By Jacob Wolinsky, ValueWalk

LRT Global Opportunities commentary for the month ended February 28, 2019, cautioning investors not to buy the best companies nor the fastest growing ones, but the companies that are the most undervalued.

Dear Friends & Partners:

The value of our investment partnership continued its rapid climb during the month of February. Our performance this month was helped by strong returns from our top positions: AutoZone, Danaher, Colliers, NVR and Heico. While short term results are inherently volatile and our returns year-to-date should not be extrapolated, we continue to expect good performance from our portfolio over the remainder of the year, as many of our portfolio companies remain significantly undervalued.

We are invested in companies with durable competitive advantages, possessing above average growth opportunities, and led by management teams with outstanding records of capital allocation. All our portfolio companies have pricing power, high %’s of recurring revenues and are price setters. As a result, we expect the businesses that we own to perform substantially better than the average company in the event of a recession. We anticipate a slowdown in the macroeconomy and continue to be defensively positioned – as expressed by the quality and durability of the companies we own.

Our results have been volatile over the recent past, but they are a good illustration of the upside that comes from having a sound investment strategy and the disciplined execution of said strategy. Over the past three months, an investor in the S&P500 would have realized a sharp loss in December followed by a rapid recover in January and February which together added up to an approximately flat performance over the entire period. Our investment partnership, on the other hand, is far ahead over the past three months – despite suffering a sharp decline in December.

In our December letter to you we wrote:

In the current environment stocks are very attractive – because they reflect a deep pessimism about the future of the economy and corporate earnings. We believe that such pessimism is unwarranted – long term investors should be buying equities. Our Partnership is doing just that.

This is what we mean when we say that we are committed to the “disciplined and consistent” execution of our investment strategy. In late December we had no way of knowing what the next two months would bring – instead we chose to focus on company fundamentals and our steadfast commitment to our portfolio execution. While all the talking heads on TV were predicting lower stock prices, and while almost everyone was selling stocks, we were buying equities. We believe that a disciplined execution of a rigorous investment process is the best way to protect capital and generate portfolio performance. Over the past two months we have been reaping the benefits of this discipline. We are happy with the performance of our partnership but remain vigilant in identifying risks and threats to our investment process. With that we would like to give you some insight into what lies ahead.

An Economic Update

Over the past two years, the US government pumped record amounts of fiscal stimulus into the economy by taxing less and spending more. Specifically, spending on defense and US fiscal borrowing has risen. This stimulus cannot and will not repeat in 2019/2020. As the fiscal stimulus from the last two years fades, economic growth will slow, especially in the manufacturing sectors which has benefited dramatically from increased defense spending.

In recent months, Federal tax revenues have been growing at the slowest rates outside of a major recession in the past four decades according to the Monthly Treasury Statement data. It is clear, that reduced US tax rates have more than offset the impact of an expanding economy as US tax receipts fell in 2018, as compared with the prior year. This should put to rest the lie of tax cuts that pay for themselves.

Meanwhile, US government spending has continued to rise at a rate close to its long-term average. In fact, federal outlays increased by more than 4% last year as compared with 2017. Combined, this has amounted to a major fiscal stimulus to the US economy – no wonder that GDP growth has been strong. Did the US economy really need a massive fiscal stimulus eight years into an economic expansion and with unemployment already at multi-decade lows? We believe the answer is an empathetic: NO.

The US economic expansion is now well into its final inning. We continue to expect a rapid deacceleration of US economic growth in the first half of 2020 as the sugar rush of tax cuts and increase government spending dissipates and leaves us with its painful aftermath: higher inflation and higher interest rates. We believe investors should be increasingly selective in the investments they make and prepare for a recession ahead. Now is a time to seek safety, stability and simplicity in one’s investment approach. As the economy slows, corporate profitability declines and many overvalued companies fail to live to their expectations, we will finally see, in the words of Warren Buffett, “who is swimming naked”. We expect our investment strategy, which takes an active approach and focuses on analyzing company fundamentals, will be well rewarded in the months ahead, as the decline in the overall market presents us with an expanded opportunity set to invest capital at attractive valuations.

Moats, Growth and Valuation

Forecasting economic growth is an obsession on Wall Street and amongst TV pundits because in the short-term, correctly calling a recession can lead to significant outperformance, yet over the longer term, stock market returns have nothing to do with economic growth. This may sound surprising and counter-intuitive, but it is supported by extensive research. A comprehensive study by Professor Jay Ritter, from the University of Florida, Gainesville, clearly shows that stock market returns are not driven by GDP growth. In his 2005 paper, “Economic growth and equity returns professor” Ritter found a small, but negative relationship between GDP growth rates and stock market returns. In the second paper, published in 2012, “Is Economic Growth Good for Investors?” Ritter shows that investors systematically overvalue stock markets of economies with high expected GDP growth rates and that this “overpayment for growth” more than offsets any gains from faster growth. This is remarkably like the well-known “glamour effect” in the stock market, where investors are known to pay unreasonably high valuations for “the best” companies – the definition of “the best” depending on the investment fad of the day.

What is true at the level of the economy at large can be translated to the level of an individual firm. Growth at the firm level benefits investors only if there are durable barriers to entry that can prevent competitors from reducing a company’s profitability. For most firms, growth leads to increased profits and increased profits attract competition which in turn leads to lower profits. Some firms, however, have beaten the odds – they have been able to sustain high profitability for many decades. These firms have something unique about them – they have a sustainable competitive advantage, or what others sometimes refer to as a moat. Absent a moat, high profits will be competed away, and growth is unlikely to benefit investors.

In today’s letter, we hope to give you some insights in the relationship between a firm’s moat, its growth rate and its valuation. We see persistent market inefficiencies in how investors assign value to companies in at least three broad areas: companies with a moat and no growth, companies with growth and no moat, and companies with a moat and fast growth but priced to perfection (overpriced). While the degree of inefficiency varies with the changing market mood, all three of these areas are fertile hunting grounds for active managers looking to add value.

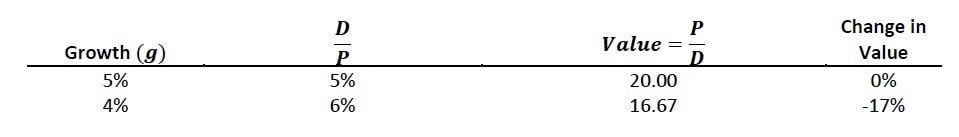

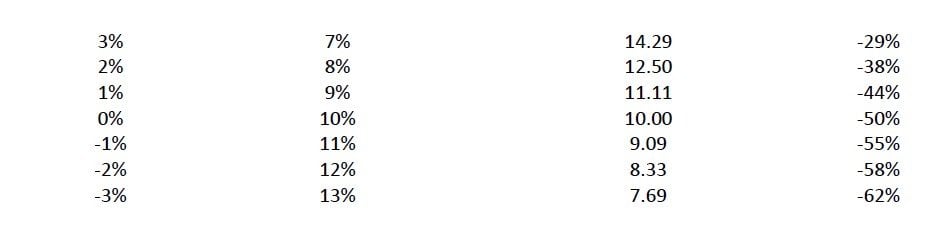

Most consumer staple companies in the United States have “legacy moats”, but no growth. Despite this they remain valued very highly as a group. We believe this is a mistake, as their moats are eroding and barriers to entry are declining, leaving them overvalued as a group. In previous letters, we have discussed the declining value of brands, the erosion of some of these legacy moats, and how we expect most companies in this category to have downsides of 30-50%. The erosion of these legacy moats will not mean a sudden collapse, but rather a slowdown in growth which should translate into a lower valuation. For a mature, slow growing company, even a small change in the rate of growth means a big change in valuation. Let us look at some math.

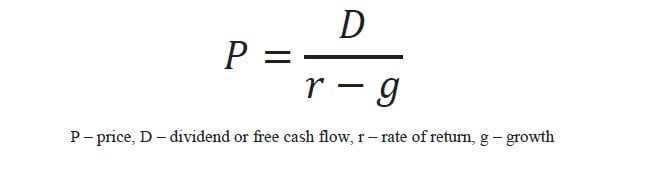

One of the most basic valuation formulas in finance is the Gordon Growth Model. This model is appropriate for valuing slow and steady companies like most consumer staples with limited reinvestment opportunities. The formula is as follows:

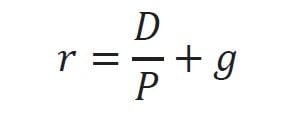

We can rearrange the formula to solve for the rate of return.

Hence, the return to investors is the current free cash flow yield (free cash flow divided by price) plus growth. Historically, the nominal return on US stocks has been approximately 10%. The rate of return investors demand for holding stocks fluctuates with market sentiment, but if we assume that over the long-term historic patterns repeat themselves we can set r = 10%. Since, D (the current free cash flow) is known, there are only two variables left to deal with. The lower the growth rate (g) is the lower price (P) must become (since D/P must rise). We can therefore calculate the fair value for a company and its change as we change the expected growth rate.

Careful readers of our investment letters will note that we have been warning about the danger of “safe” consumer staple stocks for quite some time now. We believe that our predictions are finally coming true. Over the past three months, Budweiser cut its dividend in half in a bid to help the company reduce its debt burden. Kraft-Heinz wrote down billions from the value of some of its best-known brands and reduced its dividend, in order to, “…provide greater balance sheet flexibility,” per management’s comments. Dean Foods suspended its dividend completely. Coca-Cola missed earnings expectations and said it expects no growth in earnings-per-share in 2019. We expect more such news over the coming months. “Safe” consumer staples have become a dangerous minefield.