For more on the topic of legacy moats lacking growth, please see the excellent blog post by Sean Stockton from Ensemble Capital, available here: https://intrinsicinvesting.com/2019/02/22/the-risk-of-low-growth-stocks/. We also encourage you to visit our YouTube channel and see some of the videos we have produce on this topic, specifically: Yesterday’s Home Runs Don’t Win Today’s Games and Reaching For An Aspirin.

The second area of persistent inefficiency that we see are stocks that are growing but have no moat. These companies are often highly valued as if they will soon take over the world and become sustainably profitable. Most investors either don’t understand the concept of a sustainable competitive advantage, don’t care about profitability beyond the immediate few quarters, or are “hoping” that a company will develop a competitive advantage as it grows. This issue is best illustrated with an example.

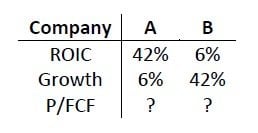

Imagine two companies: the first with high and stable returns on invested capital (ROIC), a pretty good indicator of a sustainable competitive advantage, but with low growth; the second company with low ROIC but high growth. Furthermore, assume that both companies can reinvest at the stated ROIC and growth rates for the foreseeable future. How would you value these two companies?

A few things stand out when looking at this table. First, Company B needs external financing to grow – its internal returns are too low to finance all its growth opportunities. Company A on the other hand can grow and return cash to shareholders because of its very high profitability relative to its limited growth opportunities. Which company would you rather own? This should be obvious, but to many investors it is

not. Let us dispel any illusions you may have: in the case of Company B, growth creates no value. Investors are WORSE off when the company grows. A six-percent return is terribly low for an equity investor. If you take as given the assumptions we laid out, that both growth and ROIC are stable, then Company B is actively destroying value by growing. A business earnings 6% on tangible capital should trade below book value.

Company A, on the other hand creates enormous value for shareholders when it grows. At LRT we are only interested in companies whose growth creates value. You can justify paying a price of more than 10 times the tangible invested capital that Company A employs. Often, markets work efficiently and value Company A very highly and Company B much lower. However, often does not imply always. On more than one occasion in the past, a business similar to Company B, has received a very high valuation in the marketplace as investors seemingly only focus on the company’s growth rate.

We said, “imagine two companies”. You don’t have to imagine. While facts and time periods are stylized, the companies are real. Company A is Spirax-Sarco PLC, a manufacturer of industrial boilers and related steam management products. The industrial boiler market is not particularly big, exciting or fast growing – but it is a market that delivers Spirax-Sarco PLC an exceedingly high return on invested capital. Company B is Groupon, the worldwide e-commerce company. Spirax-Sarco PLC, has been around since 1888 and publicly listed for over thirty years. Groupon is a newer company, having gone public a little over seven years ago. Did the market asses the future growth and value creation of these two companies correctly? We contend that it did not. If it did, the return earned by the shareholders of both companies should have been similar over a long-time period.

Spirax-Sarco PLC delivered a compounded annual return of 32%, 21% and 19% over the past 3, 4, and 5 years, respectively. Groupon delivered -7%, -20% and -17% over the same respective time periods. There has been no meaningful change in either company’s business model over that time period or a significant recession in either company’s end markets. We believe that market participants simply fail to account for the significant value creation that comes from a high and stable return on capital combined with slow but steady growth. Similarly, investors overpay for the growth opportunities presented by companies such as Groupon, despite their lack of sustainable competitive advantages. Careful readers will assert that the return on equity should also reflect a company’s riskiness. Taking this into account makes the gap between reality and theory even wider as Groupon is by far the riskier company and should have therefore delivered a higher return than Spirax-Sarco PLC. Spirax-Sarco PLC has had a beta of 0.54 over the past five years. Groupon’s beta over the same time has been 1.18.

Each individual company is different making a rigorous “study” impossible, but the pattern is persistent: slow and steady growing companies with high return on invested capital tend to be undervalued by market participants, while super-fast-growing companies lacking competitive advantages tend to be overvalued. It is a pattern we see over and over again in the market at large. Note, that we say “tend to” as there are many cases where the market does get it right. There are also cases where we believe things go too far – when market participants assign such a high value to a company that all future “abnormal returns” appear to be priced in.

This brings us to the third category: companies with moats (strong and durable competitive advantages), strong growth, but absurd overvaluations. As investors, we caution not to buy the “best” companies nor the fastest growing ones, but the companies that are the most undervalued. While we believe that many high return and slow growth companies remain undervalued today (even though they may look “optically” expensive), the same cannot be said for wide-moat and high growth companies. The supply of companies that combine having of a wide-moat and fast growth is very limited. Investor appetite on the other hand is so high for companies with said characteristics that we believe many investors are consciously overpaying for these businesses, disregarding fundamental valuation or simply chasing momentum. Anyone investing

in an obviously overvalued company, in the hopes of selling it on to another person at an even higher valuations, the so called “greater fool” investment strategy, is one himself.

If a company’s starting valuation is high enough, a business can perform perfectly and still deliver poor returns to shareholders. Investors chasing profitable growth must not overpay or they may find themselves chasing a bubble. When the bubble bursts, many shareholders will become “bagholders” – nursing heavy losses. Fundamentally oriented investors should avoid investing in such companies – no matter how lucrative short-term, momentum driven gains, may appear. We believe that most public Software-as-a- service (SaaS) companies meet this definition today.

Let me demonstrate my point with a concrete example. Consider what we call a “Bubble Basket” consisting of thirty-four (34) popular publicly traded SaaS companies. The full list of names in our Bubble Basket is included at the end of this letter. The companies in this index have delivered handsome results to shareholders over the past few years. Many are still unprofitable on a GAAP basis but are growing quickly and as a result are valued very highly by investors. We believe that many of these companies will deliver excellent profitability in the future, but that investors will fare poorly over the next three years because the current nose-bleed valuations make it almost impossible for the companies in question to meet the expectations embedded in their stock prices. Since many of these businesses are not yet profitable, they tend to be valued on a price-to-sales basis (P/S). Our Bubble Basket has a min, max, mean and median P/S of 3.52, 24.21, 11.84 and 10.23 respectively.

Each of the companies in our basket has a compelling story, high growth, and meaningful opportunities to reinvest capital and create value. Some of these companies will exceed expectations and deliver strong returns to shareholders, but as a group we expect them to be a disappointment. Collectively, these companies are so highly valued that there is little to no chance that they will outperform the market. Because the starting valuations are so high, even if everything goes according to plan, returns to shareholders are likely to be mediocre at best over the next three years. We believe that many investors own these stocks simply because of the strong recent price performance – they are classic momentum stocks. We expect that these stocks will collapse the fastest and collapse the most in the event of a true bear market. Investors holding these stocks will fail to protect their capital. Prudent investors should steer clear – which is exactly what are we doing.

In summary: we expect a recession and a bear market sometime in the next eighteen (18) months, driven by a sharp slowdown in US GDP growth (caused partially by the decline in fiscal stimulus and rising interest rates) and an associated sharp decline in corporate profitability. Furthermore, we see a high probability of further declines across the consumer staples sector, as investors adjust to the new (read: much lower) growth rates and associated low valuations for most companies in this group. Finally, we are warning anyone who will listen that the valuations of most SaaS business are extremely stretched – even if the businesses grow as expected, investors may not profit due to their very high valuations.

As always, I look forward to answering your questions.

Lukasz Tomicki

Appendix: The Bubble Basket

The companies in the Bubble Basket are: Benefitfocus, Inc. (BNFT), Box, Inc. (BOX), Coupa Software Incorporated (COUP), salesforce.com, inc. (CRM), Cornerstone OnDemand, Inc. (CSOD), Tableau Software, Inc. (DATA), DocuSign, Inc. (DOCU), Domo, Inc. (DOMO), Eventbrite, Inc. (EB), HubSpot, Inc. (HUBS), Instructure, Inc. (INST), LogMeIn, Inc. (LOGM), Medidata Solutions, Inc. (MDSO), ServiceNow, Inc. (NOW), Anaplan, Inc. (PLAN), Qualys, Inc. (QLYS), RingCentral, Inc. (RNG), RealPage, Inc. (RP), Rapid7, Inc. (RPD), Splunk Inc. (SPLK), SVMK Inc. (SVMK), Atlassian Corporation Plc (TEAM), The Trade Desk, Inc. (TTD), Twilio Inc. (TWLO), 2U, Inc. (TWOU), The Ultimate Software Group, Inc. (ULTI), Veeva Systems Inc. (VEEV), Workday, Inc. (WDAY), Wix.com Ltd. (WIX), Zendesk, Inc. (ZEN).

We began our Bubble Basket experiment on 3/1/2019. We assume an equally weighted portfolio and will update the portfolio’s hypothetical performance each month. We expect the portfolio to underperform the S&P 500 over the next three years, with significantly higher volatility.

For more market trends, visit ETF Trends.