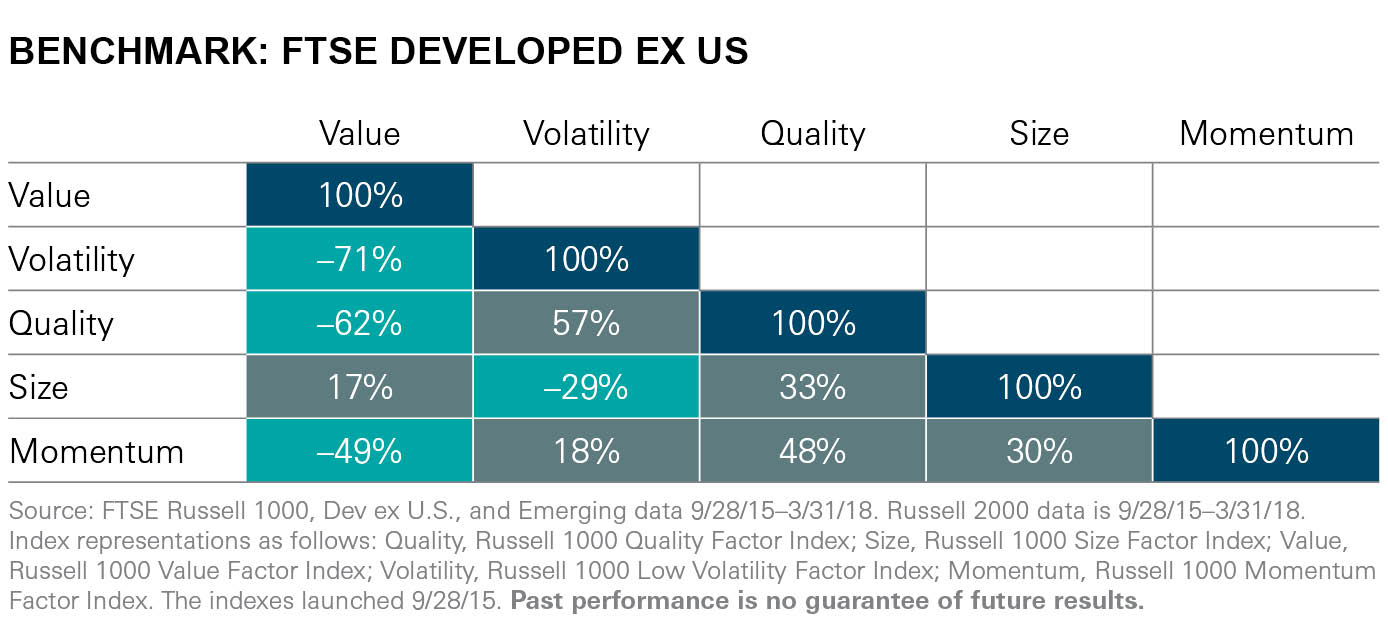

For developed markets, only quality and volatility have historically shown a return correlation in excess of 50%, while value has shown a negative correlation with three of the other four factors. Meanwhile, size and value have demonstrated a particularly uncorrelated profile—just 17%– while volatility and value can often move in opposite directions, as evidenced by their -71% excess return correlation.

![]()

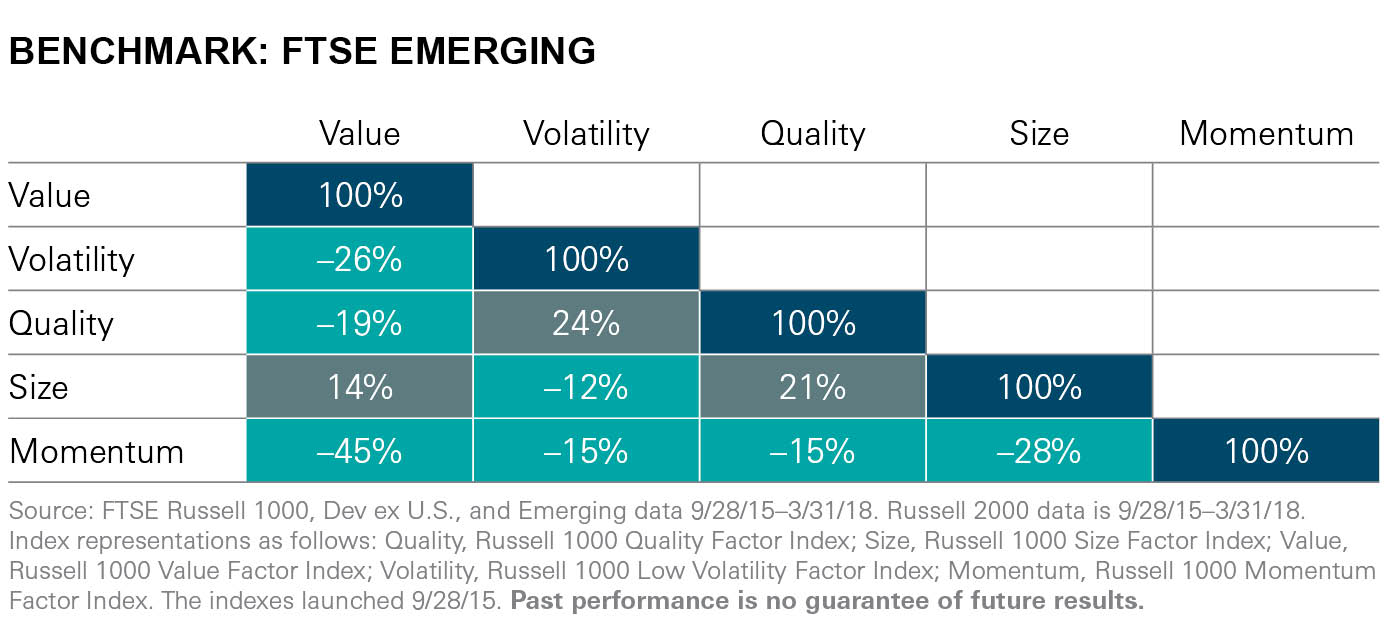

As for emerging markets, negative correlation for excess returns is widely spread when comparing the same five factors. Momentum didn’t have a positive excess return correlation with any of the other four factors, while value had a negative reading with three. Positive correlations did not exceed 25% here, showing just how important a diversified factor approach can be in emerging markets in particular.

Bottom Line

Focusing on a single factor may be a viable strategy for investors in today’s market environment, particularly thanks to the wide range of ETFs that can offer cheap and easy exposure to a given investing style. This was a breakthrough when it first hit the market, as it allowed for tactical exposure beyond general benchmark investments based on a preferred factor.

However, investors should know the limitations of focusing on just a single factor or characteristic. It is too reliant on stability in a fickle market, and while it can outperform a broader approach, it may also result in added volatility or concentration that can increase the overall risk.

That’s why it may be better to consider taking a more well-rounded approach to factor-based investing. We suggest a more diversified strategy to navigate more types of market environments and potentially lower overall volatility. This style may not be as popular as single factor investing, but it may potentially offer a better long-term investing experience, which should be the goal of using factors in the first place.