Exchange traded funds (ETFs) are highly praised for their distinct advantages over mutual funds. A recent Financial Times article noted that recent research shows that inherent tax advantages make the ETF vehicle most appealing.

“A shift in US investor flows away from mutual funds towards exchange traded funds is being driven primarily by a tax loophole, rather than any inherent advantage of the ETF structure, a team of academics has concluded,” the article explained. “In the past decade, US investors have pulled $1tn from actively managed US mutual funds, with a similar amount flowing into ETFs.”

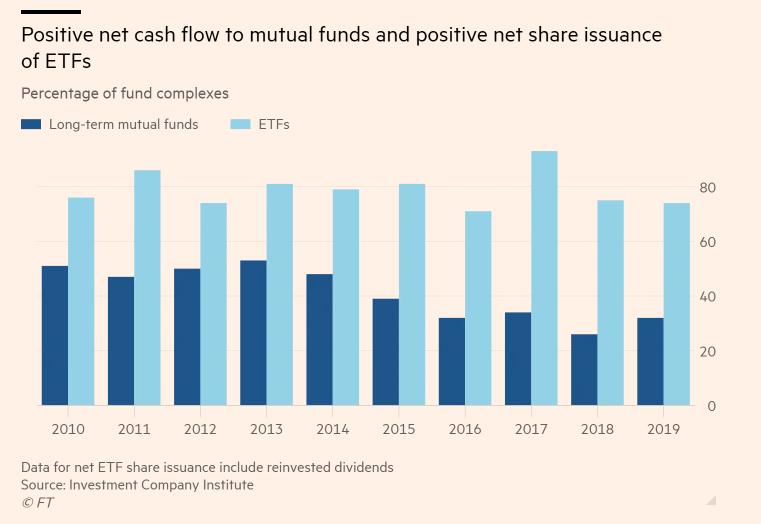

“Although the mutual fund sector is still far larger, the majority of US mutual fund ranges have seen net outflows every year since 2014, according to the Investment Company Institute, even as about three-quarters of ETFs have seen inflows,” the article added.

Academic research by Rabih Moussawi, Ke Shen, and Raisa Velthuis of Villanova University, the Wharton School at the University of Pennsylvania and Lehigh University, shows that the preference for ETFs is primarily the result of tax advantages. This runs counter to the prevailing view that lower costs and better liquidity versus mutual funds are the primary factor.

“ETFs’ tax advantage is the main catalyst behind the massive flow migration from active mutual funds to ETFs over the last two decades,” they write.

A Tax-Advantaged Investing Option

ETFs structured as a partnership are unincorporated business entities, so they are not subject to the double taxation of a corporation. If the partnership does not elect to be taxed as a corporation, then it also benefits from pass-through taxation so that any realized gains and losses flow directly to investors in the fund.

Partnerships are flexible in terms of the types of investments they can make. Unlike grantor trusts, partnerships can invest in other types of commodities like oil or natural gas due to their flexibility.

However, ETFs structured as a partnership fall under the regulatory measures of the U.S. Commodity Futures Trading Commission. As such, these ETFs are subject to reporting and other financial disclosures.

To improve tax efficiency, MLP-related ETFs limit exposure to MLPs to 24% at each quarterly rebalance. Traditional MLP funds that hold more than 25% of their portfolios in MLPs are structured as C-Corporations and must pay corporate income tax on distributions before passing them on to investors, which incurs additional tax headaches come tax season that lead to lower overall returns.

One ETF to consider is the ALPS Alerian MLP ETF (AMLP), which seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

For more news and information, visit the Smart Beta Channel.