The pandemic certainly put a re-emphasis on keeping healthy in terms of mind, body, and soul. ETF provider Amplify saw an opportunity and ran with it with the introduction of a new ETF that caters to clean living.

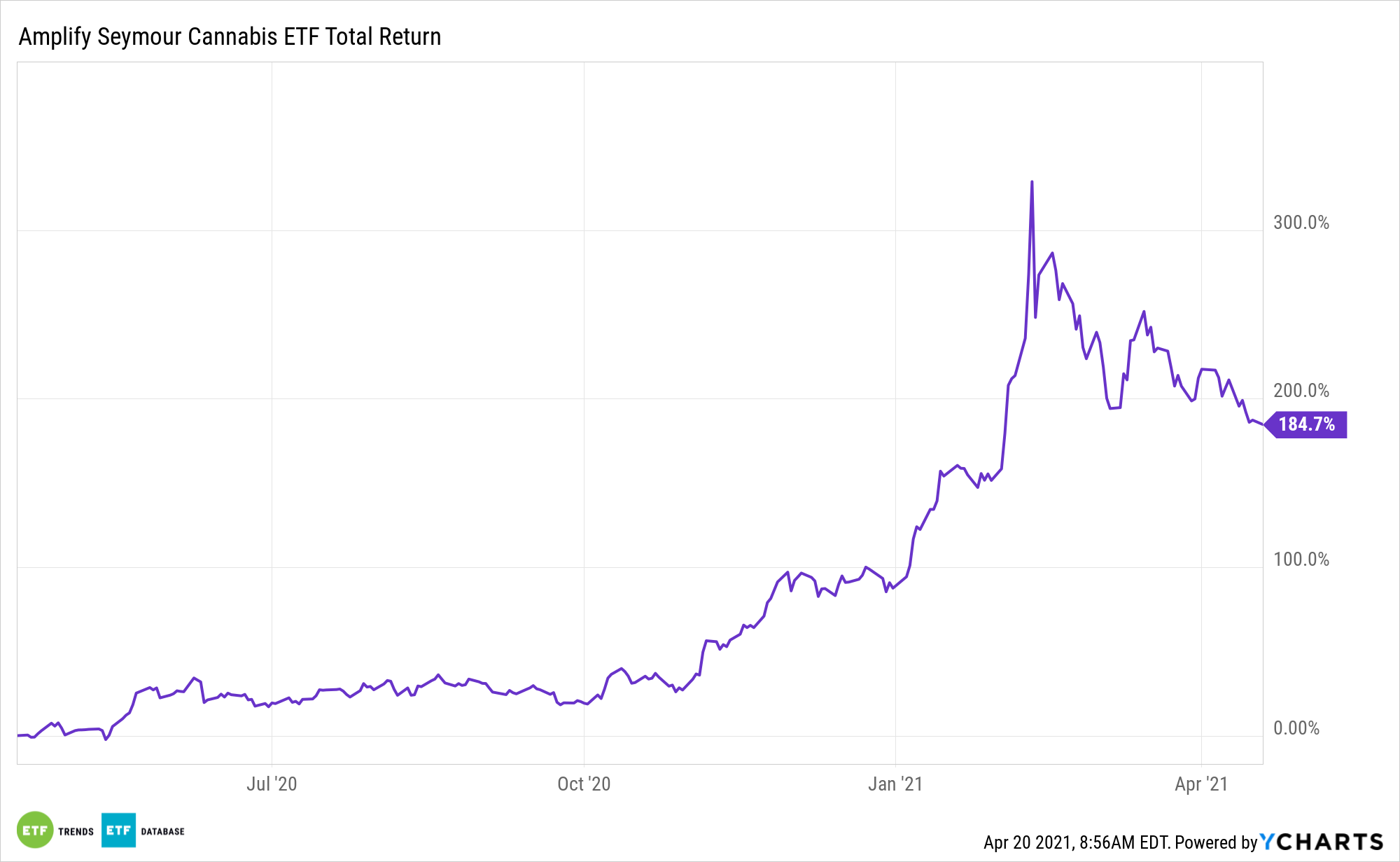

Amplify is the same provider that launched other popular ETFs, such as Amplify Seymour Cannabis ETF (CNBS) and the Amplify Transformational Data Sharing ETF (BLOK). Its newest introduction rounds out a growing roster of thematic ETFs.

A Securities and Exchange Commission (SEC) filing shows that if approved, the fund will be known as the Amplify Cleaner Living ETF and trader under the ticker symbol “DTOX.” Based on the filing, the purpose of the fund is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the Tematica BITA Cleaner Living Index.

Based on the filing information, the index “is designed to measure the market performance of a basket of publicly listed companies that the Index Sponsor identifies as creating products or providing services that have the potential for a positive impact on the human body and/or the environment (Cleaner Living Companies).”

“The Index focuses on Cleaner Living Companies in the following five market segments: cleaner building and infrastructure, cleaner energy, cleaner food and dining, cleaner health and beauty, and cleaner transportation (the “Cleaner Living Market Segments”),” the filing added. “The Index is designed to produce a portfolio that has the potential for capital appreciation by identifying companies positioned to take advantage of increasing consumer preferences for food, beverages, personal care products, energy and transportation provided by Cleaner Living Companies.”

Capitalizing on a Trend with Staying Power

Amplify founder and CEO Christian Magoon appeared on CNBC’s “ETF Edge” recently to discuss the fund. As the emphasis on healthy living continues, Magoon noted that it’s a trend that will stand the test of time.

“They have to have about 80% of their revenue in those spaces,” Magoon said.

“It’s really kind of capitalizing on this trend that people want to live more cleanly in terms of their footprint, in terms of their health, in terms of the environment,” he said further. “We think that’s a trend that’s going to be here to stay for quite a while. We think companies that are pivoting to that and have the majority of their revenue from that have a chance to produce some alpha.”

For more news and information, visit the Smart Beta Channel.