As we consider options in the environment ahead, investors should look to a smart beta, small-capitalization stock exchange traded fund to capture the growth potential of the smaller segment of the equities market and hone in on factors that could potentially enhance returns and diminish risks.

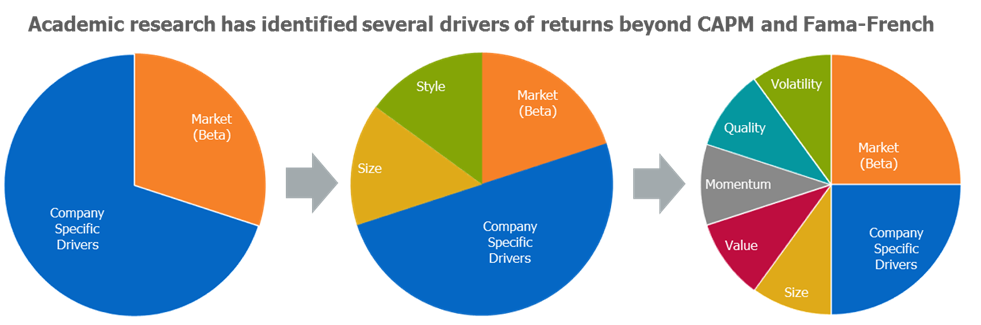

On the recent webcast, Power up Your Small Cap Portfolio: A Factor-Based Approach to Small Caps, Marc Chaikin, CEO of Chaikin Analytics, started off by explaining that factors can be thought of as any characteristic relating to a group of securities that can help explain their risk and return. Of the various factors available, the most common that have been identified historically include size, value, quality, momentum and volatility.

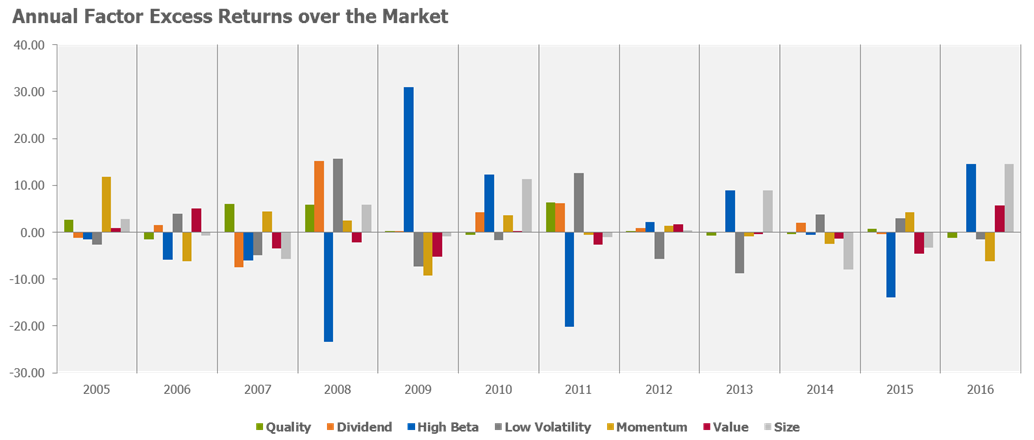

While investors can focus on single factors at a time, individual factors have exhibited cyclical trends from year to year, so getting the right timing can be difficult. On the other hand, Chaikin argued that combining multiple factors could create a more diversified solution to enhance returns over longer periods.

“While factor performance has historically been cyclical, most factor returns generally are not highly correlated with one another, so investors can benefit from diversification by combining multiple factor exposures,” Chaikin said. “Factors can be combined into one strategy, potentially enhancing returns and/or managing risk across a variety of market environments.”

Salvatore Bruno, Chief Investment Officer and Managing Director for IndexIQ, also pointed out that investors should focus on the size factor, notably small-capitalization stocks, ahead. Along with small-caps’ historical outperformance to large-caps over time and their ability to recover faster from downturns, smaller companies have historically outperformed large-caps during periods of rising rates, which is especially relevant as the Federal Reserve considers hiking interest rates two more times this year.