“The royalty allocations help investors gain exposure to the gold sector while potentially minimizing some risks associated with the industry,” Holmes said.

Related: New U.S. Global Investors Gold Miners ETF Enters Smart Beta Space

Holmes argued that royalty companies are superior in the gold mining space due to their more stable revenue and cash flow, high revenue per employee, rising book value per share and low Selling, General and Administrative costs to revenue.

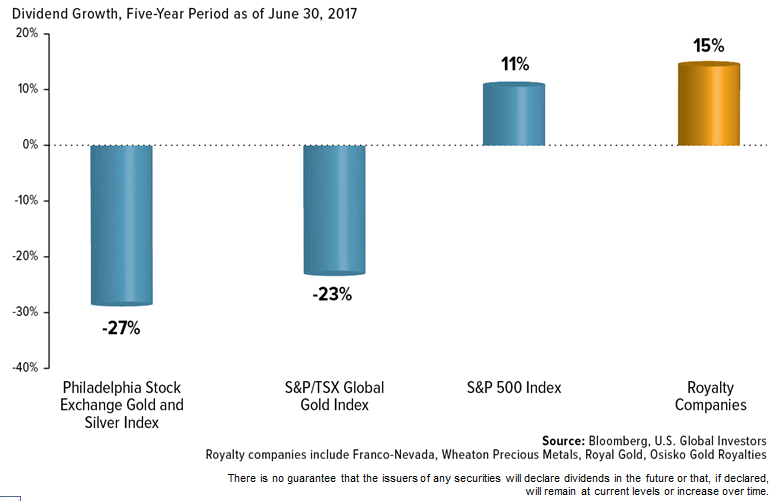

Over the past five-year period ended June 30, royalty companies have seen dividends grow at a faster rate than the S&P 500, the broad S&P/TSX Global Gold Index and Philadelphia Stock Exchange Gold and Silver Index. Royalty gold mining companies have outperformed gold over the past year, generated greater revenue per employee than other producers and incurred less debt than their competitors.

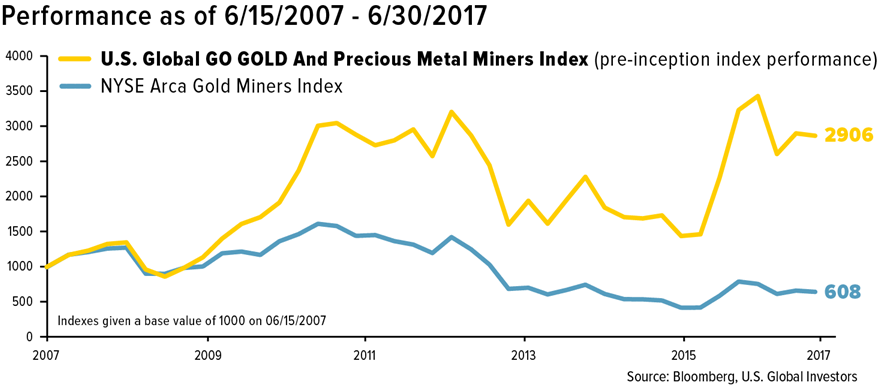

The smart beta U.S. Global GO GOLD and Precious Metal Miners Index has also been outpacing the more widely observed NYSE Arca Gold Miners Index over the past 10 years. Over the past decade ended June 30, the U.S. Global GO GOLD and Precious Metal Miners Index has increased 11.6%, compared to the -4.6% decline in the NYSE Arca Gold Miners Index.

The smart beta U.S. Global GO GOLD and Precious Metal Miners Index has also been outpacing the more widely observed NYSE Arca Gold Miners Index over the past 10 years. Over the past decade ended June 30, the U.S. Global GO GOLD and Precious Metal Miners Index has increased 11.6%, compared to the -4.6% decline in the NYSE Arca Gold Miners Index.

“GOAU uses smart beta factors instead of simply relying on market cap,” Holmes said. “It invests in quality companies with strong balance sheets, low SG&A to revenue, active miners and expert management teams. The fund emphasizes royalty companies, which we believe are the ‘smart money’ of the metals and mining industry.”

“GOAU uses smart beta factors instead of simply relying on market cap,” Holmes said. “It invests in quality companies with strong balance sheets, low SG&A to revenue, active miners and expert management teams. The fund emphasizes royalty companies, which we believe are the ‘smart money’ of the metals and mining industry.”

Financial advisors who are interested in learning more about the gold mining industry can watch the webcast here on demand.