![]()

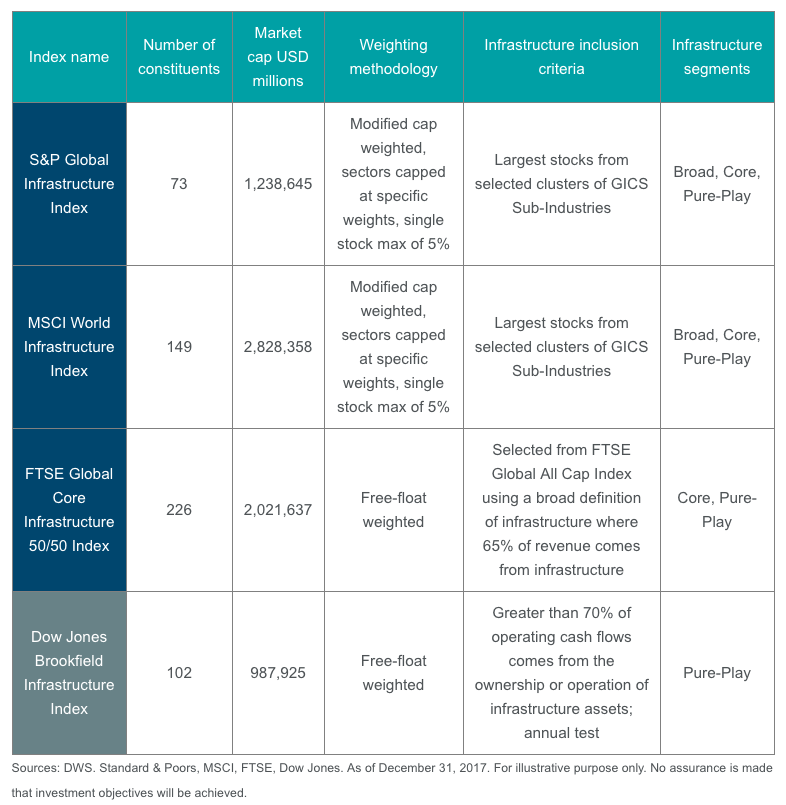

Each index represents a slightly different look at the infrastructure market. Some, such as S&P Global or MSCI, run the gambit across all of the different infrastructure types. Others, such as FTSE’s, are a bit more focused and have revenue stipulations that at least 65% of revenues must come from infrastructure-related activities.

Finally, at the end of the spectrum, investors have the Dow Jones Brookfield Infrastructure Index. This benchmark only focuses on pure play companies, requiring that at least 70% of operating cash flows come from ownership and operation of infrastructure assets.

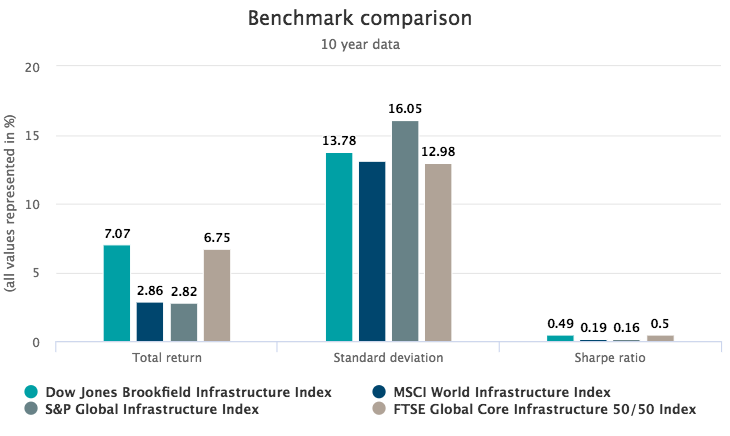

These variations have meaningful impact in terms of performance and risk metrics. As described in the chart below, the Dow Jones Brookfield Infrastructure Index has beaten its competitors over the past decade, without producing a standard deviation out of range of its rivals. This produces an impressive Sharpe Ratio that is comparable to the closest competitor on the list, the FTSE index, which is another benchmark that has a pure play focus.

In other words, in the trailing 10-year time frame, a greater focus on pure play infrastructure activities was, generally speaking, a beneficial strategy. And while past performance is no guarantee of future returns, one can see why owning the asset in question and being at the center of the infrastructure play is a potential strategy to lower volatility and capture higher returns.

Bottom Line

Relatively inelastic demand combined with a monopolistic position is a difficult pair to beat, potentially resulting in limited pricing risk and stable cash-flows. And with the ability to pass on costs to end users, inflation isn’t as much of a concern in infrastructure as it may be in other corners of the investing world.

So, while infrastructure investing may appear daunting at first glance—thanks to the size and scope of the market—one potential strategy to narrow down the universe is to focus on pure play assets. These assets appear uniquely positioned to potentially prosper in the current market environment, and relative to other infrastructure segments, no matter what comes down the pike from inflation.