Source: Bloomberg, for period 1/31/99-3/31/18. Past performance is not a guarantee of future results. Asset class representation: global infrastructure, MSCI World Infrastructure Index; global real estate, FTSE EPRA/NAREIT Developed Index; global commodities, Bloomberg Commodity Index; global equities, MSCI World Index; global bonds, Bloomberg Barclays Global Aggregate Index, Equity index returns include reinvestment of all distributions. Index returns do not reflect fees or expenses, and it is not possible to invest directly in an index. Diversification neither assures a profit nor guarantees against loss. For illustrative purposes only.

However, despite the benefits, at least from a historical perspective, there are still several misconceptions when it comes to real assets. In particular, how investors can obtain exposure to these segments, as well as how they go about fighting inflation. We have broken down some of the key points to note for each of the major real asset segments, highlighting the important features for each:

| Asset class | Definition and characteristics | Inflation hedging |

| Global real estate | — Publicly traded companies that own and operate income-producing physical commercial real estate — Include real estate investment trusts (REITs) and real estate operating companies(REOCs) |

— Varying degrees of contract duration with inflation hedging mechanisms built into rental agreements — REIT dividend payments typically grow along with inflation |

| Global infrastructure | — Publicly traded companies that derive the majority of operating income from owning and operating physical infrastructure cash flow producing assets — Inelastic demand profile and monopolistic assets provide stable, predictable, inflation linked cash flows |

— Essential infrastructure assets with long duration contacts and embedded inflation hedging — Cash flows adjust to inflation, having explicit or implicit inflation pass through ability |

| Commodities (futures and equities) | — Publicly traded companies linked to natural resources and commodities — Physical exposure to commodities through purchasing futures contracts |

— Commodities futures are generally the strongest natural hedge against inflation — Equities are a solid hedge against inflation from indirect exposure to commodities |

| TIPS* | — Treasury notes where the principal is adjusted for (positive) inflation as measured by CPI | — Suitable hedge against U.S. inflation, but lacks upside potential when inflation is not a major risk factor |

| *TIPS are not generally categorized as a real asset class, but used as a defensive tool that also offers a hedge against inflation. | ||

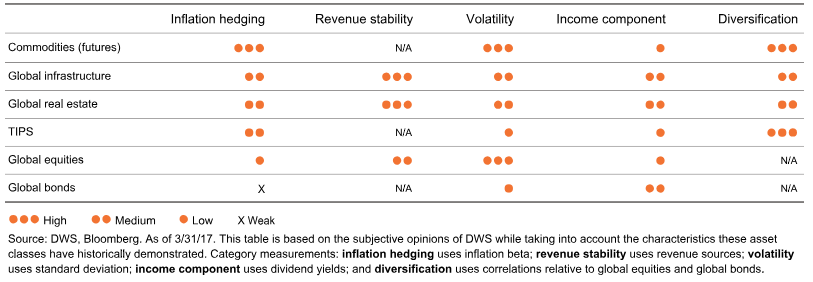

Beyond those high level characteristics, it is also useful to know how real assets can be utilized in a diversified portfolio and where they fit in:

- Commodities: An allocation to futures has historically provided an attractive hedge to inflation, while global natural resource equities may also deliver an inflation hedge due to their direct correlations.

- Global Infrastructure: Infrastructure can be viewed as the total-return component, but also responds to changes in inflation. Revenues for “pure-play” infrastructure are typically stable and predictable because of the long-dated underlying contracts and monopolistic assets.

These types of companies typically have the ability to pass on higher costs often linked to inflation, which can result in real earnings growth. - Global Real Estate: Similar to Global Infrastructure, Real Estate serves as more of a total-return component with the potential to deliver more stable current income. Inflation hedging ability is usually embedded in rental agreement structures, which generally include inflation-linked adjustments or fixed percentage increases in rents.

This gives Real Estate (i.e. real estate investment trusts, otherwise known as REITs) the potential for positive real rates of return during inflationary environments. - TIPS: Treasury Inflation Protected Securities may provide a hedge against inflation and may also help offset equity market beta in “risk-off” environments.

And while these are all vital points to understand about real assets, it may be best to compare real assets to what investors might already be familiar with, namely traditional equities and bonds.

As shown in the chart, real assets collectively act as an important counter to traditional equities and bonds, potentially providing inflation hedging and diversification benefits. It should also be noted that the total real assets picture is what is important: just selecting one or two categories within the real assets space may be sub-optimal, as different real assets respond more (or less) favorably in disparate economic environments. By combining the various real asset classes, investors can investors obtain diversified exposure that has the potential to improve the investment characteristics of a portfolio.

Want to learn more?

This is just the first step in terms of learning about real assets and the impact they may offer for investors. To obtain additional information about real assets and how they might fit into a diversified portfolio, make sure to see our real assets center for a more in-depth discussion: Guide to real asset investing.