The Nasdaq Composite hasn’t been able to sustain a scorching August that saw the index gain 5.71% and 2.15% the previous month, which could signal that investors may slowly be shifting their preferences from growth to other factors like value and now, quality.

Speaking of the latter, one ETF to look at if investors are looking to deploy capital into quality-focused funds is the iShares Edge MSCI USA Quality Factor ETF (BATS: QUAL).

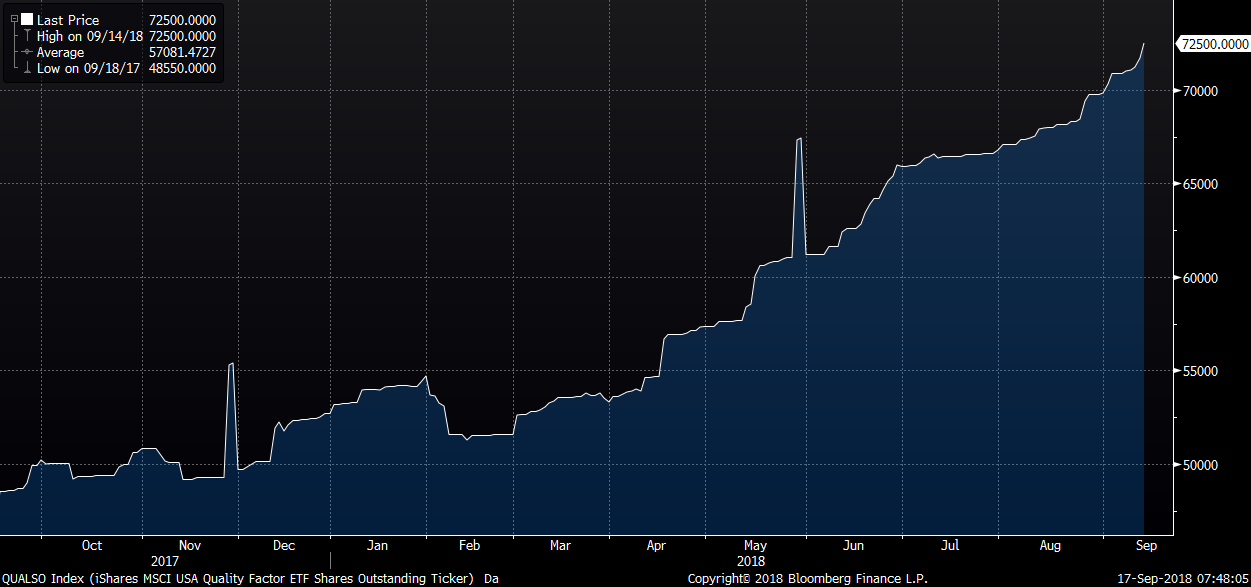

Value-focused ETFs like the Schwab US Large-Cap Value ETF (NYSEArca: SCHV) have begun to see an uptick in inflows on elevated volumes, but QUAL has also been seeing heightened activity–QUAL has traded with heavy buy flows as of late and grew assets for a fifth straight day as of last Friday. Furthermore, inflows in QUAL were steady during the summer, but has picked up in September.

![]()

QUAL seeks to track the investment results of the MSCI USA Sector Neutral Quality Index composed of U.S. large- and mid-capitalization stocks exhibiting quality characteristics as identified through specific fundamental metrics. QUAL invests its assets in component securities comprised of the index as well as certain futures, options and swap contracts, cash and cash equivalents.

Dissecting multiple factors and cornering specific areas like growth, value or quality gives investors more direct exposure to assets exhibiting these factors, but investors must shift from one to another as the market dictates which factor is currently showing strength. With the Nasdaq down 2.12% to start September, could the move from the growth factor that has been powering the extended bull run be coming out of favor?