Technology continues to play a heavy role in the Covid-19 pandemic as the world transitions to a new degree of normalcy. As such, software companies that enable technological advances will also benefit tech-heavy exchange-traded funds (ETFs), and InvestorPlace listed seven funds that investors can consider.

“If we’ve learned anything lately, it’s that tech continues to be dominant,” an InvestorPlace article said. “The sector was a leader before the novel coronavirus came along, and it has been the leader since. While some industries have been better than others, software and cloud stocks have been impressive. Because of that, investors should look at software ETFs this month.”

“Many tech stocks have enjoyed a monstrous rally from the March lows, soaring into summer,” the article added. “While there was some resting in between, in general, the group continued higher into September before topping out and correcting lower.”

The list includes names like the SPDR FactSet Innovative Technology ETF (XITK), Renaissance IPO ETF (IPO) and the SPDR S&P Software & Services ETF (XSW). Many of these tech companies hold a place in the Russell 1000, which incorporates heavy hitters in the market.

“The Russell 1000 typically comprises approximately 92% of the total market capitalization of all listed stocks in the U.S. equity market,” Investopedia explained. “It is considered a bellwether index for large-cap investing.”

A Factor-Based Option

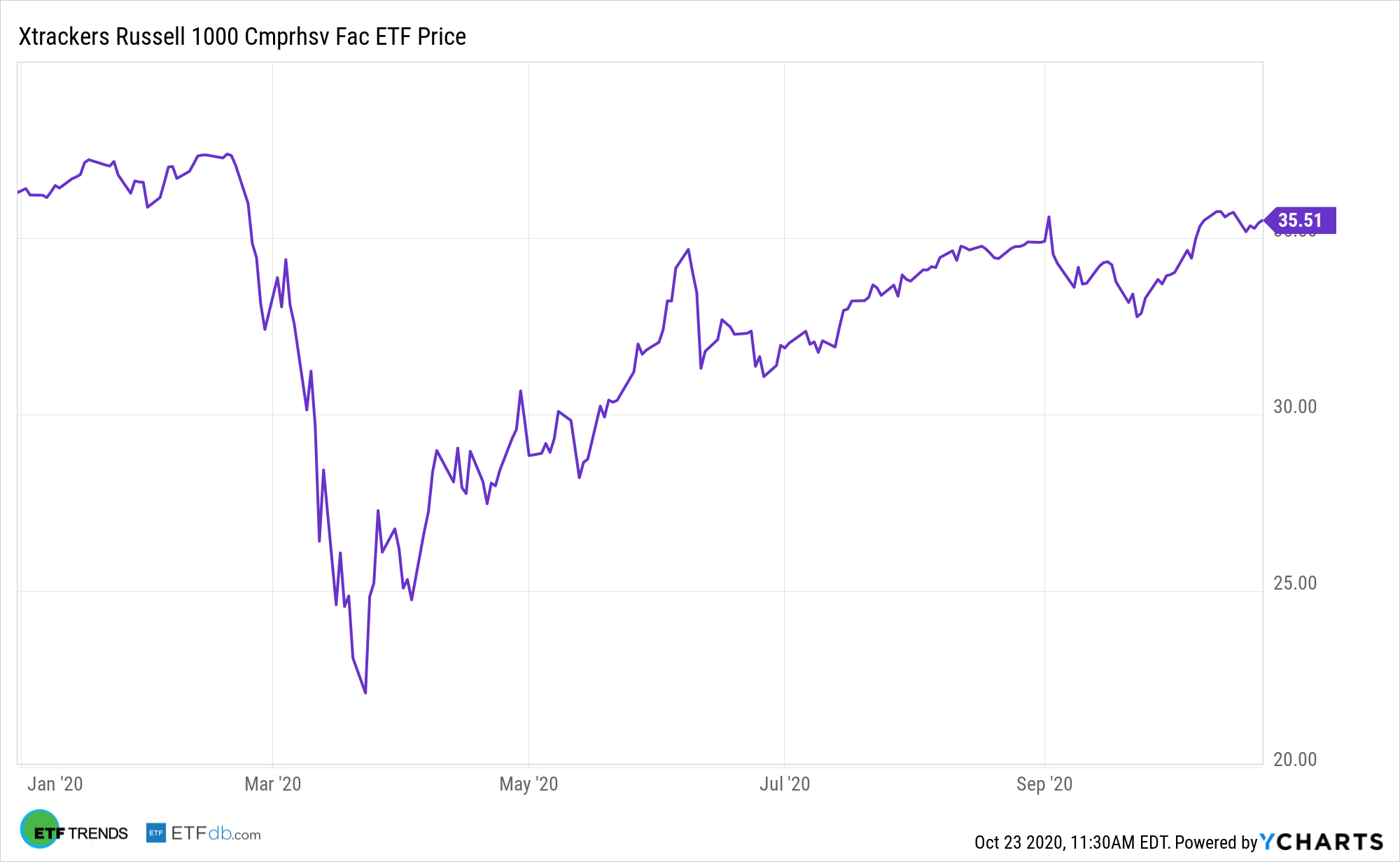

Not sure how to navigate the markets with all the uncertainty surrounding the presidential election and Covid-19? One fund that looks at a variety of factors like quality and momentum within the Russell 1000 is the Xtrackers Russell 1000 Comprehensive Factor ETF (DEUS).

DEUS seeks investment results that correspond generally to the performance of the Russell 1000 Comprehensive Factor Index. The fund, using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance of the underlying index, which is designed to track the equity market performance of companies in the United States selected on the investment style criteria of value, momentum, quality, low volatility, and size.

Rather than skew heavily towards tech, DEUS has holdings from other sectors like healthcare, consumer discretionary and industrials. While technology is currently a heavy hitter, DEUS doesn’t forget about consumer staples with holdings of companies like Target.

More something more broad-based in the Russell 1000, investors can look at the iShares Russell 1000 ETF (IWB). IWB seeks to track the investment results of the Russell 1000® Index, which measures the performance of large- and mid- capitalization sectors of the U.S. equity market.

For more news and information, visit the Smart Beta Channel.