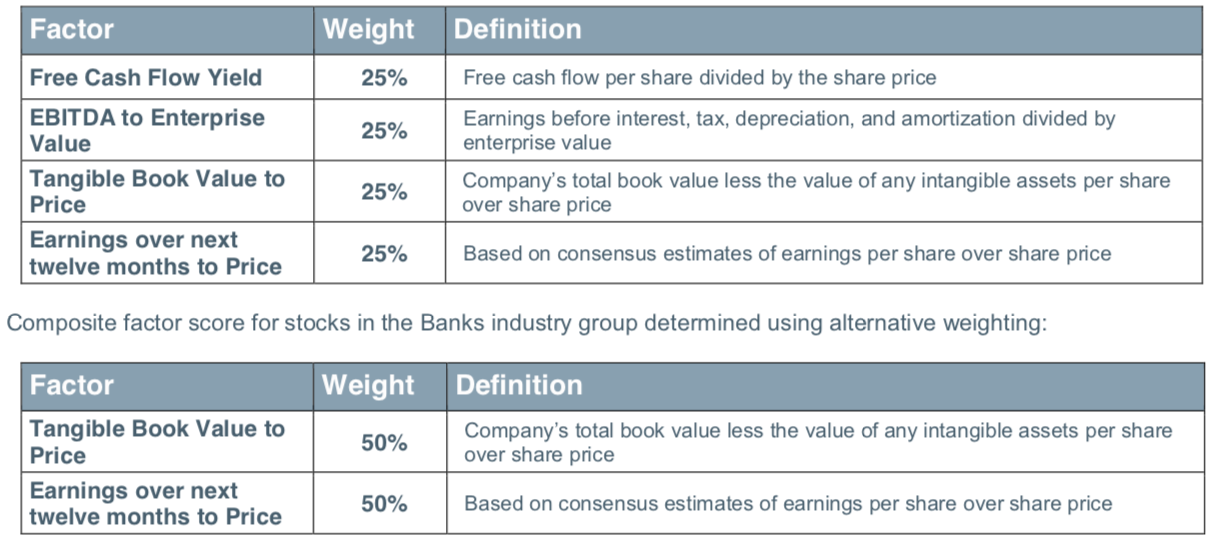

Same thing here with FIVA. It is the international equivalent of FVAL.

FIVA uses the same starting universe as FIDI. I like Fidelity’s value methodology, but this ETF has failed to gain any real traction since its launch as far as assets under management are concerned. This ETF might be one to avoid until it builds up its asset base a bit.

Highly correlated ETF: iShares MSCI EAFE Value ETF (EFV)

Fidelity Low Duration Bond Factor ETF (FLDR)

FLDR invests in a combination of investment-grade floating rate corporate bonds and intermediate-term U.S. Treasury notes (remaining maturities between 7-10 years) in order to target an overall portfolio duration of around 0.9 years. Essentially, this fund eliminates most rising interest rate risk and just leaves the credit risk of the underlying issuers.

About 90% of the fund’s assets are invested in corporate notes, so this is really just a glorified floating rate bond ETF with the yield and risk characteristics that come with such a fund.

Highly correlated ETF: iShares Floating Rate Bond ETF (FLOT)

Fidelity High Yield Factor ETF (FDHY)

FDHY is technically an actively managed fund that uses an index to guide its selection process. It scours the junk bond universe to target issues with solid total return potential that exhibit both value and quality characteristics. Essentially, it’s looking for the highest quality low-quality bonds!

The fund’s yield of 5.4% is actually fairly solid given that it’s targeting the high quality end of the spectrum and compares nicely to the 5.8% yield of the SPDR Bloomberg Barclays Short Term High Yield Bond ETF (SJNK). I don’t have an issue with the way the portfolio is constructed, but (not to sound like a broken record here) the relatively high expense ratio is a net negative.

Highly correlated ETF: Deutsche Xtrackers Low Beta High Yield Bond ETF (HYDW)

Conclusion

I think Fidelity’s smart beta lineup is a bit of a mixed bag. The Value, Quality and Low Volatility ETFs seem to be smartly constructed, but the Momentum and Rising Rates ETFs leave some room for improvement. In pretty much every case, there are cheaper (sometimes much cheaper) alternatives available. Being someone that rates fees and expenses as the most important factor in choosing an ETF, I’d hesitate to recommend more than one of these products. Overall, I think Fidelity is putting some thought into their smart beta lineup and looking to create some differentiation between similar products through its use of different selection criteria. I just wish they were a little cheaper!