![]() Smart beta ETFs have quickly attracted investment interest, but the strategies remain relatively new and investors should still review key considerations when incorporating a strategic beta fund strategy into a diversified portfolio.

Smart beta ETFs have quickly attracted investment interest, but the strategies remain relatively new and investors should still review key considerations when incorporating a strategic beta fund strategy into a diversified portfolio.

On the recent webcast (available on demand for CE Credit), Strategic Beta’s Due Diligence Dilemma, Jordan Stewart, Manager Research at J.P. Morgan Asset Management, pointed out that while smart beta or strategic beta ETFs try to enhance returns and diminish downside risks, the various strategies’ performances vary more widely than traditional cap-weighted investments, with the margin of difference frequently being the difference between a gain and loss.

Since smart beta ETFs rely on a benchmark index, investors are better able to monitor the strategies and better understand how the funds work. Smart beta ETF’s performance results and portfolio characteristics are based on index construction rules and factor criteria and ongoing monitoring as the process is largely systematized in its rules-based process.

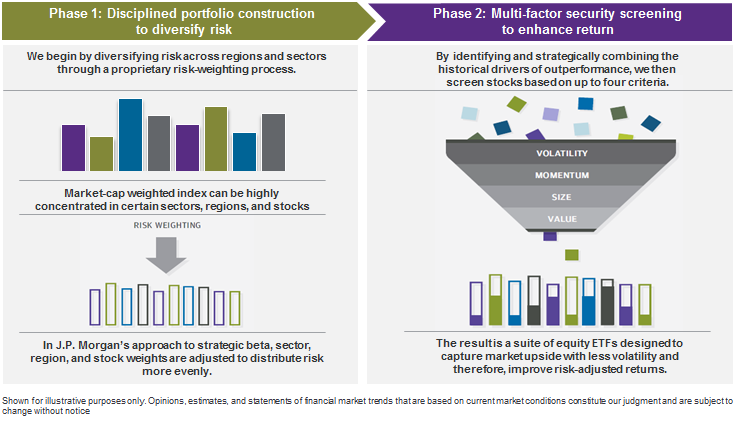

Furthermore, Joe Staines, Research Analyst and Portfolio Manager of J.P. Morgan Asset Management, argued that there is more to smart beta than just screening for specific factors like volatility, momentum, size and value, among others, pointing to a disciplined portfolio construction approach to diversify risk as well. Specifically, J.P. Morgan diversifies risk across regions and sectors through a proprietary risk-weighting process in an attempt to adjust sector, region and stock weights to distribute risk more evenly.

When considering what goes into a smart beta process, Stewart explained that there are four major steps to performing smart beta due diligence, including a starting point, hypotehtical result, investible product and ongoing benchmark tracking.

“Strategic beta due diligence must encompass both the suitability of the index and a manager’s ability to implement it,” Stewart said.