While traditional equities and bonds take up most of the investing spotlight, there is a burgeoning asset class that is gaining notable consideration, real assets.

While the marketplace has no clear definition of what constitutes Real Assets, our definition includes global real estate, infrastructure, natural resource equities, and commodities, giving investors exposure to essential physical assets, such as office buildings, toll roads and precious metals. These have historically offset the effect of rising inflation while also historically providing uncorrelated exposure to equity market beta. In the past, these securities have displayed the ability to deliver not only attractive risk-adjusted total returns over the long run, but also may provide greater sensitivity to inflation, compared to traditional stock and bond investments.

What’s changed?

Real asset classes were once restricted to endowments, pension managers, and sovereign wealth funds, but are now accessible via liquid funds to all kinds of investors. In addition to the potential diversification benefits that one may obtain from purchasing assets that are usually not in traditional indexes, there are a number of other reasons why real assets are increasingly in focus for investors.

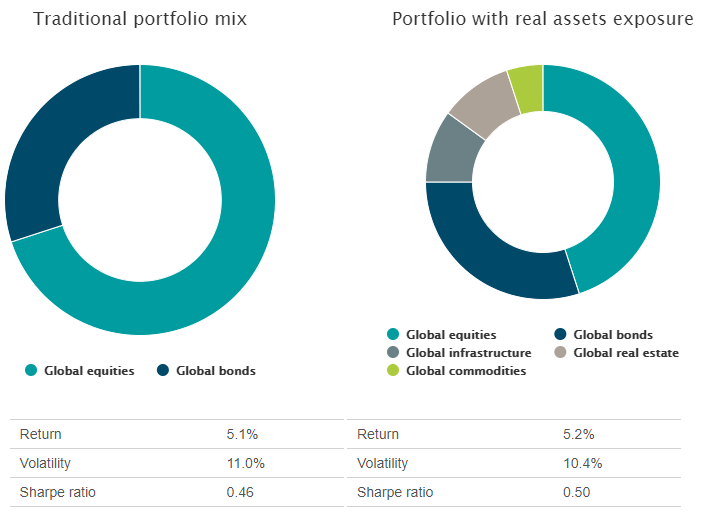

That is because, by simply adding a real asset component to a traditional portfolio, investors have, historically, seen a unique return profile and a reduction in volatility. This has helped to improve the Sharpe Ratio for an overall portfolio, making a lineup that includes real assets more risk-efficient than a portfolio that fails to include items like commodities, infrastructure or real estate, at least on a historical basis.