McIntyre Partnerships commentary for the fourth quarter ended December 31. 2018.

Dear Partners,

I hope you all are having a pleasant start to 2019. The below letter is shorter than I aim to make our typical year-end review, largely because of the significant portfolio repositioning discussed at length in the Q3 letter.

“Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him

or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren’t certain that you understand and can value your business far better than Mr. Market, you don’t belong in the game.” – Warren Buffett, 1987 Berkshire Shareholder Letter

“If you need me, I’ll be hiding under my desk. Wake me up when my PNL returns.” – My old boss, as he literally climbed under his desk in fall 2008

Performance Review – Q4 and FY 2018

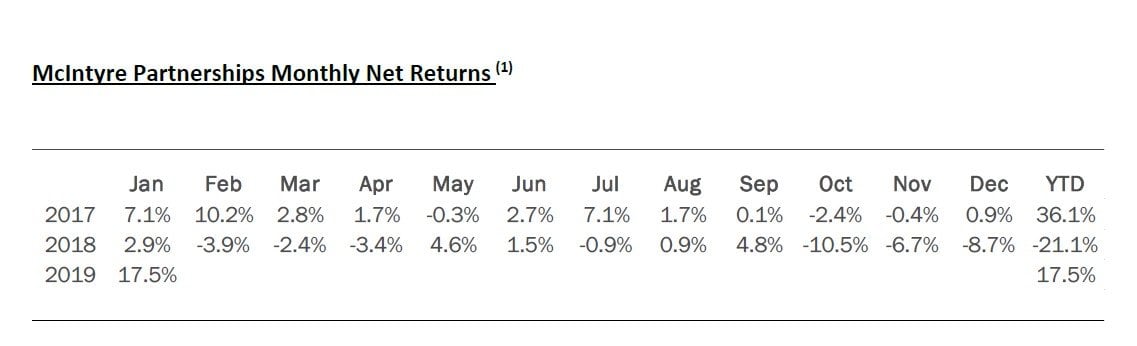

Through Year-End 2018, McIntyre Partnerships returned approx. -19% gross and -21% net. This compares to S&P 500 and S&P 600 returns, including dividends of -4% and -12%, respectively. Through January, the fund is up ~18% YTD.

Throughout 2018, the partnerships consistently lagged the market and our (bad) underperformance was exacerbated in Q4 by several large cyclical investments I entered during the market retreat, which I discussed in our Q3 letter. In short, an altogether lousy year. Given our concentrated bets and significant long positioning, underperformance like this will inevitably occur, and our performance is particularly difficult to estimate in sharp market selloffs. However, if the fund is to be successful over time, underperformance like 2018 must be rare. That’s all there is to it. However, our start to 2019 has been strong and hopefully our momentum will continue.

In Q4, we had many >100bps losers and no significant winners. For 2018, LILAK, GTX, FBHS, and CC each lost ~300-500bps, while Permanent TSB, Telesites, and our “media basket” each lost ~100-200bps. Our YTD winners were paltry – DDS and ORM each contributed ~100bps.

Portfolio Review – Exposures and Concentration

As of December end, our exposures are 128% long, 42% short, and 86% net. Our five largest positions were 74% gross exposure and our ten largest were 111%.

Our five largest positions are CC, LILAK, FBHS, GTX, and uranium.