By Eric Dutram, Contributor, DWS

Twice a year, the Federal Reserve puts out an assessment of the “resilience of the U.S. financial system”, highlighting key risks and potential flashpoints that Fed members are watching. While this often focuses on traditional metrics such as valuation, borrowing levels or leverage, the latest edition added a new issue. For the first time, the Federal Reserve’s Financial Stability Report mentioned climate change as a threat to the overall health of the system.[1]

In this landmark addition, the Fed stressed the potential for climate change to increase the “likelihood of dislocations and disruptions in the economy”. Part of this is based on the fact that it remains to be seen how and when a changing climate will impact assets and to what degree. In addition, there are often limited disclosures in terms of which assets could bear the brunt of a changing climate. As such, the Fed notes that we could see “sharp repricings” of risks for some assets which could hit the overall financial system.

While the Fed noted that it is still in the beginning stages of its evaluation process, we think this is an encouraging start nonetheless.

Here at DWS, we welcome the Fed’s addition of climate into the overall risk picture. We believe that this is something investors need to be aware of and consider when building portfolios. In fact, climate risks have been a focus of ours for quite some time and we have recently highlighted just how intense the threat from climate change may already be according to some metrics. One in particular that is rather striking is climate risk by net capital invested.

NCI in focus

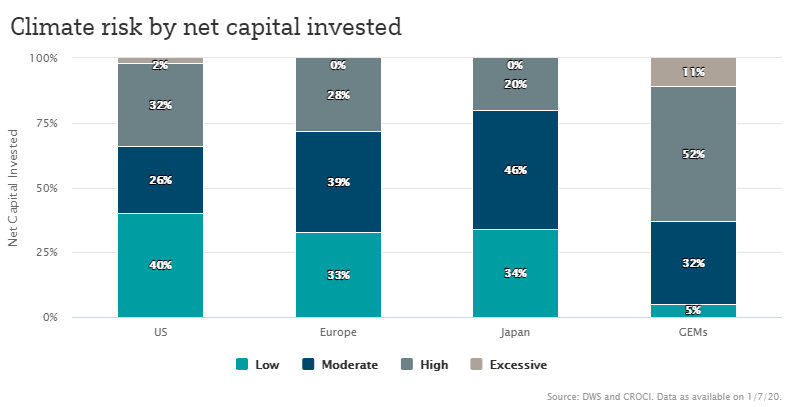

Net capital invested takes a closer look at companies’ investment into items such as property, plant and equipment, helping us to quantify how much of that investment is at risk for climate change. Our model breaks down this net capital invested into four major buckets of risk: “low”, “moderate”, “high”, and “excessive”.

For investors, this analysis is vital because, according to our research team, potentially the “best way to measure the genuine climate impact of a company is to focus on its capital”.[2] Capital-intensive assets can often have a stronger link to climate, while net capital invested may provide a more accurate risk assessment than simply by looking at market cap-related climate risks alone. And from this metric, no major economic region is safe:

As shown in the chart, Japan is the “best” positioned with just 20% of net capital invested at a potentially high climate risk level, though all major regions have a plurality of net capital invested in at least the “moderate” climate risk level, if not more severe.

For the United States, a full third of net capital invested falls into the “high” risk bucket or greater, underscoring the potential of climate issues to wreak havoc in the future. Meanwhile, over half of the net capital invested in GEMs (global emerging markets) is classified as “high” risk, putting it by far in the most precarious position from this perspective and suggesting this is a worldwide problem as well. No wonder the Fed is incorporating climate risks into their models as well.

Bottom line

The Fed is taking climate change seriously as a potential threat to the American financial system and its stability. Given the importance of the Fed in the marketplace and the possibility of directives coming down the pike from either a political or regulatory perspective, it may be increasingly important for investors to take these kinds of risks into account for their own models as well.

Fortunately, we have extensive research on the topic from both a regional and company specific basis in our ESG research center. Incorporating Environmental, Social and Governance metrics into a portfolio may help investors take key risks—such as climate change—into account. For more on ESG and climate-related research, make sure to check out our ESG page for additional details.

Originally published by DWS, 11/19/20

1. Financial stability report 11/09/2020

2. Climate risk and corporate capex, DWS Research Institute, June 2020

Important Risk Information

This website is intended to be a general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, plan feature or other such purpose. Your use of this website indicates that you agree with the intended purpose. Prior to making any investment or financial decision, you should seek individualized advice from a personal financial, tax, and other professionals who are able to provide advice in the context of your particular financial situation.

Investments in mutual funds involve risk. Stocks may decline in value. Bond investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increased volatility. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. There are additional risks associated with investing in commodities, high-yield bonds, aggressive growth stocks, non-diversified/ concentrated funds and small- and mid-cap stocks which are more fully explained in the prospectuses. Please read the prospectus for more information.

You cannot invest directly in an index. Shares of exchange traded funds (ETFs) are bought and sold at market price (not NAV) throughout the day on the New York Stock Exchange. There can be no assurance that an active trading market for shares of a fund will develop or be maintained. Transactions in shares of ETFs will result in Brokerage commissions and will generate tax consequences. There are risks associated with investing, including possible loss of principal. Stocks may decline in value. Bonds are subject to interest rate, credit, liquidity and market risks to varying degrees.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see the fund’s prospectus for a complete discussion of risks.

Shares of the exchange traded funds may be sold throughout the day on the exchange through any brokerage account. However, shares may only be purchased and redeemed directly from the funds by authorized participants in very large creation/redemption units. There is no assurance that an active trading market for shares of an exchange traded fund will develop or be maintained.

MSCI and MSCI Index are servicemarks of MSCI Inc. and have been licensed for use by db-X. The ETFs are not sponsored, endorsed, issued, sold or promoted by MSCI Inc. nor does this company make any representation regarding the advisability of investing in the ETFs. Index data source: MSCI Inc.

DWS investment products offered through DWS Distributors, Inc. Advisory services offered through DWS Investment Management Americas Inc. Xtrackers ETFs (“ETFs”) are managed by DBX Advisors LLC (the “Adviser”), and distributed by ALPS Distributors, Inc. (“ALPS”). The Adviser is a subsidiary of DWS Group GmbH & Co. KGaA, and is not affiliated with ALPS.

View our privacy policy, legal information and security statement.

Obtain A Prospectus

Carefully consider the fund’s investment objectives, risk factors, changes and expenses before investing. This and other information can be found in the fund’s prospectus. To obtain a mutual fund summary prospectus, if available, or prospectus, call (800) 728-3337 or download one from fundsus.dws.com. To obtain an ETF prospectus call (855) 329-3837 or download one from etf.dws.com. To obtain the RREEF Property Trust prospectus, download one from rreefpropertytrust.com. Read the prospectus carefully before investing.

Not FDIC/NCUA insured. May lose value. No bank guarantee. Not a deposit. Not insured by any federal government agency.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

DWS Distributors, Inc. Member FINRA