The small cap rally doesn’t appear to be slowing down. Combine that with a value resurgence and you get a potent combination in the Vanguard Small-Cap Value Index Fund ETF Shares (VBR).

“The stars are really lined up for small-caps as an asset class this year,” said Amy Zhang, a small-cap fund portfolio manager at Alger.

VBR seeks to track the performance of a benchmark index that measures the investment return of small-capitalization value stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Value Index, a broadly diversified index of value stocks of small U.S. companies.

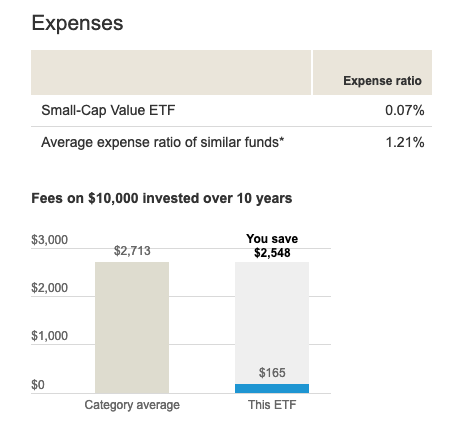

The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. Another distinct advantage of VBR is its low 0.07% expense ratio, which is remarkably lower than other comparable funds.

VBR gives investors a convenient way to match the performance of a diversified group of small value companies via a passively managed, full-replication approach. So far in 2021, VBR is up 13%. The fund is also tracking higher than a broader index in the MSCI ACWI Small Cap Value index.

Is History Actually on the Side of Small Caps?

The recent small cap rally may not be just a flash in the pan. History is squarely on the side of small caps. Meanwhile, at present, the Russell 2000 continues to trend higher.

Since August 14, 2020, the index has been on an upswing after the 50-day moving average moved past the 200-day moving average, which is also known as the ‘golden cross’. The past year, the Russell 2000 is up over 50%.

“Since 1960, annualized returns for the S&P 500 were almost 6% lower when small-cap stocks have led,” a MarketWatch article explained. “In fact, the researchers at Leuthold say that a portfolio of 50% cash and 50% small-caps could match the S&P 500’s volatility in the next few years while actually exceeding its return.”

“The backdrop of rising yields is also unlikely to derail this trajectory, the researchers say,” the article added. “Small-cap stocks have actually shown ‘a decisive performance edge’ during recent periods when stock prices and bond yields moved in sync.”

For more news and information, visit the Smart Beta Channel.