![]() In a persistently low yield environment, income-minded investors have to be a little more creative. Those who still want an alternative way to generate some extra cash in a challenging market environment may turn to targeted exchange traded fund strategies.

In a persistently low yield environment, income-minded investors have to be a little more creative. Those who still want an alternative way to generate some extra cash in a challenging market environment may turn to targeted exchange traded fund strategies.

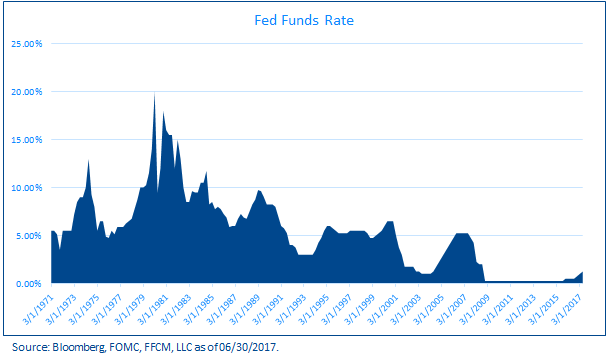

On the recent webcast (available On Demand for CE Credit), Innovative Income Strategies for Today’s Challenging Environment, Chuck Martin, Managing Director and Portfolio Manager at QuantShares, illustrated the current low-yield environment, pointing out that interest rates would have to increase nearly 325% to hit the historical average of 5.33% going back to 1971.

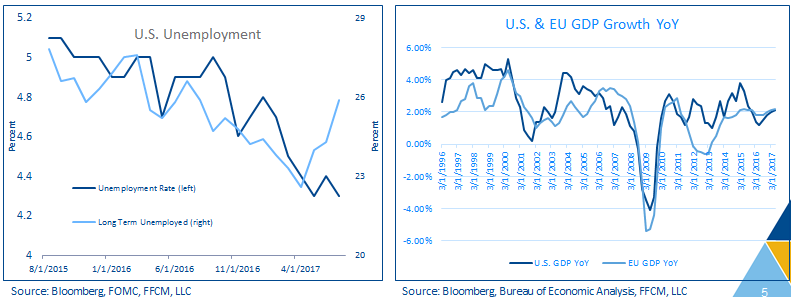

Meanwhile, investors will have to account for rising inflationary pressures in an expanding economy as the Trump administration looks to implement deregulation and tax reforms, along with a low unemployment rate that could lead to rising wages.

Meanwhile, investors will have to account for rising inflationary pressures in an expanding economy as the Trump administration looks to implement deregulation and tax reforms, along with a low unemployment rate that could lead to rising wages.

However, volatility is also an issue as factors like declining CPI, North Korea tensions and an aging baby boomer generation could all contribute to slower growth and lower inflation.

However, volatility is also an issue as factors like declining CPI, North Korea tensions and an aging baby boomer generation could all contribute to slower growth and lower inflation.

“The current low-yield environment coupled with heightened equity market volatility presents income-seeking investors with unprecedented challenges,” Martin said. “Valuations of many dividend equities are above historical norms due to strong returns and asset flows, while many investors are avoiding additional fixed income exposure in the face of rising interest rate investment.”

Alternatively, Martin pointed to the QuantShares Hedged Dividend Income ETF (NYSEArca: DIVA), which is designed to deliver to investors a strong current yield capital appreciation potential with a risk profile similar to a corporate bond index, as an alternative way for dividend investors to generate yield.

Martin explained that DIVA looks for stable or growing dividends and looks for highest yield among the 1,000 largest names in the U.S. The portfolio then limits sector weights and equally weights components to avoid concentration risks. Furthermore, the ETF shorts stocks with low yields to hedge equity and sector risks as a way to diminish overall portfolio volatility and preserve the dividend yield of long securities.