Index and analytics provider FTSE Russell found in a recent survey that smart beta environmental, social and governance (ESG) strategies are still facing an uphill climb in the U.S. as opposed to their European counterparts.

The survey said 40 percent of money managers were looking to apply ESG into their smart beta strategies, but that collective was largely focused in Europe–77 percent of funds were interested in ESG as opposed to just 17 percent interest in the United States. “Recent interventions” within pension plans implemented by U.S. President Donald Trump’s administration could be the prime reason for their lack of adoption according to the survey.

May reminded investors that they need to be strategic when it comes to investing in 2019 as volatility took hold of the capital markets as the U.S.-China trade deal that was supposed to happen morphed into an impasse. That said, more investors are beginning to realize the importance of incorporating smart beta strategies into their portfolios.

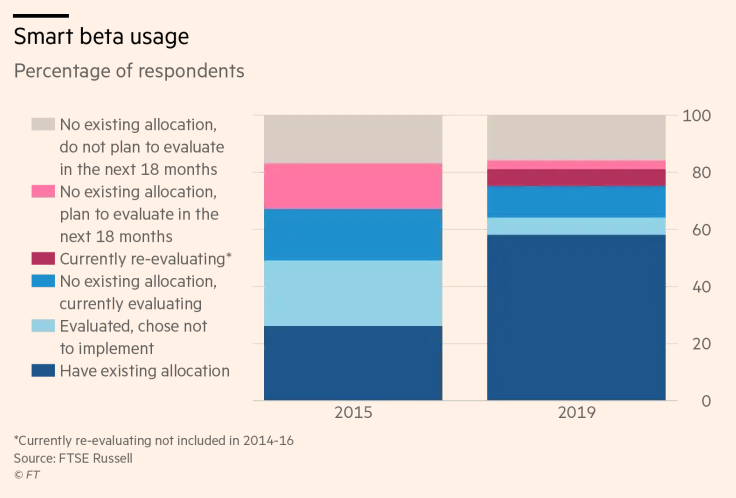

58 percent of investors have an allocation to smart beta, based on the survey of 178 asset owners. It’s more than double the amount in 2015 when the same survey yielded only a 26 percent usage by investors.

With smart beta usage on the rise, one of the challenging aspects advisors face with this more cautious investor is the plethora of options available, especially in the exchange-traded fund (ETF) space. Where are the opportunities in ETFs given the current market landscape and how can smart beta-factor strategies work in a portfolio?

A market-capitalization-weighted index provides clients with exposure to a particular market based on security prices, without considering any true company fundamental to judge its value. However, the Great Recession of 2008 roiled investors with deep declines that they were not anticipating, as a result of overexposure to potentially overpriced stocks relative to their true value.

Given certain market conditions, investors need more than just a passive index that goes beyond a one-size-fits-all template that uses market cap weighting. While these indexes provided simple, low-cost solutions, the need for even greater scrutiny is necessary in the quest for more alpha —a case for smart beta.

Through smart beta, investors get adaptable exposure with the rules-based approach in conjunction with reaping the rewards of diversification via access to a broad market index. In addition, the simplicity of buying a broad-based market index has a concentration of risk, and should a market correction ensue comparable to that witnessed in the fourth quarter, investors are left vulnerable.

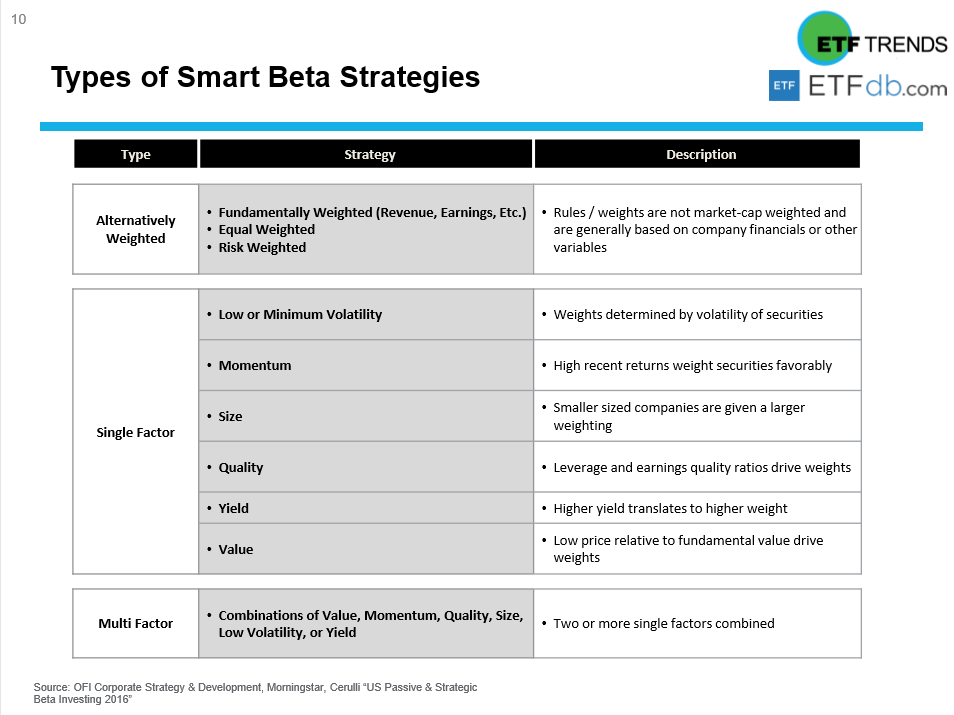

As such, smart beta strategies can be segmented into alternatively weighted, single factor and multi factor strategies–the latter to diversify concentration in a specific factor–low or minimum volatility, momentum, size, quality, yield, and value.

“Investors are becoming more comfortable with smart beta as they have developed an increased understanding of these strategies and more confidence in their track records,” said Rolf Agather, research and innovation managing director at FTSE Russell.

For more market trends, visit ETF Trends.