As far as when the value factor will make a comeback is not certain, but the discounts in value-oriented plays are there for investors if they can extrapolate them from a dichotomy of cheap versus expensive stocks–using quality as a screener. One thing investors need to take into account is that rising rates could play a factor, especially for highly-leveraged companies where their valuations might be affected as borrowing costs rise.

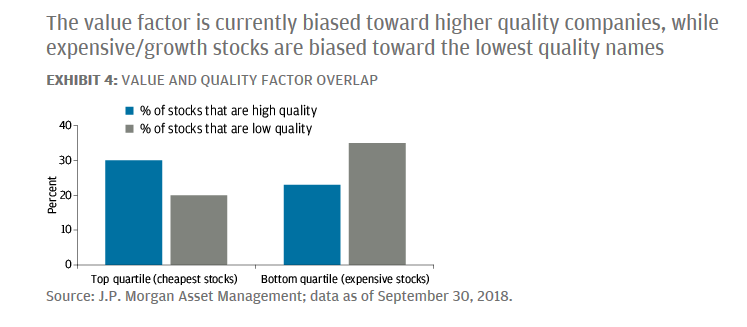

“While the timing of a value rebound cannot be known, a deeper examination of the characteristics of cheap vs. expensive stocks is telling,” the report noted. “Within the top quartile of value stocks (the cheapest names in the universe), 30% of the companies rank high in quality while 20% rank low in quality. Within the bottom quartile of value stocks (the most expensive stocks in the universe), on the other hand, 35% of the companies rank low in quality vs. 23% that rank high. In other words, the value factor is currently biased toward higher quality companies, while expensive/growth stocks are biased toward the lowest quality names.”

![]()

Furthermore, the report highlighted even-driven factors like mergers and acquisitions as being net positive, while other factors like macro struggled in the third quarter. Trade wars have decimated the value in local currencies, which speaks to the pangs experienced in emerging markets.

Overall, the report reminds investors that a mix of multiple factors can help with diversification in trying times that can be seen now in the latest October sell-off.

“Overall, a number of factors suffered during the third quarter,” the report noted. “That said, we see potential catalysts in place across the equity, event-driven and macro spaces. As always, we believe in diversifying across a broad range of compensated factors while minimizing exposure to uncompensated risks.”

For more market news, visit ETFTrends.com.